Running a proper reference check on a potential tenant isn't just paperwork; it's the single most important thing you can do to protect your property investment. Think of it as the essential due diligence for your rental business, a process that helps you dodge costly mistakes and future headaches by verifying an applicant's identity, financial stability, and past rental behaviour.

Why Tenant Referencing Is Your First Line of Defence

Let's face it, finding a great tenant can feel like a gamble. Every day a room sits empty costs you money, and that pressure can easily lead to rushed decisions you'll later regret. But skipping a thorough reference check is a classic false economy, one that often leads to far more financial pain and stress down the line.

This isn't just a box-ticking exercise. It's your most critical risk management tool, giving you a clear, evidence-based picture of the person you're about to trust with one of your most valuable assets.

The Real Cost of a Bad Tenant

Getting it wrong can go way beyond a single missed rent payment. A difficult tenancy can quickly spiral into a nightmare scenario, creating problems like:

- Persistent Rent Arrears: The time and energy spent chasing late payments is draining, and it hits your cash flow directly.

- Property Damage: Repairs from neglect or deliberate damage can easily swallow up a security deposit and much more.

- Lengthy Eviction Battles: The legal process to remove a tenant is notoriously slow and expensive, with no guarantee you’ll ever see the rent you're owed.

- Anti-Social Behaviour: In an HMO especially, disputes with neighbours or other tenants can ruin the living environment and damage your reputation as a landlord.

In the current economic climate, these risks are even greater. With the rising cost of living, some applicants may be tempted to bend the truth on their applications. This makes a diligent tenant reference check more vital than ever.

Building a Foundation for Success

A robust vetting process does more than just screen out unsuitable applicants. It sets a professional tone right from the start, showing that you're a serious, organised landlord. This, in turn, attracts higher-quality tenants—the kind who appreciate a well-managed property and are more likely to treat it with respect.

Whether you're a first-time landlord or an experienced HMO manager, this initial groundwork is the foundation of a stable, profitable tenancy. By taking the time to verify an applicant's reliability upfront, you protect your investment and pave the way for a positive, headache-free relationship. Getting this step right means you can focus on managing your property, not managing problems.

If you want to streamline the search, you can register as a landlord and connect with pre-vetted tenants on dedicated platforms.

Navigating Tenant Referencing Laws and Compliance

Before you even think about asking a prospective tenant for a single document, you need to know the rules of the game. Tenant referencing isn't a free-for-all; it’s a process wrapped up in strict UK laws designed to prevent discrimination and protect people's privacy. Getting this wrong can land you in some seriously hot water, both legally and financially.

Think of legal compliance as the bedrock of your entire vetting process. It’s what allows you to gather the information you need fairly and lawfully, protecting both you and your applicants.

Understanding GDPR and Tenant Data

The General Data Protection Regulation (GDPR) is the big one when it comes to data privacy in the UK. When you’re referencing, you are collecting, processing, and storing some very sensitive personal information. Under GDPR, you can't just ask for whatever you feel like; you must have a lawful reason for handling that data.

For landlords, that lawful basis is almost always consent. You have to get clear, explicit permission from the applicant before you can contact their boss, their old landlord, or run a credit check. A simple signature on an application form that includes a consent clause is the standard way to handle this.

This also means you have a duty of care over their information. You must:

- Collect only what you need: Don't get greedy with data. Only ask for what is genuinely necessary to assess if they're a suitable tenant.

- Store it securely: Whether it’s in a filing cabinet or on a hard drive, that information has to be protected from anyone who shouldn't see it.

- Bin it responsibly: Once you’ve filled your room, you have no reason to keep the data of the unsuccessful applicants. It needs to be securely destroyed.

A simple slip-up in how you handle data can lead to a hefty fine from the Information Commissioner's Office (ICO). My advice? Treat a tenant's personal information with the same care you would your own bank details.

The Mandatory Right to Rent Checks

For landlords in England, Right to Rent checks are not optional – they're a legal requirement. The Immigration Act 2014 puts the responsibility squarely on you to verify that any adult tenant has the legal right to rent in the UK before the tenancy starts.

Fail to do this, and you could be facing unlimited fines or even a prison sentence. The process means checking original ID documents with the person present, or you can now use a certified Identity Service Provider (IDSP) for digital checks, which is becoming the go-to for British and Irish citizens.

Crucially, you must check all new tenants. Don't just check the people you suspect might not have the right to rent. Applying the same check to everyone is your safeguard against accusations of discrimination.

Of course, referencing is just one piece of the compliance puzzle. Landlords have many other critical duties. For instance, a practical guide to fire safety regulations for landlords is an essential read to ensure your property is safe and legal. A broad understanding of all your obligations is what truly protects your investment and, more importantly, your tenants.

Upholding the Equality Act 2010

The final piece of this legal jigsaw is the Equality Act 2010. This law is there to protect people from discrimination based on 'protected characteristics', which include things like age, race, religion, sex, and disability.

When you’re referencing, your process has to be identical and fair for every single person who applies. You can't have one set of rules for one person and a different set for another. For example, asking for a higher income from a younger applicant or turning someone down because they're on maternity leave would almost certainly be seen as discriminatory.

The key here is to create a clear, written lettings policy with objective criteria and stick to it like glue. This policy becomes your best defence against a discrimination claim because it proves your decisions are based on fair, consistent business practices, not personal bias.

How to Verify Identity and Financial Stability

With the legal groundwork out of the way, it’s time to get down to the nitty-gritty. This part of the process is all about building an accurate picture of your applicant before you even think about handing over the keys. Think of it as your due diligence stage, where you methodically confirm who they are and whether they can genuinely afford the rent.

Checking Their Identity

First things first, you need to be certain they are who they say they are. Don't just accept a quick photo of an ID sent over WhatsApp; you need to see the original document. The best way is in person, but a clear, secure video call where they hold the ID up to the camera also works.

Just like businesses carry out thorough UK pre-employment checks to avoid hiring risks, landlords must be just as diligent.

For photo ID, you’re looking for one of these:

- A valid UK or EEA passport

- A current UK or EEA photocard driving licence

- A national identity card from an EEA country

Keep a sharp eye out for any signs of tampering. Are the fonts mismatched? Is the photo blurry or does it look stuck on? A genuine document will have crisp, clear details and official features like watermarks or holograms.

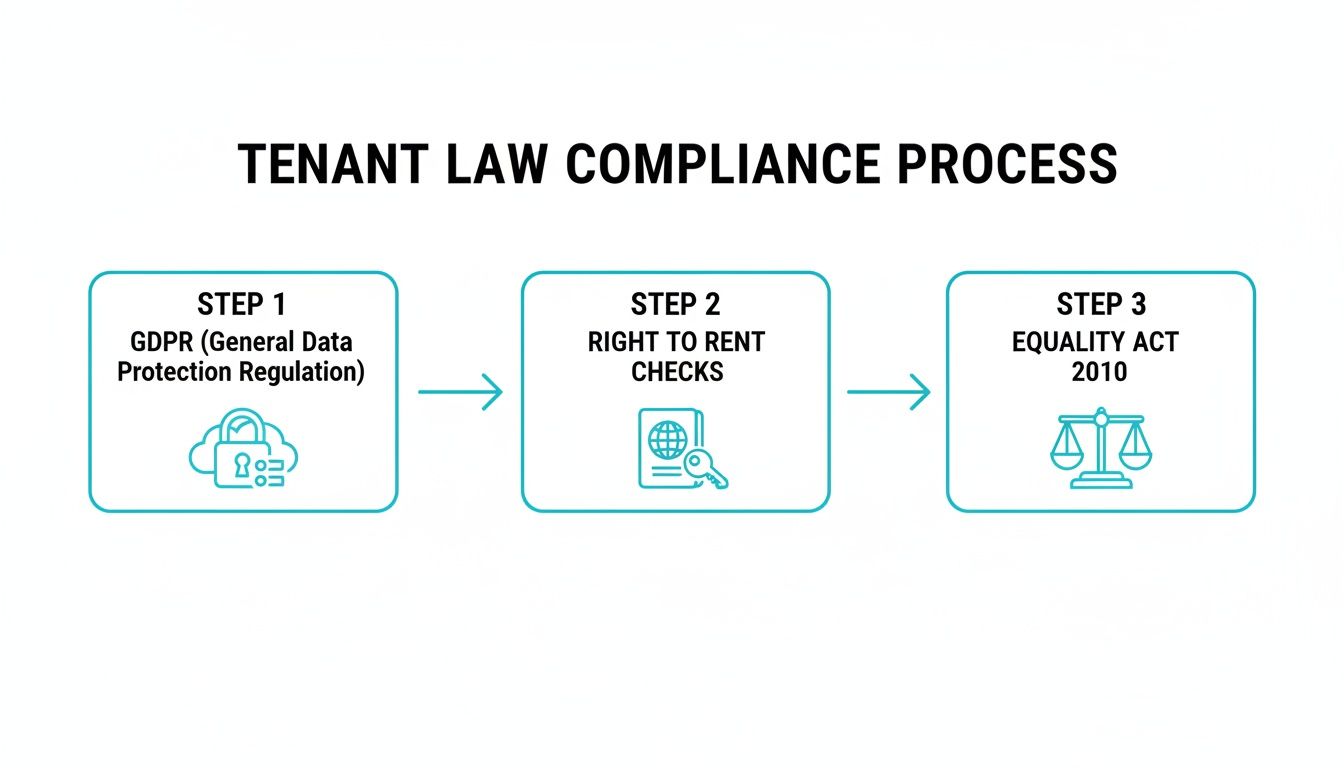

This flowchart is a great visual reminder of the key legal steps you have to navigate during the referencing process.

As you can see, getting consent under GDPR, doing your Right to Rent checks, and following the Equality Act are all linked together. They form the backbone of a legally sound referencing journey.

Can They Afford the Rent?

Once you’ve confirmed their identity, the focus shifts to their finances. The go-to industry benchmark is that a tenant's gross annual income should be at least 30 times the monthly rent. So, for a room you’re letting at £700 per month, you’d be looking for a yearly salary of at least £21,000.

But this isn’t a hard-and-fast rule you should apply blindly. Context is everything. In super expensive areas like London, you might need to be a bit more flexible and accept a lower multiple, maybe 25x, or be more open to applicants with a guarantor. In a lower-cost part of the country, sticking rigidly to the 30x rule makes a lot more sense.

To prove their income, you’ll need to see some paperwork. The usual requests are:

- Payslips: Ask for the last three months' worth. This shows consistent earnings. Check that the company name, applicant's name, and pay figures all match up.

- Bank Statements: Again, the last three months. This lets you see the salary actually landing in their account and gives you a feel for how they manage their money. Look for regular payments, a stable balance, and a lack of red flags like bounced direct debits.

- Employment Contract or Offer Letter: This is particularly handy for tenants just starting a new job. It will confirm their salary, job title, and whether the role is permanent.

Here’s a quick-reference table to help you work out affordability on the fly.

Tenant Affordability Calculation at a Glance

This table uses the standard industry multiplier to give you a clear idea of the income levels required for different monthly rents.

| Monthly Rent | Required Annual Income (Rent x 30) | Required Monthly Gross Income |

|---|---|---|

| £600 | £18,000 | £1,500 |

| £750 | £22,500 | £1,875 |

| £900 | £27,000 | £2,250 |

| £1,100 | £33,000 | £2,750 |

| £1,500 | £45,000 | £3,750 |

Remember, this is a guide. Always consider the applicant's complete financial picture before making a final decision.

The current economic climate has definitely made it tougher for tenants to meet these affordability checks. While historically around 35% of tenants would pass referencing without any issues, that figure has now dropped closer to 25%. More and more applicants are needing a guarantor simply because rents have been rising much faster than wages.

What a Credit Check Actually Tells You

The credit check is the final piece of the financial jigsaw. It's not about seeing how much money they have in the bank; it’s about understanding their track record with debt. When you run a check through a professional service, you get a report that flags key financial events.

You’re basically looking for signs of past financial trouble. The big ones are:

- County Court Judgements (CCJs): This means a court has formally ordered them to pay a debt they defaulted on.

- Insolvency or Bankruptcy: A major red flag pointing to serious historic financial problems.

- Late Payment History: A consistent pattern of missing payments on loans or credit cards can suggest poor financial management.

It’s crucial to look at the context, though. A single missed payment from five years ago is a world away from a recent CCJ for unpaid rent. The credit check gives you an objective score and a summary that helps you build a clearer picture, allowing you to make a much more informed decision.

For anyone looking for a room, having your own financial paperwork in order will make the whole process much smoother. To see what landlords are looking for and get your application ready, you can register as a tenant to find available rooms.

Getting the Real Story from Previous Landlords and Employers

Financial documents give you a black-and-white picture, but they don’t tell the whole story. They won’t reveal if a tenant paid rent on the dot every month, if they treated their last home with respect, or if they were the source of endless noise complaints.

This is where talking to previous landlords and employers comes in. These conversations add colour and context to the application, transforming a set of numbers into a three-dimensional view of your potential tenant. Getting this right is a vital part of a thorough reference check tenant process.

Speaking to a Previous Landlord

Contacting the applicant’s current landlord is a good start, but be wary. They might give a glowing review simply to move a problematic tenant on.

For a more honest assessment, always try to speak with the landlord before their current one. This referee has nothing to gain or lose, so they are far more likely to give you a candid account of their experience.

Before you pick up the phone, do a quick bit of detective work. Use the online Land Registry to confirm the name of the property owner matches the contact details you've been given. This simple step helps ensure you're not speaking to a friend posing as a landlord.

A common trick is for an applicant to provide a mate's phone number instead of their actual landlord's. Verifying ownership is your best defence against this. If the names don't match, ask the applicant to explain why before proceeding.

Once you’re confident you're speaking to the genuine landlord, you need to ask the right questions to get the information that really matters.

Essential Questions for a Landlord Reference Check

- Payment History: "Was rent consistently paid on time and in full?"

- Property Condition: "How was the property left at the end of the tenancy? Were there any damages beyond normal wear and tear?"

- Tenancy Conduct: "Were there any complaints from neighbours or other tenants regarding noise or anti-social behaviour?"

- Deposit Deductions: "Was the full security deposit returned, or were any deductions made?"

- The Killer Question: "Would you happily rent to this tenant again?"

That last question is often the most revealing. A moment of hesitation can speak volumes, even if their other answers were positive.

Contacting the Tenant's Employer

The employer reference check has a much narrower focus. Your goal here isn't to ask about their personality but to simply confirm the employment and income details they provided on their application.

Most HR departments will only confirm factual information due to company policy and data protection laws. Your approach should be professional and direct – an email is often best as it gives the employer a written record of the request.

Key Information to Confirm with an Employer

- Employment Status: Confirm their job title and that they are a current employee.

- Contract Type: Is their position permanent, temporary, or on a fixed-term contract? A permanent role offers much more stability.

- Employment Duration: Ask for their start date to verify how long they have been with the company.

- Salary Confirmation: Simply ask if they can confirm the gross annual salary figure provided by the applicant.

Avoid asking for opinions about their performance or reliability. These questions are inappropriate and will almost certainly go unanswered. You are simply looking to verify the facts they’ve presented to you.

Remember, you must have the applicant's explicit written consent before contacting any referee, whether it's a past landlord or a current employer. This is a non-negotiable step to remain compliant with GDPR.

By combining hard financial data with these real-world insights, you create a much stronger, more reliable picture of your applicant. This comprehensive approach allows you to make your letting decision with confidence, knowing you’ve done everything possible to find a responsible and trustworthy tenant for your property.

How to Spot Red Flags and Handle a Failed Check

Not every application that lands in your inbox will be a straightforward approval. As a landlord, you'll inevitably come across applications with inconsistencies, missing details, and sometimes, even deliberate deception. The trick is to approach every tenant reference check with a sharp eye and a clear game plan for when things don't quite add up.

Interpreting the results of your checks is an art as much as a science. It's about looking past the raw data to understand the story behind the applicant. A small issue might be just that—a minor blip. But other times, it could be the tip of a much larger iceberg.

Common Red Flags to Watch For

A little vigilance during the application stage can save you months of headaches down the line. With rental application fraud on the rise, knowing what to look for has never been more critical. The intense pressure of a competitive rental market can unfortunately push some applicants into making poor choices.

For instance, analysis from Goodlord revealed a staggering 140% spike in fraudulent applications in just one year. While fraud detection caught 1.2 cases per 1,000 applications in 2022, this jumped to 2.9 per 1,000 by 2023, with doctored payslips being the most common tactic. You can read more about the rising importance of tenant referencing here.

Here are some of the most common warning signs you should be on the lookout for:

- Inconsistencies in Their Story: Does the income stated on their application actually match what's on their payslip and, more importantly, what’s hitting their bank account each month? Do the tenancy dates they've provided line up correctly? Even small discrepancies can signal a much larger fabrication.

- Reluctance to Provide Information: An applicant who gets evasive, offers up excuses, or pushes back when you ask for standard documents should immediately set alarm bells ringing. Honest applicants with nothing to hide are generally more than happy to cooperate.

- Gaps in Rental History: Unexplained periods of "living with family" or "travelling" can sometimes be a convenient way to hide a past eviction or a dreadful reference from a previous landlord. It’s always worth gently probing for more detail about these gaps.

- An Overwhelming Urgency to Move: While some people have genuine reasons for needing a quick move, applying high-pressure tactics can be a strategy to rush you into skipping proper checks. Always, always stick to your process, no matter how desperate their situation seems.

A professional-looking payslip can be knocked up online in a matter of minutes. Always cross-reference the salary figures with bank statements that show the net pay actually being deposited. If the company name on the payslip sounds generic, like 'UK Business Solutions Ltd', do a quick Google search to see if it’s a real, trading company.

Navigating a Failed Check

So, what’s the next step when a check comes back with a "fail"? Your gut reaction might be to immediately reject the application, but that isn't always the most sensible—or even the fairest—course of action. A failed check is a signal to dig a little deeper, not necessarily to show them the door.

The reason for the failure is what really matters. A low credit score because of an old, settled debt from years ago is a world away from an active County Court Judgement (CCJ) for unpaid rent. The first might be easily explained; the second is a huge red flag.

When you're faced with a failed check, the best approach is to open up a dialogue. Politely explain that certain aspects of their referencing didn't quite meet the criteria and give them a chance to provide some context. Often, their response will tell you everything you need to know.

To help you decode what you find, here's a quick rundown of common red flags and what they might mean.

Common Tenant Referencing Red Flags and What They Mean

| Red Flag | Potential Implication | Recommended Action |

|---|---|---|

| Low Credit Score | Could be due to old, settled debts, no credit history (common for young people), or recent financial difficulty. | Ask the applicant for context. Look for recent defaults or CCJs, which are more serious than historical issues. |

| Active CCJ for Rent Arrears | A serious indicator of previous rental payment problems and a high risk of future arrears. | This is a major red flag. It is often a valid reason to reject the application unless there are very strong extenuating circumstances. |

| Income Fails Affordability | The applicant's income is less than the required multiple of the rent (usually 30x). | Discuss with the applicant. They may have other income sources. Consider options like a guarantor or rent upfront. |

| Poor Landlord Reference | The previous landlord reports rent arrears, property damage, or anti-social behaviour. | This is a significant concern. Politely ask the applicant about it. If their story doesn't add up, it's wise to decline. |

| Gaps in Address History | Unexplained gaps could be used to hide a previous tenancy that ended badly (e.g., an eviction). | Ask for a clear explanation of where they were living during these periods and why it wasn't a formal tenancy. |

| Self-Employed with No Accounts | The applicant cannot provide an accountant's reference or formal accounts to prove their income. | Ask for at least six months of business and personal bank statements to verify their declared income. |

Ultimately, a failed check doesn't have to be the end of the road. It's a prompt for a conversation that can lead to a secure and successful tenancy.

Alternatives to an Outright Rejection

If the applicant is upfront about their situation and the issue isn't a complete deal-breaker (like a recent eviction), you have several options that can mitigate your risk while still filling your property. These alternatives can turn a shaky application into a successful let.

Think about proposing one of these solutions:

- Request a Rent Guarantor: This is the go-to solution for most landlords. A guarantor—typically a parent or close relative who is a UK homeowner with a solid income—signs a legal agreement to cover the rent and any damages if the tenant can't. This gives you a fantastic financial safety net.

- Ask for Rent Upfront: For tenants who might fail the affordability check but have savings, asking for a few months' rent in advance is a perfectly viable option. Under the Tenant Fees Act 2019, you can't ask for more than six months' rent upfront, but even two or three months provides a significant buffer.

- Use a Rent Guarantee Insurance Policy: There are insurance products out there designed to cover you for unpaid rent. While you'll have to pay a premium, it can be a worthwhile investment for a tenancy you feel is a slightly higher risk but otherwise seems like a good fit.

By understanding how to spot red flags and knowing your options when a check fails, you can make smarter, more informed letting decisions. This flexible yet diligent approach protects your investment while giving deserving tenants a fair chance.

Your Tenant Referencing Questions Answered

Even with a solid process in place, you’re bound to come across situations that make you pause. Tenant referencing isn’t always black and white. Here, I’ll tackle some of the most common questions I hear from landlords, offering clear, direct answers to help you handle the tricky bits with confidence.

Can I Charge a Tenant for Referencing?

In a word: no. The Tenant Fees Act 2019, which covers England, is very clear on this. It explicitly bans landlords and letting agents from charging tenants for any part of the referencing process. This includes credit checks, admin fees, or the cost of using a third-party service.

Simply put, vetting a tenant is a business cost you need to cover yourself. Similar rules are in place across the UK, including Scotland's Renting Homes (Fees etc.) (Scotland) Act 2019 and the Renting Homes (Fees, etc.) (Wales) Act 2019.

How Long Should a Tenant Reference Check Take?

The timeline can really vary, but you should generally expect it to take anywhere from 48 hours to a week. The biggest bottleneck is usually waiting for other people—like employers and previous landlords—to get back to you.

A few things can speed up or slow down the process:

- Tenant Speed: How quickly does the applicant get all their documents and consent forms back to you?

- Referee Availability: Is their previous landlord on holiday? Does their employer have a busy HR department? These things matter.

- The Service You Use: Professional referencing agencies often have streamlined systems that can get things done much faster.

My advice is to keep your applicant in the loop. A quick message to let them know you've started the process and a realistic timeframe goes a long way. Sometimes, a polite follow-up call to a slow referee is all it takes to get things moving again.

What if the Applicant Is Self-Employed?

Checking a self-employed applicant requires a slightly different tack, as there won’t be any payslips or an employer to call. Your goal is to verify their income using other official documents.

Here’s what you should be asking for as proof of income:

- Tax Returns: Their most recent SA302 tax calculation from HMRC gives you a clear, official picture of their declared earnings.

- Accountant's Letter: A formal letter from their certified accountant confirming income over the last year or two is a very strong piece of evidence.

- Business Bank Statements: Looking at six months of statements can show a consistent flow of income into their business account.

What Does a Standard Referencing Service Cover?

When you hand the job over to a professional service, you’re getting a much deeper look into an applicant’s history. A standard check will usually cover credit scores and any history of debt, an affordability calculation based on their income, and feedback from previous landlords on how they treated the property and paid their rent. It also includes Right to Rent compliance and a check on their address history.

With 4.6 million properties in the UK's private rented sector, these comprehensive checks are absolutely vital for protecting your investment. You can find more details on what tenant referencing involves on airsatrealestate.co.uk.

Do I Need to Reference a Guarantor?

Yes, one hundred percent. A guarantor is essentially stepping in to cover the rent if your tenant can’t, so they need to pass the exact same financial checks. You have to be completely confident they can shoulder that responsibility.

This means running a full credit check and verifying their income to make sure it’s high enough to cover their own bills plus the potential rent for your property. Skipping this step makes their guarantee almost worthless. For more practical landlord tips and guides, head over to our Rooms For Let blog.

At Rooms For Let, we connect landlords with thousands of potential tenants across the UK every day, helping you find the right fit for your property faster. Advertise your spare room for free and start finding quality tenants today at https://www.roomsforlet.co.uk.