A tenancy deposit scheme is a government-authorised service that securely holds a tenant's deposit for the duration of their tenancy. Think of it as a neutral third-party that safeguards the money, ensuring it's returned fairly when you move out. This system isn't just a good idea—it's a legal requirement for most private tenancies in the UK.

A Neutral Guardian for Your Deposit

Imagine you're buying something expensive online from a stranger. You wouldn't just send them the money and hope for the best, would you? You’d probably use an escrow service that holds your payment until you've received the item as described. A tenancy deposit scheme works in the exact same way, but for renting.

It exists to build trust and provide a safety net for both landlords and tenants, taking the risk of disputes over unfairly withheld funds off the table. This legal framework is now a standard part of renting, covering a huge number of properties. For instance, the tenancy deposit market in England and Wales includes approximately 4.71 million deposits, highlighting just how essential this protection is. You can dig deeper into the numbers in this PRS review from Deposit Protection.

The Three Core Jobs of a Scheme

At its heart, every government-backed scheme performs three critical functions. Getting your head around these roles is the first step towards a secure and transparent tenancy for everyone involved, whether you're letting a room on Rooms For Let or renting your first flat.

- To Safeguard Funds: Its primary job is to hold the deposit money in a secure account, completely separate from the landlord's or agent's finances. This means your money is protected, even if the landlord runs into financial trouble.

- To Mediate Disputes: If there's a disagreement over proposed deductions for cleaning or damages at the end of the tenancy, the scheme provides a free and impartial Alternative Dispute Resolution (ADR) service to act as a referee.

- To Ensure Prompt Returns: When the tenancy ends and both parties agree on the amount to be returned, the scheme makes sure the process is handled quickly and efficiently, releasing the funds without unnecessary delays.

To make it even clearer, here’s a quick breakdown of what these functions mean in practice.

Key Functions of a Tenancy Deposit Scheme at a Glance

| Function | What It Means for Landlords | What It Means for Tenants |

|---|---|---|

| Securely Hold Funds | Provides proof of legal compliance and builds trust with tenants. The money is kept safe by a neutral party. | Your deposit is protected from being spent by the landlord or lost if they face financial issues. |

| Mediate Disputes | Offers a free, impartial resolution service to handle disagreements over deductions, avoiding costly court action. | Gives you a fair way to challenge deductions you believe are unreasonable, with an unbiased decision-maker. |

| Manage Returns | Ensures a clear, structured process for returning the deposit once an agreement is reached. | Guarantees your deposit (or the agreed-upon part of it) will be returned promptly once the tenancy ends. |

Ultimately, these schemes remove the guesswork and worry from the deposit process, creating a much fairer and more professional rental market for everyone.

The Legal Rules Every Landlord Must Follow

Getting your head around tenancy deposit schemes is vital because, frankly, it’s not just good practice—it’s the law. The rules in the UK are crystal clear on which tenancies need this protection, and ignoring them is a costly mistake.

If you’re a landlord letting out a property on an Assured Shorthold Tenancy (AST), which is by far the most common type of tenancy in England and Wales, you are legally bound to protect your tenant’s deposit in a government-backed scheme. Simple as that.

This isn’t just red tape. The whole system is designed to protect tenants’ money and make sure there’s a fair and impartial process when the tenancy ends. But there are a few exceptions. For instance, if you're a resident landlord with a lodger sharing your home, the rules are different, and you generally don’t need to use a scheme.

The Critical 30-Day Deadline

The moment a deposit lands in your bank account, a very important clock starts ticking. UK law gives you a strict 30-day deadline from the day you receive the money to get two key things done.

- Protect the Deposit: You must register the deposit and place the funds into one of the three official, government-approved schemes.

- Serve Prescribed Information: You have to give your tenant the specific legal paperwork that explains exactly how and where their deposit is protected.

Missing this 30-day window can land you in serious hot water, so it’s a date every landlord needs to have burned into their memory.

Key Takeaway: The 30-day rule is completely non-negotiable. Get it wrong, and you're in breach of your legal duties. This can lead to hefty financial penalties and major legal headaches, completely defeating the purpose of the schemes.

This requirement is about more than just safeguarding cash; it's about building trust and transparency. When you’re advertising a room, showing you're fully compliant from day one makes a huge difference. Landlords using platforms like Rooms For Let can build that trust from the very first interaction. You can register as a landlord on Rooms For Let to connect with tenants who are looking for responsible, professional landlords.

What is Prescribed Information?

"Prescribed Information" sounds a bit formal, but it's just the official name for the collection of details you must provide to your tenant (and anyone who chipped in for the deposit). This isn't just a quick receipt; it's a specific set of documents that has to include:

- The exact deposit amount and the address of the property it relates to.

- Your name, address, and how to contact you.

- The name and contact details for the tenancy deposit scheme you've used.

- A leaflet from the scheme explaining their dispute resolution service.

Of course, managing a tenancy involves more than just the deposit. Landlords also need to handle other legal details like tenancy extensions and formal notices. For a closer look at that, check out this great resource: A Landlord's Guide to Lease Renewal Letters.

Penalties for Non-Compliance

Let’s be clear: the penalties for messing this up are severe. If a tenant discovers their deposit wasn't protected correctly, they can take you to court. A judge can order you to pay them compensation of between one and three times the value of the deposit.

Worse still, failing to protect the deposit correctly completely strips you of your right to issue a Section 21 notice. This is the standard legal process for regaining possession of your property at the end of a tenancy without having to give a reason. In short, getting deposit protection wrong can cost you a lot of money and your ability to manage your property.

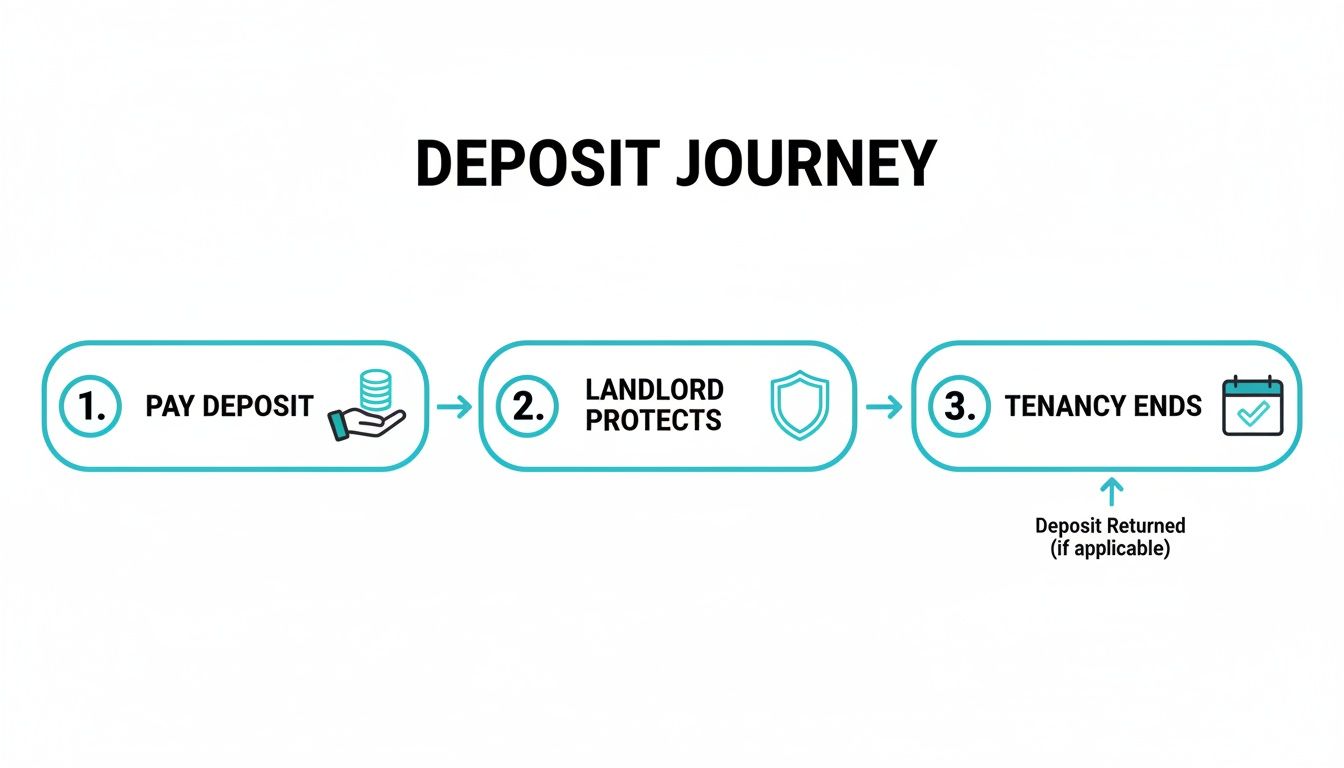

Right, so you’ve found a place, agreed on the rent, and are ready to hand over the deposit. What actually happens to that money? It’s a fair question, and thankfully, the process is much clearer and more secure than it used to be.

Let's walk through the journey your deposit takes. It's a structured path designed to protect everyone involved, turning what could be a messy affair into a straightforward, transparent process.

It all kicks off the second you pay the deposit. From that moment, a legal stopwatch starts ticking for the landlord. They have a strict 30-day window to do two very important things. First, they must protect your money in one of the three government-approved schemes. Second, they have to give you the official paperwork, known as "Prescribed Information," which proves where your deposit is and how it’s being looked after.

This first step is crucial. It immediately moves your money into a neutral, secure account, completely separate from the landlord's own finances. It’s no longer their money to hold onto; it’s yours, just held safely in trust.

The Life Cycle of a Deposit

To make it even clearer, think of the deposit's journey as a simple four-step cycle from the day you move in to the day you move out.

- Payment and Protection: You pay the deposit to the landlord or their agent. They then have 30 days to place it into a chosen protection scheme.

- Serving Information: Within that same 30-day period, the landlord must give you all the official documents confirming its protection.

- Tenancy Period: The deposit sits securely with the scheme for the entire time you live in the property.

- End of Tenancy: Once you move out, the process to return the deposit begins.

This framework removes any guesswork and ensures there’s a clear, legal trail for the funds at all times. It's designed to be fair to both you and the landlord.

Requesting Your Deposit Back

When your tenancy is over and you've handed back the keys, getting your deposit back should be simple, provided there are no disagreements. Usually, you’ll ask the landlord for it back, or you might be able to request it directly through the scheme's online portal.

The landlord then has about 10 days to respond. They’ll either agree to return the full amount or propose some deductions for things like damage beyond normal wear and tear or any unpaid rent.

Important Note: If everyone agrees on the amount to be returned—whether it’s the full whack or a partial sum—the scheme will usually release the funds within another 10 days. This means a smooth, undisputed return can be wrapped up in less than three weeks.

But what if you don't agree? If you and your landlord can't see eye-to-eye on the deductions, your money stays exactly where it is—safely protected. The next step is usually to use the scheme's free dispute resolution service to get a fair and impartial decision.

Choosing Between Custodial and Insurance Schemes

When it's time to protect a tenant's deposit, landlords have a key decision to make that goes beyond just picking a provider. You also need to choose the type of scheme you'll use. In the UK, there are two distinct models on the table: custodial and insurance-based.

Getting your head around these two options is central to understanding what a tenancy deposit scheme really is. Your choice dictates who physically holds the deposit money for the duration of the tenancy, and this single difference impacts everything from upfront costs to your cash flow and even how you'd handle a dispute down the line.

The Custodial Model Explained

Think of the custodial model as the simple, "lockbox" approach. It's often seen as the most straightforward option for both landlords and tenants.

With a custodial scheme, you collect the deposit from your tenant and then transfer the entire amount over to the scheme provider. They pop it into a secure, ring-fenced account and act as a neutral third party, holding onto the cash until the tenancy ends. Simple as that.

- Cost: It’s completely free for landlords and agents to use.

- Fund Handling: The scheme looks after the money, not the landlord.

- Tenant Peace of Mind: Tenants can relax, knowing their deposit is safe with an independent body.

This model is a huge favourite among landlords who prefer a "set it and forget it" style of management. It completely removes any worries about mixing up deposit funds with your own cash.

The Insurance Model Explained

The insurance-based model works in a totally different way, offering an alternative for landlords who'd rather keep the deposit money in their own bank account.

In this setup, you still collect the deposit from the tenant, but you keep the money yourself. Instead of handing the funds over, you pay the scheme a small fee. This fee is essentially buying an insurance policy that guarantees the tenant’s deposit is protected.

Key Difference: With an insurance scheme, the landlord holds the deposit but pays for its protection. If a dispute arises and the landlord fails to pay the tenant what they’re owed, the scheme’s insurance pays the tenant back directly. The scheme then chases the landlord for the money.

This simple flowchart shows the universal journey a deposit takes, no matter which type of scheme you choose.

Whether the money is held by the scheme or just insured by it, the core stages—payment, protection, and return—are identical. The only real difference is who has the cash in their account during the tenancy.

Custodial vs Insurance-Based Schemes Which Is Right For You?

So, which one should you go for? Both paths lead to the same destination—a legally protected deposit and access to a free dispute resolution service. However, the journey is slightly different. This table breaks down the main distinctions to help you decide.

| Feature | Custodial Schemes | Insurance-Based Schemes |

|---|---|---|

| Upfront Cost | Completely free for the landlord. | Landlord pays a small joining fee and a protection fee per deposit. |

| Who Holds the Deposit? | The scheme holds the money in a secure account. | The landlord holds the money in their own bank account. |

| Cash Flow Impact | No impact on the landlord's cash flow. | Landlord retains the deposit, which can help with cash flow. |

| Dispute Process | If a dispute arises, the scheme holds the disputed amount until resolved. | Landlord must transfer any disputed amount to the scheme to hold. |

| Best For | Landlords who want a simple, no-cost, hands-off approach. | Landlords and letting agents who prefer to manage their own cash flow. |

Ultimately, there’s no single "best" option; it all comes down to what works for you. If you value simplicity and want to avoid any fees, the custodial route is perfect. If you’re a more experienced landlord or an agent who prefers to manage the funds directly, the insurance model offers that flexibility.

What Happens When You Disagree on Deductions

Even with the best intentions, disagreements happen. A landlord might see a scuffed wall as damage, while a tenant considers it normal wear and tear. This is exactly why tenancy deposit schemes exist – not as a courtroom, but as a neutral referee to sort things out fairly.

Instead of facing a stressful and expensive legal battle, the scheme provides a free service called Alternative Dispute Resolution (ADR). Think of it as an impartial review process. An independent adjudicator, with no skin in the game, simply looks at the evidence provided by both sides and makes a call. The entire thing is handled by the scheme, keeping it out of the courts.

This process is designed to be completely fair. The final decision isn't a guess; it's based purely on the quality of the proof submitted.

Raising a Dispute and Building Your Case

If you and your landlord (or tenant) just can't agree, either of you can raise a dispute with the scheme. As soon as this happens, the money in question is frozen. It won't be released to anyone until the adjudicator has made their decision.

Winning a dispute isn't about who can argue the loudest; it's about who has the best evidence. The adjudicator can only rule on what they can see. Solid proof is your best friend.

Here are the key pieces of evidence that make or break a case:

- The Tenancy Agreement: This is the rulebook for the tenancy, setting out responsibilities like cleaning standards.

- The Inventory Report: A detailed check-in report, signed by the tenant, is the single most important document. Without one, it's incredibly difficult for a landlord to prove their claim.

- Dated Photos and Videos: Clear before-and-after pictures provide undeniable visual proof of any changes to the property's condition.

- Receipts and Invoices: If a landlord is claiming money for repairs or cleaning, they need quotes or receipts to show the cost is fair and justified.

Debunking the Myth That Landlords Always Win

There's a common fear that the system is stacked in the landlord’s favour. The data, however, tells a completely different story. The truth is, tenants get some or all of their deposit back in the vast majority of disputes. In fact, depending on the scheme, tenants are successful in over 80-90% of cases. You can learn more about these tenancy deposit statistics and what they show.

This highlights a crucial point: the burden of proof lies with the landlord. If a landlord cannot provide compelling evidence to justify a deduction, the adjudicator will rule in favour of the tenant.

This really hammers home why keeping thorough records isn’t just good practice—it’s essential for a fair outcome. For anyone feeling unsure about how to handle this process, the team at Rooms For Let is here to help. You can easily get in touch with our support team for guidance.

Your Guide to a Smooth and Fair Tenancy End

Let’s be honest, the goal for everyone involved in a tenancy is a hassle-free move-out and, crucially, the full return of the deposit. Getting there isn't about luck; it's about clear communication and a bit of prep work from both sides to keep the whole process professional and fair.

For tenants, it boils down to one simple idea: leave the property in the same state you found it, minus a bit of normal wear and tear. If you want to dramatically boost your chances of getting every penny of your deposit back, a thorough clean is non-negotiable. Following an ultimate end of tenancy cleaning checklist can make a world of difference.

But don't stop at cleaning. When you do your final walkthrough, take your own date-stamped photos. This creates your own clear record of the property's condition, mirroring the original check-in report and giving you solid evidence if any issues pop up.

Landlord Responsibilities and Best Practices

For landlords, the secret to a smooth tenancy end is sown right at the very beginning. Your most powerful tool? A meticulously detailed, signed inventory. It cuts through any ambiguity, creating a clear, mutually agreed-upon baseline for the property's condition from day one.

It’s also absolutely vital to know the difference between legitimate damage and the natural ageing of a property.

Fair Wear and Tear: This is simply the natural deterioration that happens over time from normal, everyday use. Think lightly scuffed paint in a hallway or a carpet that’s a bit worn down in a high-traffic area. You can't charge a tenant for this.

Actual damage, on the other hand, is something else entirely. This is caused by negligence, carelessness, or accidents – things like a big red wine stain on the carpet or a cracked window pane. These are the kinds of issues that justify a deduction from the deposit.

By understanding what the tenancy deposit scheme is there to cover and taking these straightforward steps, both landlords and tenants can sidestep most disputes before they even have a chance to start. It’s an approach that builds trust and makes sure the rental relationship ends on a positive note for everyone.

Frequently Asked Questions

When it comes to tenancy deposit schemes, a few common questions always pop up, especially for those navigating the rules for the first time. Let's clear up some of the most frequent queries we see from both landlords and tenants.

Do I Need to Protect a Deposit for a Lodger?

In most situations, the answer is no. The legal requirement to use a government-approved tenancy deposit scheme is tied specifically to Assured Shorthold Tenancies (ASTs).

If you're a live-in landlord renting out a spare room to someone who shares facilities with you (like the kitchen or bathroom), you’re creating a "licence to occupy," not an AST. This means you aren't legally required to protect their deposit. That said, choosing to do so voluntarily is a great way to build trust and give both you and your lodger extra peace of mind.

What Exactly Is Fair Wear and Tear?

This is the big one—the source of so many disagreements. The best way to think of it is the natural, unavoidable ageing of a property and its contents from normal, everyday use. It’s not the same as damage caused by accidents, carelessness, or neglect.

- Fair Wear and Tear: Think faded curtains from sunlight, minor scuffs on the walls in a hallway, or a carpet that's a bit flattened from being walked on for a year.

- Actual Damage: This would be something like a big red wine stain on the rug, a burn mark on the kitchen worktop from a hot pan, or a cracked window pane.

Key Takeaway: A landlord can't make deductions from a deposit to cover fair wear and tear. The deposit is there to cover the cost of fixing actual damage that goes beyond this expected, gradual decline.

What if My Landlord Never Protected My Deposit?

If you've paid a deposit for an AST and your landlord has missed the 30-day deadline to protect it in a government-approved scheme, you have a clear legal path forward. You can make a claim against them at your local county court.

The court has the power to order your landlord to do two things:

- Immediately repay the deposit to you or place it into a proper scheme.

- Pay you compensation of between one and three times the value of your deposit.

It’s also a serious misstep for the landlord in other ways. If they haven’t protected your deposit correctly, they can’t legally use a Section 21 "no-fault" eviction notice to end your tenancy. For more practical advice on renting and landlord responsibilities, have a look through the articles on the Rooms For Let official blog.

Finding the right room or the perfect tenant starts with a platform you can trust. Rooms For Let makes it simple to advertise your spare room or find your next home, with thousands of listings all over the UK. Join our community today and make your next move an easy one.