Nailing the right rent for your room is a classic balancing act. Price it too high, and you’re staring down the barrel of an expensive void period. Go too low, and you're literally giving money away each month.

The trick is to stop guessing and start calculating. The best way I’ve found to do this is to ground your decision in three core pillars: what the local market is doing, what the room costs you to run, and the unique value your specific room offers. Get these three things right, and you’ll land on a price that's competitive, profitable, and fair from day one.

Answering the Big Question: How Much Rent Should I Charge?

Figuring out the magic number can feel like a shot in the dark, but it doesn’t have to be. A clear, repeatable strategy removes the stress and uncertainty by blending hard data with a practical look at your own property.

By focusing on real-world market rates, your own financial outgoings, and the specific perks you provide, you can confidently set a price that attracts quality tenants without leaving your room sitting empty. It's all about finding that sweet spot.

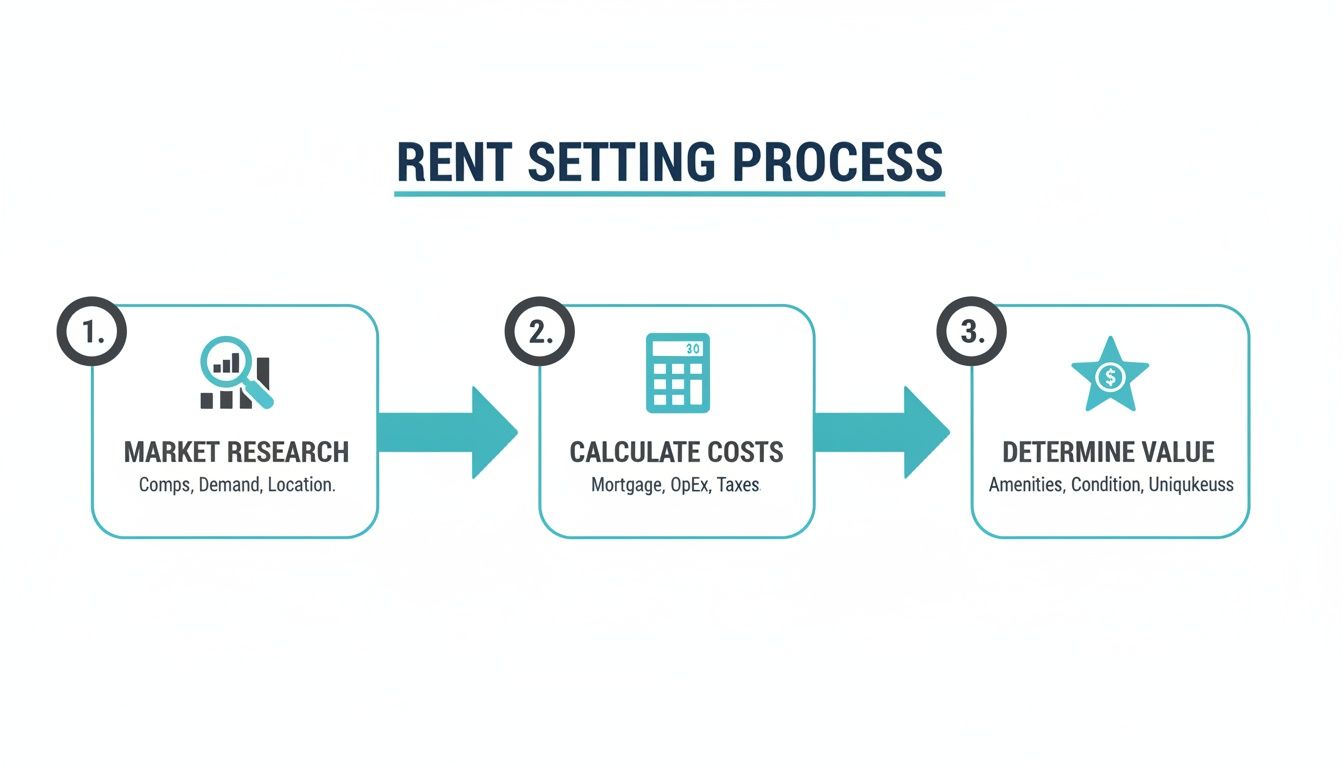

This infographic breaks down the simple three-step process we're about to walk through.

As you can see, it all flows logically: start with what everyone else is charging, figure out your own numbers, and then fine-tune based on what makes your room special.

To set your rent with confidence, you need to understand the three fundamental approaches that combine to create a fair and profitable price point. Each pillar provides a different perspective, and when used together, they give you a complete picture.

Three Core Pillars of Setting Your Room Rent

| Pricing Pillar | What It Is | Why It Matters |

|---|---|---|

| Market Comparables | Analysing what similar rooms in your immediate area are currently renting for. | This is your reality check. It anchors your price to what local tenants are actually willing and able to pay right now. |

| Cost & Yield | Calculating all your property-related expenses and determining the profit (yield) you need to make. | This ensures your rental is financially viable. Without this, you could unknowingly be losing money each month. |

| Value & Amenities | Adjusting your price based on the unique features and benefits your room offers over the competition. | This is where you justify a higher price. An en-suite, a parking space, or inclusive bills all add tangible value. |

By blending these three pillars, you move from guesswork to a data-driven strategy. This ensures your rent is not only competitive in the local market but also profitable for you as a landlord.

Start with National and Local Benchmarks

The most logical place to begin is by looking at the bigger picture to see what tenants are already paying. This immediately anchors your expectations in reality.

According to the Office for National Statistics, the average monthly private rent across the UK recently hit £1,366. But that number hides massive regional differences. For instance, the average in England was £1,422, while in Wales, it was a much lower £820.

For a Rooms For Let landlord, a useful rule of thumb is to price a single room at one-third to one-half of the local rent for a whole property. So, in a city where a three-bed house fetches that English average of £1,422, you’re likely looking at a room rent somewhere between £450 and £700. Where you fall in that range depends on things like bills, furnishings, and shared facilities.

Combining these high-level stats with a deep dive into live listings in your specific postcode is what allows you to really zero in on an accurate starting price.

Mastering Local Market Research to Price Competitively

Before you even think about posting an advert, your first job is to become a local market expert. Honestly, understanding what your direct competitors are offering—and for how much—is the single most important step in figuring out your rent. This isn't just about copying prices; it's about strategically positioning your room to attract the best tenants quickly.

This data-driven approach takes all the guesswork out of the equation. When you know precisely what tenants expect for their money in your postcode, you can price your room with the confidence that it offers fair value. And that makes it far more likely to be snapped up.

Finding Your True Competitors

Your analysis should start on the very same platforms your future tenants are scrolling through. Spend a good hour browsing sites like SpareRoom, OpenRent, and of course, the thousands of listings available when you search for rooms to rent on Rooms For Let.

It's crucial to focus your search tightly on your specific postcode or within a half-mile radius. This ensures you're comparing like-for-like properties. While it’s tempting to look at the rental landscape across your whole city, your most direct competitors are the rooms on the next street, not those across town. A room in a leafy suburb will always command a different price to one in a bustling city centre, even if they're only a few miles apart.

Looking Beyond the Headline Price

The biggest mistake I see landlords make is only looking at the monthly rent figure. The real gold is found when you dig into the details of each listing. A room that seems overpriced at first might suddenly look reasonable when you realise it includes a weekly cleaner and a dedicated parking space.

Get a simple spreadsheet going to track what you find. It doesn't need to be complicated, but it will help you spot patterns and see exactly where your room fits in. For at least 5-10 comparable rooms, note down the following:

- Monthly Rent: The advertised price.

- Room Size: Is it a small single, a standard double, or a large master bedroom?

- Bathroom: Is it an en-suite or shared? If it's shared, how many people use it?

- Bills Included: Does the rent cover council tax, utilities, and broadband? This is a massive selling point for tenants.

- Furnishings: Is it furnished? Is there a desk for home working?

- Location: How close is it to key transport links like a train station or major bus route?

- Advert Quality: Pay close attention to the photos and description. Listings with bright, clear photos and detailed, friendly descriptions often rent faster, even at a slightly higher price.

Pro Tip: Look for clues on how long a property has been on the market. If an advert has been sitting there for over three weeks, it's a huge red flag that the price is too high for what's on offer. On the flip side, an advert that vanishes in a few days was likely priced perfectly.

Using Data to Set Your Starting Point

Once you've collected all this info, you'll start to see a clear price range emerge for rooms just like yours. You might find that double rooms with a shared bathroom in your area are consistently advertised between £600 and £650, while those with an en-suite command a premium, fetching closer to £750. When you're dialling in your research, it's also worth it to utilize platforms like Zillow to validate your rent and see if the numbers match up.

Your goal is to position your room competitively within this range. If your room is freshly decorated, has a modern shared kitchen, and is closer to the station than most others, you can confidently price it at the higher end. If it’s a bit smaller or the decor is a little dated, pricing it just below the average will get you more interest.

This hands-on research gives you more than just a number; it gives you a solid justification for your price. When a prospective tenant asks why the rent is £725, you can confidently explain that it reflects the included high-speed broadband, the recent redecoration, and its prime location.

Calculating Your Costs and Targeting a Healthy Rental Yield

Market research gives you a fantastic starting point for rent, but it only tells you half the story. Setting a competitive price doesn't automatically mean you're running a profitable operation. A successful rental isn't just a filled room; it's a financially sound venture.

To find out if you’re actually making money, you need to shift your focus from looking outwards at the market to looking inwards at your own numbers. This is where you get forensic with your finances to figure out exactly what it costs to offer that room for rent. Without this step, you're essentially flying blind.

Itemising Every Landlord Expense

Before you can even think about profit, you need a crystal-clear picture of your expenses. So many landlords, especially when starting out, just factor in the mortgage and call it a day. That’s a huge mistake. It’s often the smaller, recurring costs that quietly eat away at your profit margin.

Your first job is to create a comprehensive list of every single outgoing. Think of it as a financial MOT for your rental. This process ensures there are no nasty surprises waiting for you down the line.

A thorough cost analysis should always include:

- Mortgage Interest: For most, this is the biggest single expense. Remember, it's typically only the interest portion of your payment that's considered a business expense for tax, not the capital repayment part.

- Council Tax: If you're letting rooms in an HMO (House in Multiple Occupation), the responsibility for the entire council tax bill usually falls on you, the landlord.

- Utilities: This covers gas, electricity, and water. The best way to get an accurate figure is to dig out the past 12 months of bills and calculate a monthly average.

- Broadband and TV Licence: In the world of room lets, these are no longer luxuries; they're expected. Fast Wi-Fi is pretty much essential for attracting professional tenants or students.

- Landlord Insurance: This is completely non-negotiable. Your standard home insurance policy won't cover a rental property, so you need specialist landlord cover for buildings, contents, and public liability.

Beyond these regular monthly outgoings, you absolutely must budget for the less frequent—but often more significant—costs. These are the ones that catch people out.

Budgeting for Voids and Maintenance

Let's be realistic: a room will not be occupied 365 days a year, every single year. You have to account for void periods—that downtime between tenancies when no rent is coming in, but the bills keep rolling. A sensible, conservative approach is to budget for one month of vacancy per year.

Just as important is creating a maintenance fund. Things break. It's a fact of life. Boilers give up the ghost, washing machines spring leaks, and roofs need mending. A good rule of thumb I’ve always followed is to set aside 5-10% of your annual rental income specifically for maintenance and those unexpected repairs.

For a property bringing in £15,000 in annual rent, that means putting away between £750 and £1,500 each year into a separate account. This simple habit stops you from having to dip into your personal savings when an emergency hits and keeps the rental operating as a self-sufficient business.

Finally, don't forget the costs of staying compliant. If your property is classed as an HMO, you'll have licensing fees to pay, which can run into several hundred pounds every few years. Then there are the mandatory safety certificates, like the Gas Safety (CP12) and the Electrical Installation Condition Report (EICR).

To get a true handle on your profitability, understanding your tax obligations is key. Consulting a detailed landlord's guide to taxes on rental income can help you see how everything fits together and impacts your bottom line.

To help you get started, here’s a simple breakdown of the kinds of costs you should be tracking for each room you let.

Sample Monthly Cost Breakdown For A Single Room Let

| Expense Category | Example Monthly Cost (Per Room) | Notes & Considerations |

|---|---|---|

| Mortgage Interest | £250 | Calculation based on a property with 4 rooms. |

| Council Tax | £50 | Landlord is responsible for the full bill in an HMO. |

| Gas & Electricity | £60 | Based on average usage; will fluctuate seasonally. |

| Water | £10 | Averages can be calculated from previous bills. |

| Broadband | £8 | A standard cost split between all rooms. |

| Landlord Insurance | £12 | Specialist insurance is essential. |

| Maintenance Fund (5-10%) | £30 | Essential buffer for repairs (£625 rent x 5%). |

| Void Period Provision | £52 | Budgeting for 1 month vacancy per year. |

| Certificates/Licensing | £10 | Annualised cost of CP12, EICR, HMO license etc. |

| Total Estimated Costs | £482 | This is your break-even point before any profit. |

This table is just an example, but it shows how quickly costs can add up. Tallying your own specific numbers is the only way to know for sure what you need to charge.

Calculating Your Rental Yield

Once you’ve got a solid grip on your total annual costs, you can calculate your rental yield. This is the single most important metric for understanding how well your investment is actually performing. While a gross yield calculation is quick, it's the net yield that tells you the real story of your profitability.

Gross Yield Calculation:

(Total Annual Rent / Property Value) x 100 = Gross Yield %

Net Yield Calculation:

(Total Annual Rent - Total Annual Costs) / Property Value x 100 = Net Yield %

Let's run through a quick example. Imagine your property is worth £250,000 and it generates £15,000 a year in rent.

Your gross yield would be (£15,000 / £250,000) x 100 = 6%. Looks pretty good, right?

But now let's factor in the costs. If your annual expenses (mortgage interest, bills, voids, maintenance) come to £8,000, your net annual income is only £7,000.

Your net yield is therefore (£7,000 / £250,000) x 100 = 2.8%. A very different, and much more realistic, picture.

So, what’s a ‘good’ yield? It really varies across the country. In high-value areas like London, net yields are often lower (3-5%). In other parts of the UK, especially for well-run HMOs, experienced landlords often target a gross yield of 6-9% or higher to make sure there's healthy cash flow left over after every single cost has been paid.

This kind of detailed analysis lets you work backwards, giving you a clear, data-driven answer to the question: "How much rent do I need to charge to make this investment worthwhile?"

Adjusting Your Rent for Amenities and Inclusions

Once you've got a baseline figure from your market research and costings, it’s time to fine-tune. No two rooms are identical, and your final asking price has to reflect the real, tangible value you’re offering. This is where you can confidently justify a higher rent by highlighting exactly what makes your room a cut above the rest.

Even small upgrades can add up, turning a standard room into a premium let that not only commands a better price but also attracts higher-quality tenants happy to pay for convenience.

Putting a Price on Key Features

Certain amenities have a direct and measurable impact on your rental income. One of the biggest upgrades you can offer is an en-suite bathroom. In competitive city markets, the privacy and convenience of an en-suite can easily add £100-£150 per month to your asking price compared to a similar room with a shared bathroom.

Think about what your ideal tenant really values. Other high-demand features allow you to nudge your rent upwards:

- Off-Street Parking: A dedicated space can be worth an extra £50-£75 a month in areas where parking is a daily nightmare.

- A Proper Workspace: With remote working now the norm for many, a room with a proper desk, an ergonomic chair, and fast Wi-Fi is a huge draw. This alone can justify a premium of £20-£40 a month.

- Weekly Cleaner: A cleaner for the communal areas is a massive perk for busy professionals. Factoring this service into the rent can add another £30-£50 per room.

Of course, you have to be honest about the downsides, too. A ground-floor room on a noisy road, a tiny box room, or a dated kitchen will need to be priced slightly below the market average to get any traction.

Structuring an All-Inclusive Bills Package

For room lets in the UK, advertising a price with bills included is pretty much standard practice. It gives tenants simplicity and budget certainty, making your room far more appealing. But you need to structure this package carefully to shield yourself from volatile energy prices.

Start by calculating the average monthly cost of all your property's utilities: gas, electricity, water, council tax, broadband, and a TV licence. A good rule of thumb is to review the last 12 months of bills to get a reliable average. Then, just divide this total by the number of rooms to get a per-room cost.

It's wise to add a 10-15% buffer on top of this calculated cost before adding it to the base rent. This cushion protects you from unexpected price hikes. Always include a 'fair usage' clause in your tenancy agreement to prevent excessive energy consumption.

This all-inclusive approach simplifies everything for both parties and is a major selling point. It helps you justify a higher headline figure when you answer the question, "how much rent do I charge?" by showing the comprehensive value included.

The balance of supply and demand also directly influences your pricing. Recent UK data shows that while rent growth has slowed, the underlying rental market remains tight. As industry analysis points out, the current vacancy rate in the UK is still below the historical norm of around 4–5% — a clear sign of constrained supply. For landlords, a low-vacancy market usually allows for slightly higher asking rents, but the cost of an empty room is very real. If your room is still vacant after two or three weeks, reducing the rent by even £25–£50 per month can often cut your void period significantly. To get a better handle on these dynamics, you can read more about the UK's buy-to-let market trends and rental growth.

Staying on the Right Side of the Law: Rent Increases and Deposits

Setting a rent that’s both competitive and profitable is just the beginning. To operate successfully as a landlord in the UK, you have to work within a clear legal framework designed to protect both you and your tenants.

Getting this right isn't just about avoiding fines; it’s about building trust and running a professional, sustainable rental business. Understanding your legal obligations from the start prevents costly mistakes and disputes down the line. The key areas to get your head around are the rules on upfront fees, tenancy deposits, and the correct way to raise the rent.

The Tenant Fees Act: What You Can (and Can't) Charge For

The Tenant Fees Act 2019 completely changed the game for what landlords in England can charge tenants before, during, and after a tenancy. The law is incredibly specific, and straying outside these rules can lead to some hefty penalties.

Essentially, you can only charge for what the law calls permitted payments. Anything not on this list is a prohibited payment, and you simply cannot legally ask a tenant to pay it.

So, what can you charge for?

- The rent itself. Obviously, this is your primary charge.

- A refundable tenancy deposit. This is capped and must be properly protected.

- A refundable holding deposit. This is to reserve a property and is capped at one week's rent.

- Payments for changing the tenancy. This is capped at £50, or your reasonable costs if they are higher.

- Payments for early termination. You can only charge to cover your actual financial loss.

- Payments for utilities, council tax, etc. This is only allowed if it's clearly specified in the tenancy agreement.

- A default fee for late rent or lost keys. These are strictly regulated, so you can't just pluck a number out of thin air.

This means you can no longer charge for things like referencing, credit checks, inventories, or general administration. These are now rightly considered part of your cost of doing business as a landlord.

Getting Tenancy Deposits Right

When you're figuring out your rent, the deposit is a separate but closely related calculation. Under the Tenant Fees Act, tenancy deposits are also capped.

For any property where the total annual rent is less than £50,000, you can only take a maximum of five weeks' rent as a deposit. If the annual rent is £50,000 or more, this cap rises to six weeks' rent.

This bit is absolutely critical: you are legally required to protect this deposit in one of three government-approved tenancy deposit schemes within 30 days of receiving it. You must also give the tenant the official paperwork about where their money is being held. Failing to do this is a serious breach and can result in you having to repay the full deposit plus a penalty of up to three times its value.

How to Handle Rent Increases Lawfully

Once you have a tenant in place, you can't just increase the rent whenever you feel like it. The process is governed by rules that ensure any increase is fair and predictable. For a periodic tenancy (one that rolls on month-to-month), you can typically only increase the rent once per year.

You must provide at least one month's notice and use the correct legal document, known as a Section 13 notice. The new rent you propose must be fair and realistic, which means it needs to be in line with the current market rates for similar properties in your area. If a tenant thinks the increase is excessive, they have the right to challenge it at a tribunal.

Knowing the recent trends is vital for judging what a fair increase looks like. While data shows average UK private rents recently rose by 4.4% annually, regional differences can be huge, with growth in Wales hitting 6.1% while Scotland saw 3.3%.

For Rooms For Let users, this translates into a practical rule of thumb: annual increases between 2% and 5% have been common recently, though new lets often see larger seasonal swings. Many landlords now opt for a modest rise somewhere between inflation and local rent growth to keep good tenants happy. It's always worth exploring more data on how the UK rental market is shifting to inform your own strategy.

Finally, a quick note for live-in landlords. The government’s Rent a Room Scheme is a fantastic benefit. It allows you to earn up to £7,500 per year completely tax-free from letting out a furnished room in your main home. This is a huge incentive that can make taking on a lodger much more profitable.

Finalizing Your Price and Crafting a Standout Advert

You've done the hard graft with the research, and now you have a target price in mind. The final piece of the puzzle is putting together an advert that actually gets your ideal tenant to click – and then get in touch.

How you present your room is every bit as important as how you price it. A brilliant advert can help you rent faster, often for a better price. A poor one? Well, that can leave even the most perfectly-priced room sitting empty for weeks. It’s time to bring all that value you’ve identified and package it up into something compelling.

This isn't just about listing features; it's about selling a lifestyle.

The Psychology of Pricing and Presentation

Before you even start writing, let's talk about a small but powerful trick from the world of retail. Listing a room at £695 often performs much better than a round £700. It’s called "charm pricing," and it works because the price just feels significantly lower to prospective tenants, even though it’s only a fiver's difference. It’s a tiny detail, but in a competitive market, it can give you an edge.

Your headline is the first thing anyone sees, so it needs to pack a punch. A generic "Double Room to Rent" will get lost in the noise. Instead, try to highlight a key benefit right away.

- Good: Double Room in Central Manchester

- Better: Large Double Room with En-Suite, 5 Mins from Piccadilly Station

- Best: Bright & Modern En-Suite Room for Professional - All Bills Inc.

See the difference? The best headlines are specific, give a nod to the ideal tenant, and shout about the most desirable features.

Crafting a Compelling Advert Description

Think of your advert's description as your sales pitch. It needs to be structured so people can scan it easily and find the information that matters to them. Kick things off with a short, friendly summary, then switch to bullet points to lay out the specifics of the room and the house.

A bit of honesty goes a long way. Mentioning who currently lives in the house (e.g., "living with two professional females in their late 20s") helps potential tenants self-select. It saves you from wasting time on viewings with people who just wouldn't be the right fit.

A simple, effective structure to follow is:

- Catchy Headline: Grab their attention immediately.

- Brief Summary: A warm, two-sentence intro to the room and the home.

- Key Features (Bulleted): List the essentials like room size, en-suite, bills included, broadband speed, and parking.

- About the Housemates: A quick, honest profile of the household vibe.

- Location & Transport: Mention nearby stations, key bus routes, and local shops or parks.

Finally, high-quality, bright photos are completely non-negotiable. Grab your phone on a sunny day, make sure you’re shooting in landscape, and get clear snaps of the bedroom, kitchen, bathroom, and any communal living areas. A clean, well-lit space looks infinitely more appealing.

When you're all set to go live, check out the latest Rooms For Let advert prices to pick a package that will give your standout advert the visibility it deserves.

Common Questions About Setting Your Rent

Even with the best calculations, a few specific questions always seem to crop up. I get asked these all the time, so let's run through some quick, practical answers for UK landlords.

Should I Include Bills in the Rent?

For room lets and HMOs, the short answer is yes. An all-inclusive price is what tenants are looking for. It just makes their life simpler, and it makes your advert stand out.

To work it out, tot up the average monthly cost for everything: council tax, gas, electricity, water, broadband, and your TV licence. Divide that total by the number of letting rooms, then I’d suggest adding a small buffer—maybe 10% or so—to cover any unexpected price hikes. Tack this figure onto your base rent. Just remember to pop a 'fair usage' policy into your tenancy agreement to protect yourself from someone running the heating 24/7 with the windows open!

How Often Can I Legally Increase the Rent?

If your tenant is on a periodic tenancy (rolling month-to-month), you can typically only increase the rent once a year. You have to give them at least one month's notice, and it has to be done properly using a Section 13 notice.

For tenants on a fixed-term contract, it’s a different story. You can only increase the rent if they actually agree to it, or if you’ve already got a ‘rent review clause’ written into the original agreement. Whatever you do, the increase has to be fair and in line with what similar rooms are going for locally.

What Should I Do if My Room Isn’t Renting?

This is a painful one, but if your advert has been up for a couple of weeks with no serious bites, the price is almost certainly the problem. Before you drop it, give your advert a quick once-over. Are the photos bright and clear? Is the description detailed and appealing? If the advert is genuinely good, it's time to look at the competition again.

A small price drop of £25-£50 per month can make a massive difference. I know it stings, but it’s far better than letting a room sit empty for another month and losing out on hundreds of pounds of income.

Ready to find your next great tenant? Rooms For Let makes it easy. You can register as a landlord and advertise your room for free to connect with thousands of people searching for a new home today.