Tenant background and credit checks are, without a doubt, the single most powerful tool a UK landlord has to protect their property investment. This isn't just about dodging rent arrears; it's about setting the stage for a stable, long-term tenancy and sidestepping the nightmare of property damage.

Why Rigorous Tenant Screening Is Your Best Investment

Let's be honest—finding a great tenant can feel like you're navigating a minefield. Many landlords, especially those new to the game, see comprehensive screening as just another tedious box to tick. But treating tenant checks for background and credit as a mere formality is a costly mistake I've seen made time and again.

Think about real-world scenarios. I know a landlord in Manchester who, feeling the pressure of a void period, took on a tenant after a quick chat and a single reference. Just three months later, he was staring down the barrel of thousands in rent arrears and a drawn-out, stressful eviction process. Another landlord in London skipped a proper credit check, only to discover later that her tenant had a string of County Court Judgements (CCJs) for unpaid debts.

The Pressure to Make Quick Decisions

In a hot rental market, the temptation to rush is huge. An empty property is a leaking bucket of cash, and a charming applicant can easily make you want to skip the boring paperwork. This is precisely where the biggest risks are hiding. A proper screening process isn't about being cynical; it's about turning a reactive, emotional decision into a proactive business strategy.

It helps you:

- Verify Financial Stability: First and foremost, can they actually afford the rent without stretching themselves thin?

- Spot Past Problems: A background check can flag up previous evictions or a pattern of difficult tenancies.

- Ensure Legal Compliance: It gets you started on the right foot with mandatory obligations like Right to Rent checks.

The real goal here is to reframe tenant screening. Stop seeing it as a chore and start seeing it as a core strategy for securing your investment. A few days of thorough vetting can genuinely save you months of financial and emotional strain down the road.

Protecting Your Property and Your Income

The private rented sector (PRS) is a massive part of the UK housing market. As of March 2024, a staggering 19% of all UK households were renting privately. Unfortunately, data from the 2023 English Housing Survey revealed that 10% of these homes had serious hazards. This just goes to show how poor tenant selection can lead to property neglect and eye-watering repair bills, making robust tenant checks on background and credit more critical than ever.

Ultimately, by investing a little time and effort in proper screening, you're not just finding someone to pay the rent. You are building the foundation for a successful, profitable, and stress-free tenancy. To delve deeper into landlord best practices, feel free to explore more guides on our blog.

Getting the Legal Side of Tenant Referencing Right

When you’re running a tenant check on background and credit, getting the legal details right isn't just good practice—it's absolutely essential. One wrong move with an applicant's data or a failure to get proper consent can land you in some seriously hot water.

Let's break down what you need to know in plain English, making sure your process is as solid as it is effective.

The entire referencing process hangs on one simple principle: explicit consent. You cannot legally run a credit check or look into someone's personal history without their clear, written permission. This isn't a box you can just tick for them or assume is given because they've applied for your property.

This permission needs to be an active choice. A pre-ticked box on a digital form simply won't do. Your application form must have a distinct section where the applicant actively agrees to the specific checks you plan to carry out.

Your Duties Under GDPR

The moment an applicant hands over their personal information, you become what’s known as a 'data controller' under the General Data Protection Regulation (GDPR). This means you have a legal duty to handle that information with care.

Here’s what that means for you:

- A Lawful Reason: You must have a legitimate reason for processing their data, which in this context is for the purpose of tenant referencing.

- Collect Only What’s Needed: Don’t get greedy with data. Only ask for the information you absolutely need to assess their suitability as a tenant.

- Keep it Secure: You have to store their application forms and any reports securely. This applies whether you're dealing with digital files on your laptop or physical paperwork in a drawer.

- Their Right to See: Tenants have the right to ask for a copy of the information you hold on them, and you’re obliged to provide it.

Remember, GDPR isn't just for big corporations. As a landlord, you are legally on the hook for the sensitive data you handle. A simple mistake, like leaving an application form visible in a public place, could lead to a hefty fine from the Information Commissioner's Office (ICO).

Staying Fair with the Equality Act

Beyond data protection, your screening process has to be fair and non-discriminatory. The Equality Act 2010 is there to protect people from being treated unfairly based on 'protected characteristics'.

This means you cannot treat an applicant differently because of their age, disability, gender reassignment, race, religion or belief, sex, or sexual orientation.

Your selection criteria have to be the same for every single applicant. For instance, if you require a certain income-to-rent ratio for one person, you must apply that exact same standard to everyone else. Keeping a clear paper trail with objective notes for each application is your best defence against any claim of unfair treatment. Consistency is king here.

Putting together a quick compliance checklist can be a real lifesaver. Before you start any tenant checks background credit process, make sure you can tick off these points:

- Written Consent Clause: Is there a clear, unticked box on your application form that explicitly asks for permission to run credit and background checks?

- Privacy Notice: Have you given the applicant a straightforward notice explaining what data you’ll collect, why you need it, and how you'll store it safely?

- Objective Criteria: Have you set out a fair, consistent list of criteria that you'll apply to all applicants without exception?

By building these three pillars—consent, data protection, and fairness—into your screening routine, you'll create a robust process that not only finds you a great tenant but also keeps you well clear of any legal trouble down the road.

Your Guide to Pre-Tenancy Verification Checks

Before you even think about looking at bank statements, the first checks you run are your first line of defence. This is the crucial stage where you confirm an applicant is who they say they are and that they have the legal right to rent your property. Honestly, getting these fundamental tenant checks on background and credit right from the outset saves a world of headaches later on.

The whole process kicks off with the mandatory 'Right to Rent' check. This isn't just good practice; it’s a legal requirement for every landlord in England, designed to prevent illegal immigration. Get this wrong, and you’re looking at hefty fines—up to a staggering £10,000 per illegal tenant for a first breach. It’s a step you simply can't afford to skip.

Mastering the Right to Rent Checks

You need to check every single adult who will be living at the property, not just the names on the tenancy agreement. The process means you either have to check their original identification documents with them physically present, or you can use the Home Office's online service.

For British or Irish citizens, it’s usually straightforward. A valid passport is the simplest proof. Alternatively, a UK photocard driving licence paired with a UK birth certificate will do the job.

For tenants from overseas, the required documents will differ. They might present a residence card, an immigration status document, or a visa. The vital thing here is to meticulously check the document’s validity dates to ensure they have the right to rent for the entire time you plan for the tenancy to run.

The Home Office has a comprehensive list of all acceptable documents on their website. I'd strongly recommend bookmarking it. Trying to rely on memory is a recipe for disaster and could lead to very costly mistakes. Always remember to take copies of the documents, date them, and keep them stored securely for the duration of the tenancy and for one year after it ends.

Using the Home Office Online Service

For many applicants who hold a biometric residence card, a biometric residence permit, or have status under the EU Settlement Scheme, you can use the official government online service. It’s quick, secure, and gives you a definitive answer without any guesswork.

Here’s how it works:

- Request a Share Code: The applicant gives you a nine-character 'share code' along with their date of birth.

- Verify Online: You simply pop this information into the GOV.UK 'View a tenant's right to rent' page.

- Confirm the Identity: The final, crucial step is to check that the photo on the online result matches the person in front of you. This can be done in person or over a live video call.

Using this digital method provides you with a statutory excuse against a civil penalty, which is exactly the peace of mind you need.

Verifying Identity and Employment

Beyond the legal minimum, you need to be confident that the applicant's story adds up. Verifying their identity and current employment is a vital part of your own due diligence. Ask to see a photo ID like a passport or driving licence, and cross-reference their current address with a recent utility bill or bank statement (make sure it’s dated within the last three months).

When it comes to their job, don’t just take a payslip at face value. A quick, professional call to their employer’s HR department can confirm their employment status, job title, and how long they've been with the company. Just be sure to explain that you're conducting pre-tenancy referencing and have the applicant's permission to do so.

Asking the Right Questions to Previous Landlords

Getting in touch with a previous landlord can offer insights that no formal report ever will. The problem is, many landlords give vague, non-committal answers because they don't want to get into trouble. The trick is to ask questions that encourage a proper response.

Instead of a lazy "Were they a good tenant?" try asking these instead:

- "Did they consistently pay their rent on time and in full throughout the tenancy?"

- "When they moved out, was the property left in a clean and well-maintained condition?"

- "Were there any issues with anti-social behaviour or any complaints from the neighbours?"

- "Knowing what you know now, would you be happy to rent to them again?"

This direct approach helps you paint a much clearer picture of who you're dealing with. In today's rental market, landlords are relying more and more on these thorough tenant checks on background and credit to manage their risks. It's no surprise when you see figures like the latest Tenant Satisfaction Measures showing rising complaint volumes, with stage one complaints hitting 42.5 per 1,000 homes for large landlords. Proper screening helps you avoid the kind of problems that lead to those complaints. You can read more about these trends in the official headline report. And if you're a landlord looking to connect with tenants, you can start by registering your property with us.

Choosing the Right Tenant Referencing Service

Once you've handled the initial ID and Right to Rent checks, it's time to dig into an applicant’s financial reliability. This is a critical part of your tenant checks background credit process, and it presents you with a key decision: do you use a dedicated tenant referencing service, or go directly to a credit agency like Experian or Equifax?

For many landlords, especially if you’re managing just a handful of properties, the answer isn’t immediately obvious. Each path offers a different balance of cost, convenience, and depth of information. The right choice really hinges on your specific needs, how much risk you're comfortable taking on, and the amount of time you can spare.

The Full-Service Referencing Agency Approach

Think of a dedicated referencing service as your all-in-one solution. These companies are specialists in the rental market, bundling multiple checks into a single, easy-to-understand report. They do far more than just pull a credit file; they carry out a comprehensive assessment designed specifically for landlords.

What you'll typically get includes:

- A full credit check, including searches for any County Court Judgements (CCJs) or insolvency records.

- Direct verification of income and employment status, where they actually contact the applicant's employer.

- References from previous landlords to get the inside scoop on payment history and how they treated the property.

- An overall affordability calculation, giving you a clear ‘pass’ or ‘fail’ recommendation.

The biggest draws here are convenience and expertise. You're effectively outsourcing the legwork to a team that knows exactly what red flags to look for. This saves you a ton of time and gives you a clear, actionable recommendation, which is a lifesaver for busy landlords.

The Direct Credit Agency Check

Going straight to a major credit reference agency like Experian, Equifax, or TransUnion is your other main option. This is a much more focused approach, giving you the raw credit report on an applicant. You will, of course, need the applicant's explicit consent, and they often have to kick off the check themselves to share the report with you, keeping everything above board with GDPR.

This route gives you direct access to their credit history, public records like CCJs, and their credit score. The catch? The burden of interpretation falls squarely on your shoulders. You won’t get an employer’s confirmation or a previous landlord’s opinion—just the financial data.

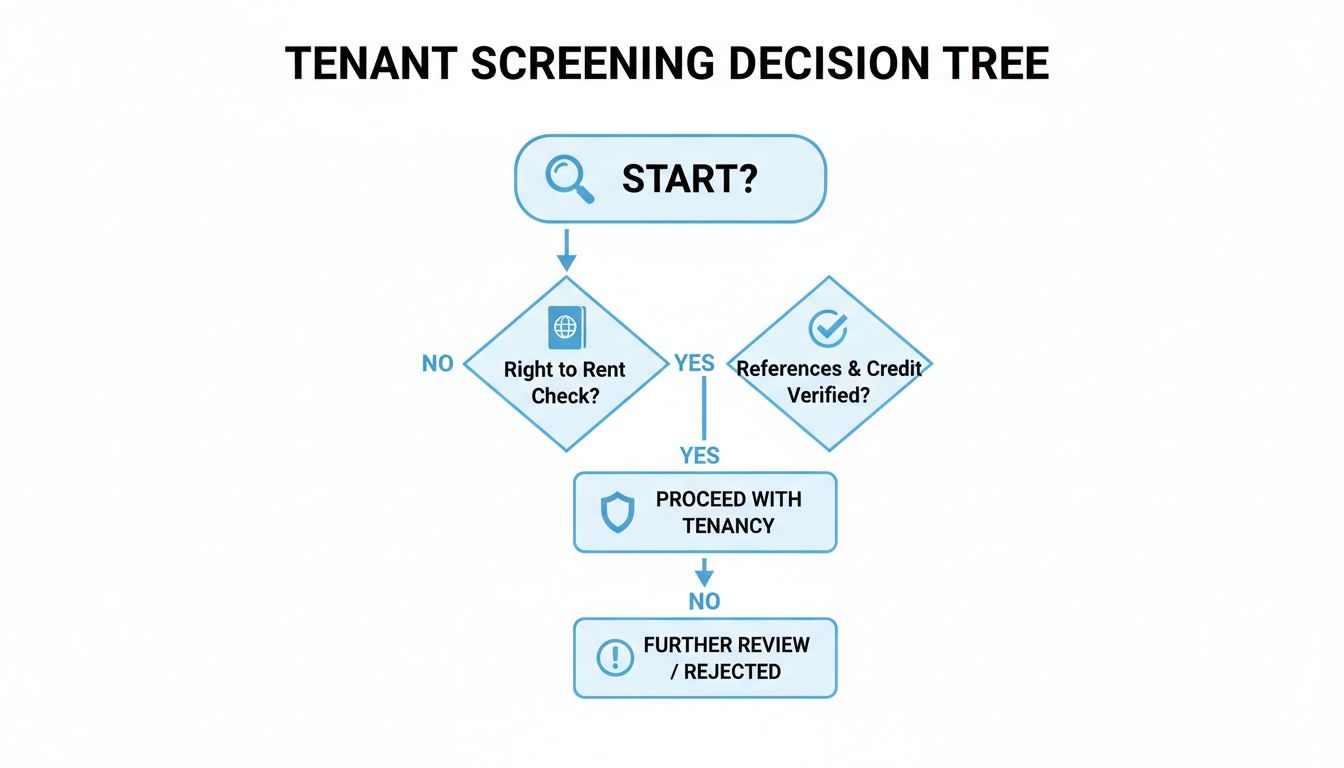

This flowchart helps to visualise the screening journey, from those initial checks right through to the final decision.

As you can see, a failed Right to Rent check is an immediate dead end, while other outcomes require a bit more thought before you proceed.

Weighing Your Options

So, which is the better choice for you? A full referencing service offers a much more complete picture of the applicant, making it the lower-risk option for most landlords. The combined checks provide crucial context that a simple credit score just can't deliver.

For a first-time landlord or someone managing a high-value HMO, the peace of mind offered by a comprehensive service is often worth the slightly higher cost. It provides a structured, defensible process for making your tenancy decision.

On the other hand, a direct credit check can be a perfectly good, cost-effective solution for experienced landlords. If you're confident in your ability to analyse a credit report and are happy to conduct the employment and landlord checks yourself, it can work well.

To make things clearer, let's break down the key differences.

Comparing Tenant Referencing Options

Choosing between a full service and a direct check depends on how hands-on you want to be. The table below lays out the main pros and cons of each approach to help you decide which fits your style of landlording best.

| Feature | Full Referencing Service | Direct Credit Check |

|---|---|---|

| Scope | Comprehensive (credit, income, landlord refs) | Financial data only (credit report & score) |

| Convenience | High (all-in-one report & recommendation) | Lower (requires you to conduct other checks) |

| Cost | Typically £15 - £30 per applicant | Can be lower, sometimes free for the tenant |

| Interpretation | Easy (often provides a simple pass/fail) | Requires you to analyse the raw data |

| Best For | New landlords, HMO managers, risk-averse owners | Experienced landlords, lower-risk tenancies |

Ultimately, the best approach for your tenant checks background credit process comes down to your own circumstances. A full service provides a safety net and saves time, while a direct check offers a more DIY, cost-effective route if you have the experience.

If you'd like to chat about your specific needs or have questions about managing your rental property, feel free to get in touch with our team. We're here to help you make the most informed decision possible.

How to Read Reports and Spot Critical Red Flags

Getting the referencing report back is one thing; knowing what to do with it is where the real skill comes in. These documents can feel like they're written in another language, full of financial jargon and numbers. But learning to read between the lines is a massive part of any solid tenant checks background credit process. It’s how you move beyond a simple score and build a proper picture of who you’re dealing with.

The first things that usually jump out are the big, scary-sounding terms like County Court Judgements (CCJs) or insolvency. It's tempting to see one of these and instantly bin the application. But context is everything. A single, small CCJ from five years ago that’s been fully paid off tells a very different story to a string of recent, unpaid judgements.

Understanding Major Financial Red Flags

A CCJ is an order from the court in England, Wales, or Northern Ireland telling someone to pay money they owe. If you see one on a report, it means the applicant defaulted on a debt and the creditor had to take them to court. This is a big deal – it’s a clear sign of someone failing to meet their financial commitments.

Likewise, any mention of insolvency, bankruptcy, or an Individual Voluntary Arrangement (IVA) points to serious financial trouble. These are huge indicators that an applicant has really struggled with debt and could be a high risk for future rent arrears.

Here are the main financial alerts to keep an eye on:

- Active CCJs: Multiple or very recent judgements are a major concern, especially if they’re still outstanding.

- History of Insolvency: Bankruptcy or IVAs within the last six years suggest a high degree of financial instability.

- High Levels of Debt: This on its own isn't a dealbreaker, but a very high debt-to-income ratio might mean the rent will stretch them too thin.

- Frequent Missed Payments: A pattern of late payments on credit cards or loans is a classic sign of poor financial management.

Looking Beyond the Obvious Credit Score

While a low credit score is definitely a warning, it’s vital to remember that these automated scores often lack nuance. Research has shown that some screening algorithms rely on outdated or misleading information that doesn’t accurately predict whether someone will be a good tenant. In fact, there’s very little hard evidence linking a credit score directly to a successful tenancy.

This is where your judgement is so important. You need to look for the subtle clues and inconsistencies an algorithm might miss. It’s all about finding the patterns that tell the real story.

A common mistake is to rely solely on the final score or recommendation. The real value is in the detail. For example, a young applicant with a 'thin' credit file might have a low score simply because they've never taken out credit, not because they are a financial risk.

Spotting the Subtle Human-Level Clues

Your most powerful tool is your ability to connect the dots. Compare the application form, the referencing report, and what the applicant told you face-to-face. This is where the truth usually reveals itself.

Look out for these more subtle red flags:

- Frequent Address Changes: A history of moving every six or twelve months could point to instability or past issues with landlords. It's worth asking about it – there might be a perfectly good reason, like short-term work contracts.

- Gaps in Employment History: Unexplained gaps might signal an unreliable income. A polite question can help you understand their situation better.

- Mismatched Information: Does the salary on their application match what their employer verified? Do the addresses they’ve given you line up with the credit report? Small discrepancies can sometimes point to bigger problems.

Handling Applicants with Minor Credit Issues

Not every financial blip should mean an automatic ‘no’. A fantastic applicant might have a minor, old issue that has no bearing on their current situation. If the rest of their tenant checks background credit report looks great—stable job, good income, glowing landlord reference—it’s often worth a conversation.

If you're on the fence about someone with a less-than-perfect history, think about asking for a guarantor. It's a common and sensible solution that gives you a financial safety net. A guarantor, typically a UK homeowner like a parent or relative, co-signs the tenancy and agrees to cover the rent if the tenant can't.

Just remember to run the same thorough background and credit checks on the guarantor as you did on the tenant. Their financial stability is your security blanket, so you need to be confident they can step in if needed. This simple step can turn a potentially risky tenancy into a secure one, letting you accept a good tenant you might otherwise have had to turn away.

Common Questions About UK Tenant Screening

Even with the slickest screening process, you’re going to hit some tricky situations. Let's be honest, navigating the finer points of tenant referencing can feel like a bit of a minefield. Having clear answers to the most common questions will give you the confidence to act decisively and, most importantly, stay on the right side of the law.

Here are some of the questions we see UK landlords asking all the time, with practical answers to help you handle them.

How Long Does a Full Tenant Check Take?

This is a classic "how long is a piece of string?" question. An automated credit check can ping back almost instantly. But if you’re doing things properly with a full referencing service—one that involves actually speaking to previous landlords and current employers—it’s going to take a bit longer.

Realistically, you should budget for 48 to 72 hours to get a comprehensive report back. Nine times out of ten, the bottleneck isn't the referencing company; it's waiting for referees to respond. It’s always a good idea to manage the applicant's expectations from the outset. Let them know it might take a few days, and don't be afraid to give a slow referee a polite nudge with a follow-up call. It can work wonders.

Can I Legally Charge a Tenant for Referencing?

This is a big one, and the answer depends entirely on where your property is. For landlords in England, the answer is a hard no. The Tenant Fees Act 2019 made it illegal for landlords or letting agents to charge tenants for referencing, admin, or credit checks. You, the landlord, have to cover these costs.

The rules are different elsewhere in the UK, but the trend is the same:

- Scotland: Similar rules apply under their own 2019 Act.

- Wales: The Renting Homes (Fees, etc.) (Wales) Act 2019 also bans most upfront fees.

- Northern Ireland: The rules here are less strict, but it's always best practice to check the latest government guidance.

Never assume the law is the same across the UK. Getting this wrong can lead to some hefty penalties.

A common mistake is assuming the law is the same across the board. The Tenant Fees Act in England was a major shift, and falling foul of it can result in an initial fine of up to £5,000.

What if a Good Applicant Fails the Credit Check?

A failed credit check doesn’t automatically mean you should show them the door. If you have an applicant who seems perfect in every other way—stable job, glowing references—a poor credit score might not tell the whole story. It’s worth digging a little deeper.

First, just talk to them. It could be an error on their report they weren't aware of, or there might be a perfectly reasonable explanation for a past financial blip, like a messy divorce or a business that went under. If you’re satisfied with their explanation but still feel a bit exposed, you have options to reduce your risk.

You could ask for a guarantor – someone who promises to pay the rent if the tenant can't. Another option is to ask for a few months' rent upfront, which gives you a cash buffer and shows the tenant is serious.

Do I Really Need to Check a Guarantor?

Yes. Absolutely. There is no point in having a guarantor if you don't check them out thoroughly. Their promise to cover the rent is worthless if they don’t have the money to back it up.

You must run the exact same tenant checks background credit process on the guarantor as you would on the tenant. That means verifying their income, running a full credit check, and, ideally, confirming they are a UK homeowner. A homeowner provides a much stronger guarantee, as there's a tangible asset that could be pursued in a worst-case scenario. Skipping this step completely defeats the purpose of having a guarantor in the first place.

Finding the right tenant starts with having the right tools and reaching the right audience. At Rooms For Let, we connect UK landlords and HMO managers with thousands of prospective tenants every day, making it easier to find reliable occupants for your rooms and properties. Advertise your room with Rooms For Let and fill your vacancies faster.