Figuring out how much rent to charge is a balancing act.You need to cover your own costs, of course, but you also have to stay competitive with what’s happening in your local market.

A common rule of thumb you’ll hear about is the 1% rule, which suggests your monthly rent should fall somewhere between 0.8% and 1.1% of your property's value. But let's be honest, that's just a starting point. The real answer depends heavily on your specific location, property type, and running costs.

Finding Your Ideal Rent: A Practical Overview

Setting the right rent can feel a bit like guesswork, but it really doesn't have to be. Your goal is to find that sweet spot – a price that not only fills your property quickly but also keeps your investment profitable.

Get the price right, and you'll attract high-quality tenants who are more likely to stick around, cutting down on those painful and expensive void periods. This guide will give you a clear framework for setting your price, helping you avoid the classic mistakes of overpricing (and having your property sit empty for months) or underpricing (and leaving your hard-earned money on the table).

The Core Pillars of Rental Pricing

To land on a figure that makes sense, you need to look at several key factors that all influence each other. Think of it as putting together a puzzle; miss a piece, and the final picture won't look right.

Here’s a snapshot of the essential components we'll break down:

- Local Market Comparisons: What are similar properties in your neighbourhood actually renting for right now?

- Property-Specific Value: What unique features, amenities, or recent upgrades make your place stand out from the crowd?

- Operational Costs: Tallying up everything from the mortgage to maintenance funds to find your absolute break-even point.

- Tenant Demand: Getting a feel for how many people are looking for a place like yours in the current market.

Landing on the right rent isn’t just about picking a number out of thin air. It's about building a solid financial model for your rental property that works for the long haul.

A thorough analysis is the bedrock of any successful letting business. If you want to dig deeper into evaluating your property's potential, it's worth learning how to analyze a rental property in more detail.

Now, let's unpack each of these pillars with practical, actionable steps.

How to Accurately Research Your Local Rental Market

Before you can even think about putting a price on your room, you need to become a bit of a local market detective. If you pluck a number out of thin air, you risk two things: pricing too high and suffering a long, expensive void period, or pricing too low and leaving cash on the table every single month.

Your first job is to get a handle on the rental landscape right on your doorstep.

The goal is to find your direct comparables. These are properties as similar to yours as possible, in the same immediate area. Think of it like valuing a car; you wouldn't compare a family saloon to a two-seater sports car, even if they're parked next to each other. The same logic applies here.

Finding Your True Competitors

Your research will almost certainly start online. For UK rooms and house shares, specialist platforms are your best friend because they cut through the noise of the wider property market.

A brilliant place to start is to simply search for rooms to rent on Rooms For Let. This shows you exactly what prospective tenants in your postcode are seeing right now.

As you browse, pay really close attention to the details that matter most for room lets:

- Property Type: Is it a room in a shared house (HMO)? A spare room in a live-in landlord's home? Or a self-contained studio?

- Room Size: A cosy single room simply won't command the same price as a large double with space for a desk and armchair.

- Bills: Are they all-inclusive? This is a huge factor. Tenants love the simplicity of one fixed payment, so "bills included" often carries a premium.

- Furnishings: Make a note of the quality. Is it basic flat-pack furniture, or is it a well-presented, modern room? Good presentation justifies a higher price.

Don't just glance at the headline price. You have to analyse what’s actually included for that amount. A room advertised at £650 with all bills included is often a much better deal for a tenant than a £600 room where they'll have to budget an extra £100+ for utilities and council tax.

Filtering Out the Noise

While you're looking at listings, you’ll quickly spot some that seem wildly overpriced or suspiciously cheap. Just ignore them. These are the outliers.

An overpriced room will probably sit empty for weeks, costing the landlord a fortune. A rock-bottom price might signal issues with the property or a landlord in a desperate situation. Your focus should be on the cluster of similar properties priced in the middle—this is your true market rate.

To really get this right, it pays to understand how the pros do it. Getting your head around the principles of mastering real estate property valuation methods will help you assess your room's value beyond simple online comparisons.

Spotting Local Trends and Opportunities

Finally, lift your head from the screen and take a look at what’s happening in your actual neighbourhood. Local developments can have a direct impact on rental demand and, consequently, what you can charge.

- New Transport Links: Has a new bus route just started? Or maybe a new entrance to the local train station has opened up, cutting down commute times?

- Major Employers: Is a big company opening a new office nearby? That could mean an influx of professionals looking for quality accommodation.

- University Expansions: Are the local universities increasing their student intake this year? More students means more demand for rooms.

These are the kinds of factors that create fresh demand. Being aware of them allows you to price your room not just on what it is today, but on the convenience and value it offers tenants tomorrow.

Calculating Your Costs and Target Rental Yield

Just matching what other landlords are charging in your area won't cut it if you want to run a profitable rental. I've seen too many newcomers get this wrong. The smart approach is to work backwards, starting with your own numbers and your desired return on investment.

This way, you're not just guessing a competitive price; you're setting a rent that actually covers your outgoings and meets your financial goals. It’s the difference between hoping for a profit and building a strategy to guarantee one.

Itemising Your Landlord Expenses

Before you even think about profit, you need a painfully honest list of every single cost involved. The mortgage is the obvious one, but a dozen other expenses can sneak up and quietly drain your income if you don't account for them from day one.

To find your true break-even point, you need to tally up everything.

- Mortgage Payments: Your biggest monthly outlay, no doubt.

- Insurance: This isn't just standard buildings insurance; you need proper landlord liability cover, too.

- Council Tax: This is a big one for room lets. If you're running a House in Multiple Occupation (HMO), you, the landlord, are usually on the hook for the entire property's council tax bill.

- Maintenance Fund: Don't skip this. A good rule of thumb is to stash away 1% of the property's value every year for repairs. A boiler breakdown can wipe out months of profit if you're not prepared.

- Void Periods: Properties don't stay full 100% of the time. It's wise to budget for at least one month of vacancy a year to cover the gaps between tenants.

- Utilities: If you're offering "all-inclusive" rent (which is very common for room lets), you'll need a solid estimate for gas, electricity, water, and broadband.

- Listing Fees: Finding good tenants costs money. Whether it’s agency fees or advertising costs, it needs to go on the balance sheet. Check out our straightforward advert prices to see how this fits into your budget.

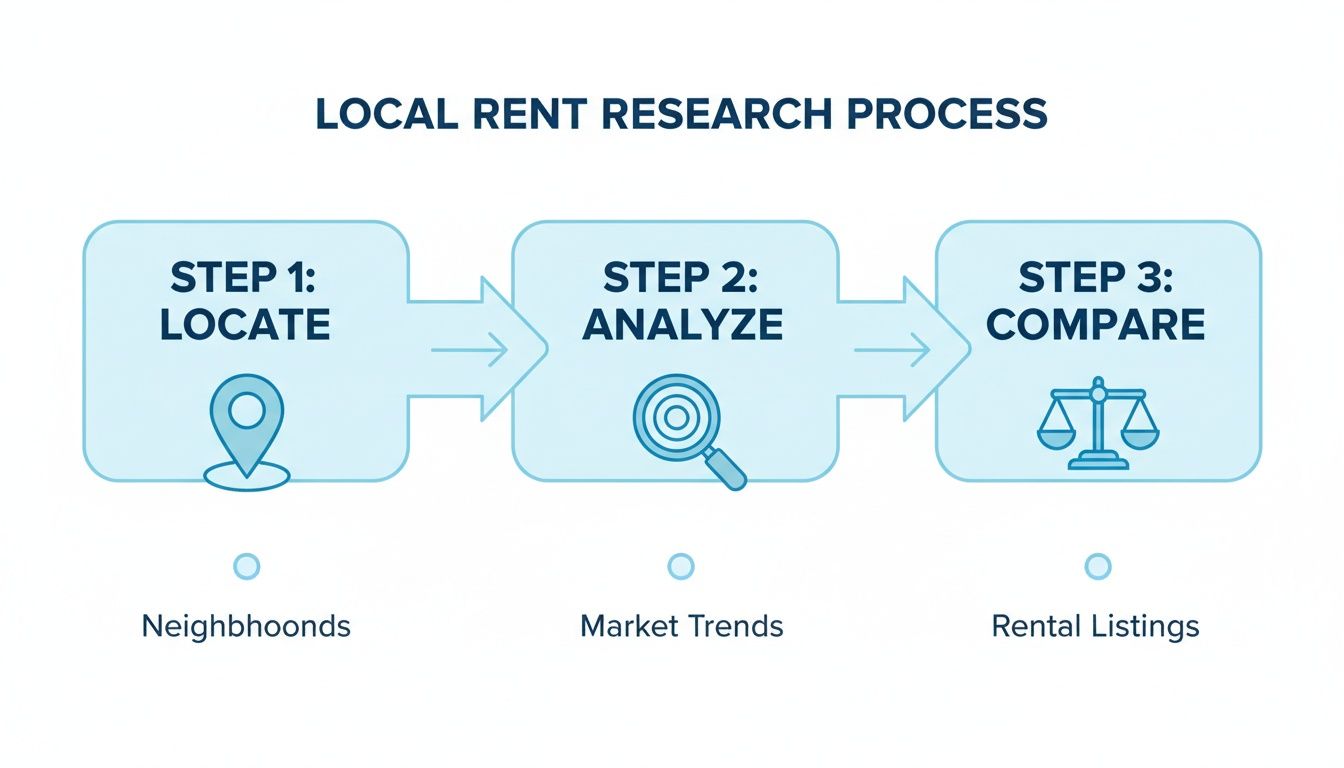

This three-step process is a great visual reminder of how to structure your research before you even get to this cost-calculation stage.

Putting it all together, here’s a quick example of what your monthly costs might look like for a single room. This is just a sample, of course—you'll need to plug in your own numbers.

Sample Monthly Cost Calculation for a Single Room Let

| Expense Category | Example Monthly Cost (£) | Notes |

|---|---|---|

| Mortgage (pro-rata for room) | £250 | Your total mortgage divided by the number of rooms. |

| Council Tax (pro-rata) | £50 | If you're liable for the whole bill. |

| Utilities (all-inclusive) | £100 | Gas, electricity, water, broadband. Be realistic! |

| Insurance (pro-rata) | £10 | Landlord and buildings insurance. |

| Maintenance Fund | £25 | Based on 1% of property value per year. |

| Void Period Provision | £40 | Budgeting for one month's vacancy per year. |

| Listing/Admin Fees | £10 | Annual costs spread across 12 months. |

| Total Monthly Costs | £485 | Your break-even point for this room. |

This table shows that you'd need to charge £485 per month just to cover your costs. Anything above that is your profit. This simple exercise is vital for making sure your rental is financially viable from the start.

Working Backwards From Your Target Yield

Once you know your costs, you can figure out the rent required to hit a specific gross rental yield. This is a classic metric landlords use to quickly gauge a property's performance before digging into the finer details.

The formula is straightforward:

(Annual Rent / Property Value) x 100 = Gross Yield %

Historically, buy-to-let investors in the UK aimed for gross yields of around 5-6% a year. For HMOs, where you have multiple income streams from one property, the target has always been higher—more like 7-10%.

For example, a property worth £200,000 generating £12,000 in rent per year would have a 6% gross yield. It’s a solid benchmark that many experienced landlords still use today.

Real-World Example: A Room in a Shared House

Let's say you own a four-bedroom house valued at £250,000 and you're aiming for a healthy 8% gross yield.

- Target Annual Rent: £250,000 (Property Value) x 0.08 (Target Yield) = £20,000

- Target Monthly Rent (Total): £20,000 / 12 months = £1,667

- Required Rent Per Room: £1,667 / 4 rooms = ~£417 per room

This gives you a clear target. Your next move is to compare that £417 figure with your market research. If similar rooms in the area are going for £500, you’re in an excellent position. If they're all advertised for £400, you might need to adjust your yield expectations or find ways to increase the property's value to justify a higher rent.

Starting with your costs and targets ensures your final price is grounded in financial reality, not guesswork.

Here’s the rewritten section, crafted to sound like an experienced human expert in line with your requirements and examples.

The Hidden Costs of Overpricing Your Rental

It’s completely natural to want the highest possible rent for your room; maximising your return is the name of the game, after all. But one of the most common and damaging traps a landlord can fall into is overpricing their property, even by a little bit. Setting your rent above the going market rate can trigger a whole cascade of expensive problems that will quickly erase any extra income you were hoping to make.

The first and most painful hit is a long void period. Every single week your room sits empty, you aren't just missing out on rent—you're actively losing money. Your fixed costs don’t stop. The mortgage, insurance, and council tax payments all keep coming, but there’s zero income to cover them.

Let’s look at the simple maths. Say you decide to list a room at £750 a month instead of the market rate of £700. On paper, you’re aiming for an extra £600 over the year. But if that higher price means the room is vacant for just one extra month, you’ve already lost £750 in rent. Suddenly, you’re £150 behind before a tenant has even moved in.

The True Price of a Vacant Room

In a competitive rental market, prospective tenants are savvy. They have plenty of options and they know what a fair price looks like. An overpriced listing gets fewer clicks, fewer messages, and definitely fewer viewings. While you hold out for that one person willing to pay your premium, dozens of great, well-qualified tenants will have already signed on the dotted line for similar, fairly priced rooms nearby.

This isn’t just a theory. Recent trends across the UK rental market show that this strategy consistently backfires, forcing landlords to drop their prices after weeks of silence. The property experts at Northwood found that a massive 24% of listings had their prices reduced after going live, often because they were simply too expensive for what the market would bear. You can discover more insights about these market shifts and see just how critical accurate pricing has become.

How Overpricing Sinks Tenant Quality

Beyond the obvious financial drain of an empty room, asking for too much can also seriously affect the quality of people who apply. When your property is priced right, you’ll likely get a healthy stream of enquiries. This gives you the huge advantage of being able to choose the most reliable and suitable person for your property.

On the flip side, when you overprice, that pool of applicants shrinks to a puddle. You might feel backed into a corner, tempted to accept the first person who shows any interest just to get some money coming in, even if they have a few red flags. This short-term fix can lead to much bigger headaches down the road, from late rent payments to difficult and stressful tenancies.

A competitively priced room isn't about leaving money on the table. It’s a strategic move to minimise vacancies, attract a better calibre of tenants, and secure a more stable, profitable return over the entire year. The goal is maximum annual income, not the highest possible monthly figure on paper.

Adjusting Rent Based on Amenities and Bills

Once you've got that baseline figure from your market research, it’s time to fine-tune it. This is where you factor in the unique value your property brings to the table. Let's be honest, not all rooms are created equal, and tenants are absolutely willing to pay a premium for features that make their lives easier or more comfortable. Your job is to figure out what that extra value is worth.

Put yourself in a tenant's shoes for a moment. A freshly refurbished kitchen with shiny new appliances is a world away from a tired, dated space. It’s a huge selling point. And in today's world, fast, reliable broadband isn’t just a nice-to-have; for students and anyone working from home, it’s a deal-breaker they’ll happily pay more for.

Quantifying the Value of Your Amenities

Certain features consistently give you the green light to charge a higher rent. The trick is to look at your local comparables again and see what sort of premium these extras are commanding in your specific area.

Here are some of the most impactful amenities to think about:

- En-suite Bathrooms: This is probably the single biggest upgrade for a room in a shared house. Having your own bathroom can often add £50-£100 or more to the monthly rent compared to a room that shares a bathroom down the hall.

- Off-Street Parking: In busy urban areas, a guaranteed parking spot is like gold dust. This can easily justify an extra £25-£50 per month, sometimes more depending on how expensive local parking is.

- Quality Furnishings: A room that’s thoughtfully furnished with a decent mattress, good storage, and a proper desk will always beat one with basic, mismatched furniture. It just looks better and signals that you’re a landlord who cares for the property.

- Outdoor Space: Access to a garden or even a small balcony adds huge appeal, especially in cities where private outdoor space is a real luxury. If it’s well-kept, it can certainly bump up the price.

By methodically listing every positive feature, you're not just setting a price; you're building a list of key selling points to highlight in your advertisement. This helps prospective tenants immediately see the value you're offering.

The All-Inclusive vs Bills-Excluded Debate

For room lets and HMOs, offering an "all-inclusive" rent has become pretty standard, and tenants love it. It gives them complete certainty over their budget – they know exactly what they need to pay each month without stressing about a surprise energy bill.

If you decide to go down this route, you’ll need to work out the cost of all the utilities and roll it into your base rent. A typical all-inclusive package should cover:

- Gas and Electricity

- Water

- Council Tax

- High-Speed Broadband

- TV Licence (if there’s a TV in a communal area)

To get your numbers right, dig out the property’s bills from the last 12 months and work out a monthly average. It’s always a smart move to add a small buffer—around 10% is a good rule of thumb—to this figure. This protects you from any sudden price hikes and ensures your costs are covered, while still offering a competitive, hassle-free deal for your tenants.

Finalizing Your Price and Planning for Future Reviews

After diving into market rates, crunching the numbers on your costs, and factoring in your property's best features, you should have a solid, data-backed figure for your rent. This is the moment to pull all those threads together. You're not just guessing a number; you’ve built a strong case for it, making sure it’s competitive enough to attract great tenants while still being profitable.

With your price locked in, it's time to get your property listed. Your advert is your first chance to show off the value you’re offering. Be sure to highlight all those premium features you just accounted for, whether it's the en-suite bathroom, the inclusive bills, or the brand-new kitchen. A strong listing justifies your price from the very first impression.

Planning for Annual Rent Reviews

Setting your initial rent is a huge step, but it’s really just the beginning. To keep your investment performing well over the long haul, you need to think ahead about rent reviews. This isn't a one-and-done task; it’s an ongoing part of managing your property well.

A classic mistake is letting the rent stagnate for years, only to hit a tenant with a sudden, large increase down the line. This can come as a real shock and often results in good tenants deciding to move on. A much smarter—and fairer—strategy is to implement small, regular, evidence-based increases each year. This approach feels more reasonable to the tenant and ensures your rental income keeps up with inflation and market shifts.

The point of a rent review isn’t to squeeze every last penny out of a tenancy. It’s about making fair, incremental adjustments that protect your investment's value and encourage good, reliable tenants to stay for the long term.

Keeping Increases Fair and Legal

So, how much should you actually increase the rent by each year? A modest uplift that mirrors national trends is usually the most sensible path.

For instance, forecasts from major commentators like Zoopla and Savills suggest UK rental growth is steadying at around 2-3% annually. Applying a similar increase to your property is perfectly reasonable and easy to justify. For a landlord on a platform like Rooms For Let, this means keeping annual increases in the 2-4% band. You can learn more about buy-to-let market forecasts to help guide your decisions.

It’s also absolutely crucial to follow the correct legal procedures in the UK. How you can increase rent depends on the type of tenancy:

- Fixed-Term Tenancy: You can only increase the rent during the fixed term if there's a specific 'rent review clause' written into the tenancy agreement. If not, you have to wait until the term is up for renewal.

- Periodic Tenancy: For rolling or 'periodic' tenancies, you can typically only increase the rent once every 12 months. You must give the tenant at least one month's notice using the correct official form (known as a Section 13 notice).

By planning for small, regular reviews and sticking to the proper legal steps, you can maintain a healthy, profitable rental property without unsettling your tenants.

Got Questions About Setting Your Rent?

Even after you've crunched the numbers and scouted the competition, a few specific questions always seem to pop up right at the end. Here are some quick, straight-to-the-point answers to the most common queries I hear from landlords finalising their rent price.

Should I Just Include Bills in The Rent?

Bundling bills into the rent, creating an 'all-inclusive' package, is a massive draw for tenants, especially in shared houses and HMOs. It gives them one simple, predictable monthly payment, which is a fantastic selling point. This approach also lets you advertise a higher, more attractive headline rent.

The catch? All the risk lands on your shoulders. If energy prices suddenly shoot up, your profit margin can get squeezed. A sensible strategy is to work out the average annual utility costs for the property and then add a small buffer—say, around 10%—before you roll it into the final monthly figure.

How Often Can I Actually Increase The Rent?

In the UK, the rules around rent increases hinge on the type of tenancy you have.

For a periodic tenancy (one that just rolls from month to month), you can generally only increase the rent once a year. You also have to give at least one month's notice using the correct legal paperwork.

If your tenant is on a fixed-term contract, you can only increase the rent if they agree to it, or if you were clever enough to include a 'rent review clause' in the original agreement. Any increase must be fair and realistic, meaning it needs to be in line with what similar local properties are going for.

Help! My Property Isn't Renting. What Do I Do?

If your room has been on the market for over two weeks with little more than a whisper of interest, the price is almost certainly too high. The market is giving you blunt feedback. It's time to go back to your research on comparable properties. Did you miss something? Were you a bit too optimistic?

The quickest fix for a vacant property is nearly always a price adjustment. Dropping the rent by just 5-10% can spark a whole new wave of interest. Remember, losing an entire month's rent will hurt your wallet far more than a small reduction right now.

While you're at it, take a hard look at your advert. Are the photos top-notch? Is the description clear, compelling, and shouting about the best features? Sometimes, a lazy advert is just as much to blame as the price. Our landlord's blog is packed with more tips on this. You can read more expert advice on our blog for extra guidance.

Is It a Good Idea to Set Rent Slightly Below The Market Rate?

Absolutely. Pricing your room just a fraction below the local average can be a seriously powerful move. It often triggers a flood of enquiries, giving you a much bigger and better pool of potential tenants to pick from. This massively boosts your chances of finding that perfect, reliable, long-term tenant.

Think about it: securing a fantastic tenant quickly at a slightly lower rent is almost always more profitable over the year than holding out for top-dollar and suffering a long, expensive void period.

At Rooms For Let, we make it easy to advertise your spare room and connect with thousands of potential tenants across the UK. List your room with us today and fill your vacancy faster.