So, what exactly is an HMO? You’ve probably heard the term, but the definition can feel a bit technical.

Put simply, a House in Multiple Occupation (HMO) is a property rented out by at least three people who are not from one single ‘household’ but share facilities like the kitchen or bathroom. Think of a classic student house or a group of young professionals sharing a property – those are prime examples.

The magic word here is ‘household’. It’s the legal trigger that changes everything.

Getting to Grips with the HMO Definition

At its heart, the whole HMO concept boils down to understanding what a ‘household’ is in the eyes of the law. A family, whether it's a couple or a family with five children, counts as just one single household.

But if three unrelated friends decide to rent a house together, the law sees them as three separate households. It’s this distinction that officially turns a standard rental property into an HMO.

And this isn't just a bit of administrative jargon. The moment a property becomes an HMO, a whole new set of rules and responsibilities kick in for the landlord. These regulations are there for a good reason: to make sure that homes with more people sharing are safe, well-managed, and fit for purpose. Nailing this concept is the first, most crucial step for anyone involved in the shared rental market.

How Different Rentals Compare

To make things clearer, let’s see how a standard buy-to-let stacks up against different types of HMOs. The number of people and households living in a property directly shapes the legal hoops a landlord has to jump through, especially when it comes to licensing.

The key takeaway is simple: the more unrelated people sharing a space, the more stringent the regulations become. This tiered system is designed to scale safety measures with the potential risks associated with higher occupancy levels.

For a clearer picture, the table below breaks down the essential differences, giving you a quick snapshot of what to expect from each property type. As you'll see, moving from a single-family let to even a small HMO is a significant step up in terms of management and legal compliance. You can learn more about landlord responsibilities in our comprehensive landlord guides on our blog.

Standard Let vs Small HMO vs Large HMO at a Glance

This table offers a straightforward comparison to help you quickly grasp the key distinctions between property types.

| Property Type | Minimum Occupants | Minimum Households | Typical Licensing |

|---|---|---|---|

| Standard Let | 1+ | 1 | None (Selective licensing may apply) |

| Small HMO | 3 | 2 | Additional (Council dependent) |

| Large HMO | 5 | 2 | Mandatory (Nationwide) |

As the table shows, the jump from a standard rental to an HMO introduces new layers of regulation, with Large HMOs facing the strictest rules across the country.

Navigating HMO Licensing and Legal Rules

Stepping into the world of HMO property management means getting to grips with the legal side of things, and licensing is the main event. It isn't just about paperwork; these rules are here to guarantee safe, decent living conditions for tenants across the UK. Think of it less as red tape and more as a blueprint for responsible letting.

The regulations make sure every HMO meets specific standards, covering everything from fire safety to room sizes. The HMO sector is a huge part of the UK's rental market, valued at around £78 billion as of early 2025. This scale shows exactly why a clear legal structure is so important, protecting both landlords and the millions of tenants who call these properties home. You can read more about this growing investment market from research by Foot Forward Properties.

Mandatory Versus Additional Licensing

In the UK, the licensing system for HMOs falls into two main categories. Figuring out which one applies to your property is the first crucial step.

- Mandatory Licensing: This is a nationwide rule for all 'large HMOs'. A property is considered a large HMO if it’s home to five or more tenants from two or more separate households, all sharing facilities like a kitchen or bathroom.

- Additional Licensing: This is where things get more local. Councils have the power to bring in their own licensing schemes for smaller HMOs that don't meet the 'large HMO' criteria. This often captures properties with just three or four tenants.

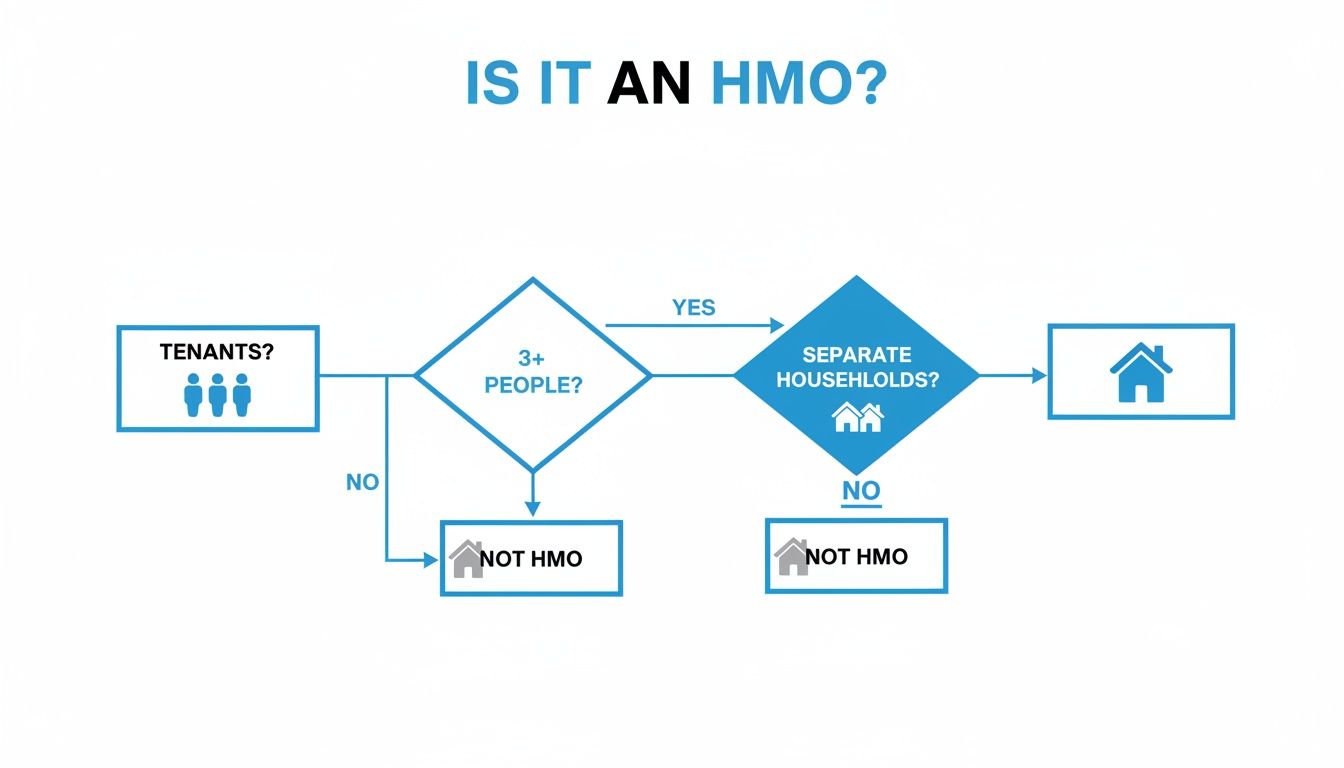

This flowchart gives you a simple way to see if a property qualifies as an HMO.

As the visual guide shows, the core definition hinges on having at least three tenants from separate households sharing the essentials.

Key Requirements for a Licence

To get an HMO licence, landlords have to prove they are up to the job of managing the property responsibly. The council will look at several key factors before giving the green light, and failing to meet these standards can lead to a rejected application.

A core part of the process is the 'fit and proper person' test. This assessment confirms that the landlord or managing agent has a suitable track record and is a responsible individual to hold a licence.

Beyond that, you'll need to provide solid evidence that the property itself is safe and well-kept. This usually includes:

- Gas Safety Certificate: An up-to-date certificate issued every year by a Gas Safe registered engineer.

- Electrical Installation Condition Report (EICR): A report from a qualified electrician, typically needed every five years.

- Fire Safety Measures: Proof of working smoke alarms on every floor and, often, carbon monoxide alarms in rooms with solid fuel appliances.

- Adequate Facilities: Evidence that there are enough bathrooms, kitchens, and bins for the number of tenants.

Ignoring these rules is a costly mistake. Running an unlicensed HMO can lead to prosecution and unlimited fines, rent repayment orders, and even being banned from letting properties. For any serious landlord, getting this right from the very start is non-negotiable.

Essential Responsibilities for HMO Landlords

Getting that HMO licence is a huge milestone, but it's really just the starting line. Running a successful HMO is an active management role, one that goes way beyond simply collecting the rent each month. Your primary job is to ensure the safety and wellbeing of every single person living under your roof, which is a significant step up from managing a standard buy-to-let.

The rulebook you need to know is The Management of Houses in Multiple Occupation (England) Regulations 2006. These regulations lay out a clear framework for landlords and, importantly, they apply to all HMOs, whether they need a licence or not. Think of them as the backbone of good HMO management, covering everything from mandatory safety checks to keeping the shared areas in good nick.

Prioritising Health and Safety

In an HMO, safety is absolutely non-negotiable. With more people living in one property, the risks naturally increase, which is why the regulations are so strict. Your duties here are crystal clear and there’s no room for cutting corners.

These responsibilities include:

- Fire Safety: You're in charge of making sure all fire alarms are working perfectly and that escape routes are kept clear at all times. Depending on the size and layout of your property, you might also need to install fire doors and emergency lighting.

- Gas Safety: A Gas Safe registered engineer must carry out a gas safety check every single year. You also have to give a copy of that certificate to your tenants.

- Electrical Safety: You'll need an Electrical Installation Condition Report (EICR) carried out by a qualified electrician at least every five years. This certifies that all the wiring and electrical systems in the house are safe.

Your duty of care as an HMO landlord is comprehensive. It means proactively identifying and managing risks to provide a safe living environment, not just reacting when problems arise.

Maintaining Communal Areas and Facilities

Beyond the critical safety checks, you're also on the hook for the general upkeep of the property’s shared spaces. Getting this right is crucial for keeping tenants happy and avoiding arguments before they even start. A well-maintained HMO isn't just easier to manage; it helps you attract and keep the best tenants.

You must make sure that:

- All common areas—kitchens, bathrooms, hallways, and living rooms—are kept clean and in a good state of repair.

- There are enough cookers, washing machines, and bathrooms for the number of people living in the property.

- A proper system for rubbish is in place, with enough bins to handle all the household waste.

Juggling all these duties requires a proactive and organised approach. Many landlords find this level of hands-on involvement quite demanding, which is why it's vital to have solid systems in place from day one. If you're ready to take the next step, you can easily register as a landlord on Rooms For Let to start finding great tenants for your property.

The Reality of HMOs for Landlords and Tenants

Deciding whether to invest in or live in an HMO is a classic head vs. heart decision. You need to look at the full picture, because for both landlords and tenants, this model comes with a unique set of upsides and challenges.

An HMO isn't just another rental; it’s a dynamic, living environment that operates under a completely different set of rules from a standard buy-to-let. Let’s weigh up the real-world pros and cons.

The Landlord Perspective

For landlords, the number one reason to get into HMOs is simple: money. The potential for significantly higher rental income is the main attraction. By letting rooms individually, the total rent you collect can easily dwarf what you’d get from a single-family let, creating a much healthier cash flow. This model also acts as a safety net—if one room is empty, you still have income rolling in from the others.

But, as with most things, that increased earning potential doesn't come for free. It comes with much bigger responsibilities.

- Higher Initial Costs: Getting a property ready for multiple tenants isn't cheap. You’ll likely face a hefty upfront investment to meet strict fire safety standards, add bathrooms or kitchen facilities, and furnish several rooms.

- Intensive Management: HMOs are not a ‘set and forget’ investment. They demand constant, hands-on management. You’re not just dealing with one tenancy but several, which means more admin, more tenant turnover, and a higher chance of having to play mediator in housemate disputes.

- Stricter Regulations: You'll be navigating a complex web of rules from both national government and your local council. From mandatory licensing to specific management duties, staying compliant requires constant vigilance.

The trade-off is crystal clear: you get higher yields in exchange for a much heavier workload and greater responsibility. To succeed as an HMO landlord, you have to be organised, proactive, and completely on top of your legal duties.

The Tenant Perspective

For tenants, the biggest draw of living in an HMO is affordability. Renting a single room is almost always cheaper than trying to afford an entire flat, especially in pricey city centres. This makes it the go-to option for students, young professionals, and anyone trying to keep their living costs down.

Beyond the price tag, many HMOs offer a simpler way of living.

- Bills-Inclusive Rent: Most room lets roll council tax, utilities, and internet into one fixed monthly payment. It makes budgeting a breeze when you know exactly what’s going out each month.

- Ready-Made Social Life: Moving into a shared house can be a brilliant way to meet new people, which is a massive plus if you’re new to a city and don't know anyone.

- Flexibility: Tenancy agreements for individual rooms are often more flexible than standard property lets, with shorter minimum terms available.

Of course, shared living isn’t without its hurdles. Less privacy is a given, and there's always the potential for friction with housemates over whose turn it is to take the bins out or who’s making too much noise. The quality of the landlord or agent can also vary massively, which makes a huge difference to how quickly repairs get sorted.

Research consistently shows that HMO investments in the UK deliver substantially higher rental returns, with some sources indicating they can generate up to 30% higher returns than standard buy-to-lets. Encouragingly, data also reveals that 90% of HMO investors report minimal safety or noise concerns from their properties. This suggests that when managed properly, tenant experiences are generally positive, though the regulatory side always demands close attention. You can dive deeper into these key HMO trends and statistics on AgentHMO.

How to Find and Advertise Your HMO Room

So, you're either a landlord with a room ready to go, or a tenant on the hunt for your next home. This is where all the theory gets put into practice, turning an empty space into someone's new base.

For landlords, a successful advert is about more than just listing a room; it’s about selling a lifestyle. High-quality photos are simply non-negotiable. Of course, you need to capture the available room in its best light, but don’t forget the shared spaces. The kitchen, living room, and any outdoor areas are often the real deal-breakers for prospective tenants.

Creating an Irresistible Listing

Think of your description as your sales pitch. Go beyond the basics and shine a spotlight on the features that make your HMO special. Is the rent inclusive of all bills? Do you offer superfast broadband? Is there a weekly cleaner who takes care of the communal areas? These are the details that grab attention.

An effective advert should always include:

- Clear, bright photos of the bedroom and all the shared facilities.

- A detailed description of the property, its amenities, and what the local area has to offer.

- A little information on the current housemates to help applicants see if they'd be a good fit.

- Transparent details on the rent, deposit, and contract length.

This level of detail helps attract serious people who are a genuine match for your property, which ultimately saves everyone a lot of time and hassle. You can find out more about putting together the perfect listing with our guide to HMO advert prices and features.

Finding Your Perfect Room

For tenants, an efficient search is a smart search. Start by using the filters on platforms like Rooms For Let to zero in on your options by location, price, and any must-have amenities. And a word of advice: don’t just scroll through the bedroom photos. Pay close attention to the kitchen and living areas to get a real feel for how the house is kept.

The UK HMO market is huge, with approximately 362,000 registered properties across England and Wales alone. With that much choice, setting up alerts for new listings that match your criteria is a savvy move. It ensures you see the best rooms the moment they hit the market. It’s a competitive world out there, but shared living is increasingly seen as a long-term solution, with 39% of HMO tenants reporting they have no plans to move on.

A Few Common Questions We Hear About HMOs

Once you start digging into the world of HMOs, a few practical questions almost always come up. It's one thing to know the definition, but it's another to understand how things work on the ground, whether you're a landlord trying to get the finances right or a tenant wondering about your rights.

Let’s clear up some of the most common queries we see. Getting these details sorted is the key to making sure everything runs smoothly and legally for everyone involved.

Who Pays the Council Tax?

This is probably the most frequent question of all, and thankfully, the answer is straightforward: the landlord is almost always responsible.

In a typical rental, the tenants get the council tax bill. But with an HMO, the local authority views it as a single household and sends one bill for the entire property directly to the owner. This is precisely why so many landlords offer rooms with "bills included"—they simply factor the cost of council tax, along with utilities, into each tenant's monthly rent.

Honestly, this setup makes life easier for everybody. Tenants get a simple, fixed monthly cost without any surprises, and landlords keep control over a crucial bill, making sure it’s paid on time, every time.

Do I Need Special Planning Permission?

This is a massive question for anyone thinking about setting up an HMO, and the answer is a classic "it depends"—specifically on your local council's rules. Generally speaking, converting a standard family home (which falls under Use Class C3) into a small HMO for up to six people (Use Class C4) is often covered by ‘permitted development rights’. This is great news, as it means you don't need to go through the full planning permission process.

But here's the catch. In areas where there's already a high number of shared houses, many councils have brought in something called an ‘Article 4 Direction’.

An Article 4 Direction is a tool councils use to remove those permitted development rights. If your property sits inside an Article 4 zone, you’ll need to apply for full planning permission for any change to an HMO, even if it’s just for three tenants.

Before you spend a single penny, your first step should always be to check the planning portal on your local council's website.

What Are My Basic Rights as an HMO Tenant?

Just because you're living in a shared home doesn't mean you have fewer rights—far from it. As an HMO tenant, you have a solid set of legal protections that your landlord absolutely must follow.

Here are the big ones:

- A Safe and Liveable Home: Your landlord is legally required to keep the property in good shape and ensure it meets all fire, gas, and electrical safety regulations.

- Your Deposit is Protected: After you pay your security deposit, the landlord has 30 days to place it into one of the three government-approved tenancy deposit schemes.

- Protection from Unfair Eviction: A landlord can't just kick you out. They have to follow the correct legal steps and give you proper notice to end your tenancy.

- You Have a Right to Know: You're entitled to know who your landlord is and have their contact information so you can report any problems.

Can a Live-In Landlord Have an HMO?

This is an interesting one because it brings a specific legal distinction into play. If a landlord lives in their own home and rents out rooms to one or two people, those people are legally considered ‘lodgers’, not tenants. In that situation, the property isn't an HMO.

However, the game changes as soon as the live-in landlord takes in a third person. Once you have three or more lodgers sharing facilities like a kitchen or bathroom, the property crosses the legal threshold and officially becomes an HMO. At that point, all the rules about licensing, safety, and management standards kick in.

Ready to find the perfect tenant for your HMO room or looking for your next shared home? With thousands of listings across the UK, Rooms For Let makes the process simple, fast, and effective. Find or advertise your room today!