So, you're looking to rent a room or property. It’s natural to wonder what checks landlords actually carry out. In short, it boils down to two main types of checks: those on you, the prospective tenant, to make sure you're a good fit, and statutory safety checks on the property itself to ensure it's legal and safe to live in.

A Tenant's Guide to Landlord Checks

Applying for a rental property can sometimes feel a bit like a job interview, but it gets a lot less daunting once you understand what the landlord is looking for. These checks aren't designed to trip you up; they're simply a standard part of building trust and making sure the tenancy gets off to a solid start for everyone.

Think of it as a two-way street. While the landlord is checking that you’re a reliable tenant who can comfortably afford the rent, you also get the peace of mind that the property meets all the critical legal and safety standards. The whole system is there to protect everyone involved and set the scene for a secure, hassle-free tenancy.

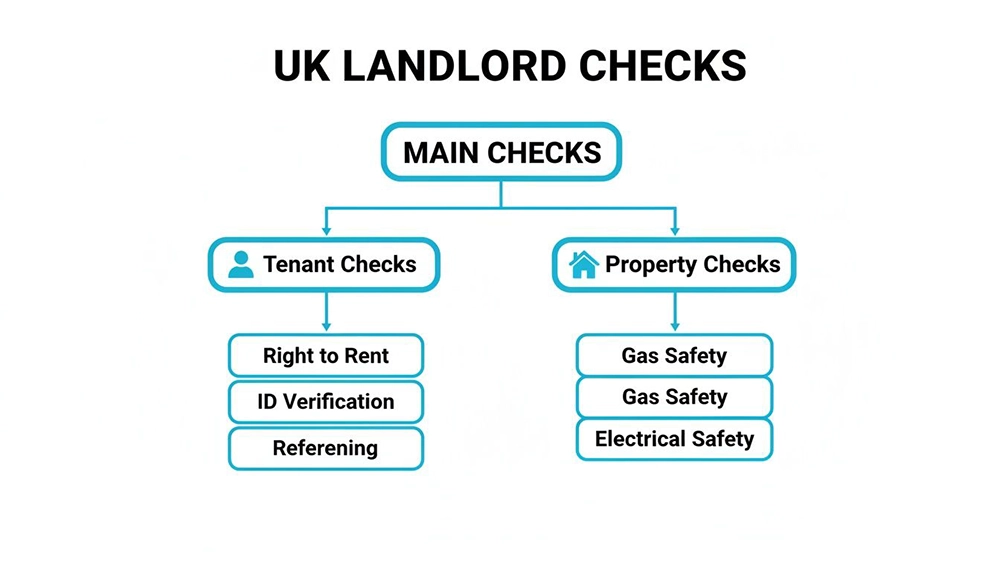

This diagram neatly shows how landlord checks are split between vetting the tenant and making sure the property is up to scratch.

As you can see, the process is clearly divided between the due diligence on you and the legal duties a landlord has for the property itself.

To give you a clearer picture, here’s a quick summary of the checks landlords typically perform on both tenants and properties across the UK.

UK Landlord Checks at a Glance

| Check Category | Specific Checks Included | Primary Purpose |

|---|---|---|

| Tenant Vetting | ID Verification, Right to Rent, References (Employer & Previous Landlord), Credit & Affordability Checks, Guarantor Checks (if needed) | To confirm identity, legal rental status, financial reliability, and suitability as a tenant. |

| Property Safety | Gas Safety Certificate (CP12), Electrical Installation Condition Report (EICR), Energy Performance Certificate (EPC), Smoke & CO Alarms, Fire Safety (especially for furnished properties & HMOs) | To meet legal obligations, ensure the property is safe for habitation, and avoid significant fines. |

This table covers the main bases, showing the dual responsibility landlords have: finding a trustworthy tenant and providing a safe, compliant home.

Why Landlords Perform These Checks

For a landlord, their property isn't just a building; it's a huge investment. The main reason for tenant referencing is simply to minimise risk. By checking your identity, income, and rental history, they get the confidence they need that you’ll pay the rent on time and look after their asset.

Landlord checks are essentially a risk assessment. They balance finding a trustworthy tenant quickly with fulfilling their legal duties to provide safe, compliant housing. A thorough process benefits everyone, preventing future disputes and ensuring a stable tenancy.

It’s also about ticking legal boxes. Landlords in the UK have to follow strict rules and can face hefty fines if they don’t, especially when it comes to Right to Rent and property safety certificates. For them, these checks are non-negotiable legal requirements.

Whether you're after a room in a shared house or an entire flat, getting your head around this process is a game-changer. For anyone looking for shared accommodation, you can find thousands of verified listings on platforms like Rooms For Let that help connect good tenants with responsible landlords. By knowing what to expect, you can get your documents ready and apply with confidence, making it that much easier to land your ideal home.

The Essential Checks on You as a Tenant

So, you’ve found a place you love. Fantastic. The next step is for the landlord to get to know you on paper. This part of the process, usually called tenant referencing, is all about building a clear picture of you as a potential tenant. Think of it less as a test you have to pass and more as a way to pull together a complete and trustworthy application.

These checks are designed to confirm three main things: who you are, whether you have the legal right to rent here in the UK, and if you've got a solid track record as a tenant.

Let's break down exactly what landlords look at during this stage.

Confirming Your Identity

The very first step is simple but absolutely crucial: proving you are who you say you are. Landlords need to verify your identity to make sure the tenancy agreement is legally sound and to protect themselves against any potential fraud.

You’ll usually be asked for one or more of the following:

- Photographic ID: A valid passport or a photocard driving licence is the gold standard here.

- Proof of Address: A recent utility bill (from the last three months), council tax statement, or bank statement showing your current address will do the trick.

A top tip is to have these documents scanned and ready to go. It can seriously speed up your application and shows you’re organised. It’s a straightforward check that forms the foundation of your entire tenant profile.

The Non-Negotiable Right to Rent Check

Of all the hoops to jump through, the Right to Rent check is perhaps the most important from a legal perspective. This is a check mandated by UK law, and it confirms that you and any other adults moving in have the legal right to live in the UK.

This isn't optional for the landlord; it's a strict legal duty. They must check every single adult who will be living in the property before the tenancy can begin. For British or Irish citizens, a passport is usually all that’s needed. For non-UK nationals, you'll need documents like a biometric residence permit or an immigration status document, which is verified using a Home Office share code.

The consequences for landlords who skip this check are severe. They can face unlimited fines and even potential prison time for repeatedly failing to comply. This is precisely why every landlord and letting agent takes it so seriously.

The government has been cracking down hard on this. In 2023, there was a staggering 405% increase in fines handed out to landlords and agents for Right to Rent breaches compared to the previous year. It’s a clear signal that this is one step landlords absolutely cannot afford to miss.

Gathering Your References

Beyond your ID and legal status, landlords want to get a sense of your track record. References give them a third-party perspective on how reliable you are, both as an employee and a tenant. You can think of them as letters of recommendation for your rental application.

Landlords will almost always ask for two key types:

- An Employer Reference: This confirms your job status, your salary, and whether your contract is permanent or temporary. It’s how the landlord verifies the income you’ve declared on your application.

- A Previous Landlord Reference: This is your chance to shine. A glowing reference that confirms you paid your rent on time, looked after the property, and were a respectful tenant is worth its weight in gold.

Being prepared is key here. Give your referees a heads-up that someone will be in touch. A quick response from them can prevent frustrating delays. If you're looking for a new room to rent, you can even pre-register your details as a tenant to get ahead of the game. The smoother you can make this for everyone, the better.

How Landlords Verify Your Financial Stability

The financial check is often the most nerve-wracking part of the rental application, but it all boils down to one simple question: can you comfortably afford the rent? Landlords aren't digging for a flawless financial past; they just need reassurance that you're a low-risk tenant who can reliably pay on time each month.

Think of it as the landlord's due diligence. They're simply trying to protect their investment from the risk of rent arrears, which is a stressful and costly headache for everyone involved. If you can see it from their perspective, you can get your information ready to clearly show you're a safe bet.

Cracking the Affordability Code

So, how do they figure this out? The most common tool in a landlord's kit is the rent-to-income ratio. It’s a straightforward calculation to see if your earnings can cover the rent without stretching you to breaking point.

The widely-used industry benchmark is that your gross annual income (that's before tax) should be at least 30 times the monthly rent. For a room costing £800 a month, a landlord will want to see you're earning at least £24,000 a year (£800 x 30). This simple formula gives them the confidence that you won't be financially overstretched.

What Landlords Actually See on Your Credit Check

Contrary to what many people think, a landlord doesn’t get to see your neat little credit score. What they get is a more general overview of your public financial records, designed to spot any major red flags. And they can only run this check after getting your explicit written permission.

The report they see will highlight serious financial difficulties, such as:

- County Court Judgements (CCJs): These are official court orders showing you’ve defaulted on a debt in the past.

- Insolvency or Bankruptcy: Any history of bankruptcy or individual voluntary arrangements (IVAs) will be listed.

- Electoral Roll Information: This is used to confirm your name and current address, helping to verify your identity.

A minor missed payment from a few years back is highly unlikely to be a deal-breaker. Landlords are really looking for significant, unresolved debts that point to a pattern of non-payment, as these are the strongest indicators of future risk.

The rise in rent arrears is a massive concern for landlords right now. Recent government data showed that landlord possession claims jumped by 19% year-on-year. Private landlords filed a staggering 7,402 claims between July and September 2023, mostly due to tenants falling behind on payments. This statistic really underscores why landlords have to be so thorough with their financial checks. You can read the full government report on landlord possession statistics for more detail.

At the end of the day, these checks aren't personal. They're a crucial part of what landlords do to create a secure and stable tenancy for everyone involved.

Of course. Here is the rewritten section, crafted to sound like it was written by an experienced human expert, following the provided style guide and examples.

Checking Your Track Record as a Tenant

Beyond your bank balance, landlords are keen to understand your history as a tenant. Are you someone who pays on time and looks after the property? This part of the process is all about building a picture of you to see if you’re a reliable and responsible person to have in their property.

The single most valuable piece of information for this is a reference from your previous landlord. It’s a direct, real-world account of what you’re like to have as a tenant, and a letting agent or landlord will almost always reach out to them for a quick chat.

What Will My Old Landlord Be Asked?

Don't worry, this isn't a deep interrogation. It's usually a straightforward set of questions to confirm the basics:

- Did you pay your rent on time? This is the big one. A solid history of punctual payments is the clearest signal of a dependable tenant.

- How did you leave the property? They want to know if you treated the place with respect and didn't cause any damage beyond reasonable wear and tear.

- Were there any serious problems? This covers things like complaints from neighbours or any major breaches of the tenancy agreement.

- Would you rent to them again? A simple, confident "yes" to this is the best endorsement you can get. It cuts through everything.

Think of a landlord reference as the rental equivalent of a job recommendation. A glowing report can make your application stand out, often pushing you ahead of others who might look similar on paper.

What About Criminal Record Checks?

Occasionally, a landlord might request a criminal record check. This isn't standard practice for most tenancies but can come up for high-value properties or in a House in Multiple Occupation (HMO), where the landlord has a duty of care to all the residents living there. The aim isn't to pass judgment, but simply to assess any potential risks.

Crucially, a landlord must get your clear permission to do this and handle the information securely under data protection laws. A basic check typically shows unspent convictions, and the landlord has to consider if it’s even relevant to the tenancy.

These background checks have become a routine part of a landlord's risk assessment, particularly as eviction claims have risen. In the first quarter of 2023 alone, private landlord possession claims reached 7,269, showing why landlords are so careful about who they rent to. You can learn more about the importance of tenant screening in the UK to understand the landlord's perspective.

Beyond checking if you’re the right fit for the property, landlords have a strict legal duty to make sure the home itself is safe and up to scratch. These aren't just ‘nice-to-haves’; they are serious legal requirements designed to keep you safe.

Think of these checks as the property's MOT. They're official proof that everything is in safe, working order before you get the keys. Knowing about them means you can be confident you’re moving into a home that meets critical safety standards. A good landlord will often provide these certificates in a welcome pack without you even needing to ask.

Gas Safety Certificate (CP12)

If there are any gas appliances in the property – a boiler, a gas hob, or a fireplace, for instance – the landlord must get them checked every single year by a Gas Safe registered engineer. This is probably one of the most critical safety checks on the list.

Once the inspection is done, you must be given a copy of the Gas Safety Certificate (sometimes known as a CP12). This certificate confirms that all the gas appliances are working as they should and aren’t a danger. You should get a copy before you move in, and then within 28 days of every new annual check.

Electrical Installation Condition Report (EICR)

It’s not just gas that needs checking; the property’s wiring and electrical system must also be professionally inspected. A qualified electrician is brought in to conduct an inspection and produce what’s called an Electrical Installation Condition Report, or EICR.

This report is valid for five years, and again, your landlord must give you a copy before your tenancy begins. It’s their way of proving that the sockets, light fittings, and fuse box are all safe and don’t pose a risk of electric shocks or fires. If the report flags any urgent problems, the landlord is legally required to get them fixed.

These safety checks are a cornerstone of a landlord's legal duties. It’s not just about ticking boxes for compliance; it's about providing a fundamentally secure home and building a relationship of trust with you from day one.

Energy Performance Certificate (EPC)

An Energy Performance Certificate (EPC) gives the property an energy efficiency rating, from A (very efficient) all the way down to G (very inefficient). A landlord is required to show you the EPC when you view the property and must provide a copy when you move in.

By law, a rental property in the UK has to achieve at least an 'E' rating, though some exemptions can apply. The certificate is valid for 10 years and also gives you a handy estimate of what your energy bills might look like, which is incredibly useful for budgeting.

To keep track of all these crucial duties, many landlords use a detailed rental property inspection checklist to stay organised. Ultimately, knowing what checks landlords must do gives you the peace of mind that your new home isn't just comfortable, but legally and fundamentally safe to live in.

Common Questions About Landlord Checks Answered

Navigating the world of tenant referencing can bring up a lot of practical questions. This final section tackles the most common queries head-on, giving you straightforward answers to help you approach your rental application with total confidence.

We'll clear up any lingering uncertainties you might have, from timelines and costs to handling potential bumps in the road.

How Long Do Landlord Checks Usually Take?

The entire referencing process typically wraps up in anywhere from 48 hours to one week. The biggest variable is often how quickly your referees—especially your employer and previous landlord—get back to the referencing agency.

You can definitely help speed things up. Have digital copies of your ID and proof of income ready to email over. More importantly, give your referees a quick heads-up to expect a call or email so they can respond promptly. If everything is lined up, many third-party agencies can get the full suite of checks done and dusted in just two or three working days.

Can a Landlord Legally Charge Me for Checks?

In a word, no. In England, the Tenant Fees Act 2019 put a stop to landlords or letting agents charging prospective tenants for referencing, credit checks, or any other admin fees. The landlord is responsible for covering these costs.

The only upfront payments a landlord can legally ask for are:

- A refundable holding deposit, capped at a maximum of one week's rent.

- Your tenancy deposit, which is capped at five weeks' rent for properties with an annual rent below £50,000.

Any other fees for starting the tenancy are off-limits, so be wary if you’re asked to pay just for the application itself.

Failing a check isn’t always the end of the road. It opens a conversation. Being transparent about a poor credit history or offering a guarantor can often turn a potential 'no' into a 'yes' by showing you’re proactive and responsible.

What Happens If I Fail One of the Checks?

Failing a check doesn't automatically mean your application is dead in the water. If you don't quite meet the affordability criteria, a common solution is for the landlord to ask for a guarantor. If you have a poor credit history, being upfront and explaining the situation can sometimes make all the difference.

However, a failed Right to Rent check is a firm stop. Landlords are legally forbidden from renting to someone without the correct documentation. If your application is rejected for other reasons and the landlord decides to keep your holding deposit, they must give you a written explanation within seven days.

For more insights on the landlord-tenant journey, you can find a wealth of information by exploring our UK rental market blog.

What Is a Guarantor and What Checks Do They Face?

A guarantor is someone, often a parent or close relative, who agrees to pay your rent if you're unable to. They essentially co-sign your tenancy agreement, giving the landlord an extra layer of financial security.

Because of this, a guarantor has to go through the exact same rigorous checks as a tenant. They’ll need to pass credit, affordability, and identity checks to prove they have enough income to cover their own living costs as well as your potential rent. Landlords usually look for a guarantor who is a UK homeowner with a stable income and a clean credit history.

Finding the right room shouldn't be a struggle. At Rooms For Let, we connect tenants with verified landlords across the UK, making your search for a new home simple and secure. Find your next room with us today!