Got a spare room in your house? Thinking of taking in a lodger? The UK government’s Rent a Room Scheme is an absolute game-changer, and something you need to know about.

In simple terms, it allows you to earn up to £7,500 per year tax-free by letting out a furnished room in your main home. It’s a wonderfully straightforward way to bring in some extra cash without getting tangled up in complicated tax returns.

Understanding the Rent a Room Scheme

Think of the Rent a Room Scheme as a financial shortcut from HMRC. It was created to make life simpler for homeowners and to encourage more people to make affordable rooms available. If you've got a spare furnished room and are considering a lodger, this is your starting point.

The real beauty of the scheme is its simplicity. Instead of painstakingly tracking every little expense to offset against your rental income, the scheme gives you a single, generous tax-free allowance. That means the first £7,500 you earn is entirely yours, with no Income Tax to pay and—if you stay under the limit—no paperwork.

Rent a Room Scheme Key Details at a Glance

Here’s a quick rundown of the essential facts you need to know about the scheme.

| Feature | Details for UK Taxpayers |

|---|---|

| Tax-Free Allowance | £7,500 per year. |

| Joint Ownership | The allowance is £3,750 each if you own the property jointly with someone else. |

| Who Can Use It? | Resident landlords and those running a B&B or guesthouse. |

| Property Type | Must be your main or only residence. |

| Accommodation | Must be furnished. |

| Income Covered | Gross receipts from rent and associated services (e.g., meals, cleaning). |

| Automatic Exemption? | Yes, if your gross rental income is below the £7,500 threshold. You don't need to do anything. |

| Tax Return Needed? | Only if you earn more than £7,500 and need to declare it, or if you want to opt out of the scheme. |

| HMRC Contact | Not required if you earn less than the threshold. You must contact HMRC if you choose to opt out of the automatic scheme. |

This table provides a great snapshot, but let's dive into the core principles that make it all work.

The Core Principles of the Scheme

The allowance is aimed squarely at resident landlords—that is, people who live in the property they're renting a room from. It isn't for those with a separate buy-to-let portfolio.

To qualify, you need to tick these boxes:

- You must be a resident landlord: This means you have to live in the home for at least some of the time your lodger is there.

- It must be your main residence: The property has to be your only or main home.

- The room must be furnished: The scheme only applies to the letting of furnished accommodation.

This powerful tax break isn't new; it was introduced by the government way back in 1992. The threshold was originally £4,250 but was given a hefty boost to £7,500 from the 2016–17 tax year. This was a deliberate move to help homeowners and increase the supply of affordable rooms. You can read the official government line on the Rent a Room relief increase yourself.

This isn't just about earning extra cash; it's about doing so in the most tax-efficient way possible. The scheme removes the administrative headache for thousands of homeowners, making the idea of renting out a room far more approachable.

What Does the Allowance Actually Cover?

The rent a room tax allowance covers your gross receipts from the letting. That’s a key phrase. It includes not just the rent money, but also any extra you receive for services like cleaning, meals, or laundry.

If your total income from all these sources stays below £7,500 for the tax year, the tax exemption is automatic. In most cases, you don’t need to do a thing.

This guide will walk you through everything else you need to know, from working out your eligibility and doing the maths, to claiming the allowance and handling trickier scenarios.

Who Qualifies for the Rent a Room Scheme?

So, you've heard about the Rent a Room Scheme and its juicy tax allowance. The first step is figuring out if you can actually use it. HMRC has some clear rules to make sure the scheme is used as intended—by people renting out a spare room in the home they live in, not commercial landlords with a portfolio of properties.

The big idea is simple: you must be letting out a furnished room within your main home. This single principle separates it from regular buy-to-let renting, where you're letting out a whole property you don’t live in.

The Main Residence Rule Explained

This is the most important rule of all, and there’s no getting around it: the room you’re letting must be in your main or only residence.

Let’s say you own a flat in Manchester where you live and work day-to-day, but you also have a little cottage in the Lake District for weekend getaways. You can only use the scheme for a room you rent out in your Manchester flat. The cottage doesn't count because it's not where you primarily live.

This rule keeps the scheme focused on homeowners and tenants who are genuinely sharing their living space with a lodger.

Who Is Considered a Qualifying Individual?

You might be surprised by who can benefit. The scheme isn't just for homeowners; tenants who are allowed to sublet can get in on the action too.

You’ll generally qualify if you're one of the following:

- A resident landlord: This is the classic example. You own your home, have a spare furnished room, and take in a lodger.

- Running a guesthouse or B&B: If the property you operate is also your main home, the scheme can apply to your letting income.

- A tenant who sublets: If your own tenancy agreement gives you the green light, you can take in a lodger and use the tax relief on the income you get from them.

What’s great is the flexibility here. While the scheme is designed to make tax simple, it doesn't lock you in. If your allowable expenses are higher than the tax-free allowance, you can choose to opt-out and deduct those expenses instead. This choice ensures you can pick the most tax-efficient route each year. You can read more about this in the official government summary of responses.

Special Rules for Joint Property Owners

What if you own your home with a partner, spouse, or even a friend? It's a very common situation, and HMRC has a straightforward rule to avoid any mix-ups.

If you own the property jointly, the tax-free allowance of £7,500 is split equally between you. That means you each get a personal tax-free allowance of £3,750.

This is a crucial detail. The allowance is per property, not per owner. You can't both claim the full £7,500. Getting this right from the start will save you from a nasty tax surprise later on.

For instance, if you and your partner jointly own your home and earn £8,000 in rent over the year, you've each received £4,000 in gross income. As this is more than your individual £3,750 allowance, you would both need to declare it to HMRC.

Once you're confident you qualify, the next challenge is finding the right person for your room. To get your space seen by thousands of potential lodgers, a great next step is to register as a landlord on a dedicated platform and create your listing.

Choosing the Best Way to Calculate Your Tax

Once your rental income crosses that magic £7,500 threshold (or £3,750 if you share the income), you've hit a financial fork in the road. It’s no longer a question of if you need to tell HMRC, but how you should work out your taxable profit.

You have two clear options, and picking the right one can make a real difference to your tax bill. Think of it as choosing the right tool for the job. One is simple and straightforward; the other takes a bit more effort but can deliver a much better result if your costs are high.

Method A The Automatic Allowance

This is the default path, and it’s beautifully simple. Even if your gross rental income is over the threshold, you can stick with the Rent a Room Scheme. You just deduct the tax-free allowance from your total income and pay tax on whatever is left.

Let’s say you earned £9,000 in rent over the tax year. The calculation is a breeze:

- Gross Rental Income: £9,000

- Less Rent a Room Allowance: £7,500

- Taxable Profit: £1,500

You’d then just pay your usual rate of Income Tax on that £1,500 profit. It's clean, simple, and means you don't have to keep a shoebox full of receipts.

Method B Opting Out and Claiming Expenses

Your other choice is to formally opt out of the scheme for the tax year. This means you calculate your profit just like a traditional business: you subtract your actual, allowable expenses from your rental income to find out what you really made.

This method is the clear winner when your actual running costs add up to more than the £7,500 allowance. It’s more work, absolutely—you’ll need to keep meticulous records and receipts for every cost—but the tax savings can be well worth it.

So, what counts as an "allowable expense"? Essentially, it’s any cost you’ve incurred purely for the purpose of your rental. Common examples include:

- A fair portion of your utility bills (gas, electricity, water)

- A slice of your Council Tax bill

- Specific landlord insurance

- Costs for repairs and maintenance, like fixing a leaky tap or repainting the lodger's room

- Fees for finding a new lodger. If you're advertising, platforms like Rooms For Let have thousands of listings to browse for inspiration.

It's also worth exploring various tax deductions for short-term rentals, as some principles can apply here and help you decide which method works best for you.

Allowance vs Expenses A Comparative Scenario

Seeing the numbers side-by-side is the best way to grasp which method saves you more money. Let’s run the numbers for a landlord who earned £10,000 in gross rent.

We'll compare two scenarios: one with low running costs and another where things got a bit more expensive.

| Financial Item | Scenario A (Using Allowance) | Scenario B (Deducting Expenses) |

|---|---|---|

| Gross Rental Income | £10,000 | £10,000 |

| Deduction | £7,500 (Allowance) | £8,500 (Actual Expenses) |

| Taxable Profit | £2,500 | £1,500 |

In this case, with high running costs, Method B is the clear winner. By opting out of the scheme and claiming your actual costs, your taxable profit is £1,000 lower. This is exactly why HMRC gives you the choice.

You have to tell HMRC you're opting out by the Self Assessment deadline (31 January after the tax year ends). The golden rule is to run both calculations before you file. A few minutes with a calculator can save you a bundle.

How to Claim the Rent a Room Tax Allowance

So, you’ve figured out you qualify for the scheme and you've worked out which calculation method saves you the most money. The final piece of the puzzle is letting HMRC know what you’re doing.

Thankfully, the process is surprisingly straightforward. It all boils down to one simple question: is your gross rental income for the tax year more or less than the £7,500 threshold?

Your answer will determine which of the two paths you need to take. Let's walk through exactly what to do in each scenario.

Path 1: Your Income Is Below the Threshold

If your total rental income for the tax year is less than £7,500 (or £3,750 if you’re sharing the income), you're in the easiest possible position. The Rent a Room Scheme’s tax exemption is automatic.

That’s right – in most cases, you don’t need to do anything at all. No need to register for Self Assessment or fill out a tax return specifically for this income. It’s one of the most user-friendly tax reliefs going, designed to make life simpler for homeowners earning a bit of extra cash from a spare room.

The real beauty of the scheme is its automatic nature for lower earners. HMRC just assumes you want to use the tax-free allowance, so there’s no formal paperwork to "claim" it if you stay under the limit.

There is one small catch, though. If you already fill out a Self Assessment tax return for other reasons – maybe you're self-employed or have income from another rental property – you still need to mention your tax-exempt lodger income in the right section of the return.

Path 2: Your Income Is Above the Threshold

The moment your gross rental income tips over the £7,500 allowance, you have to tell HMRC about it. This means you must complete a Self Assessment tax return, even if you’ve never filed one before.

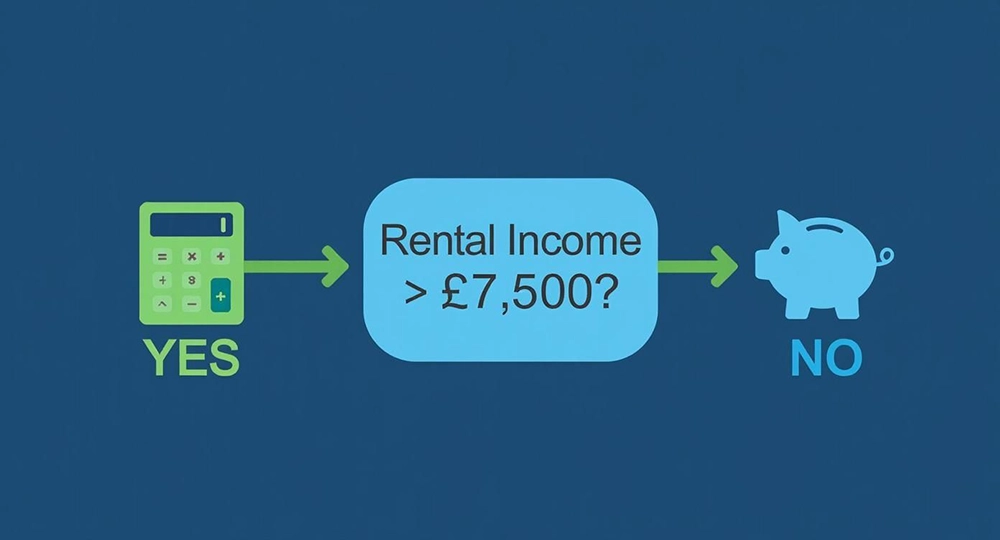

This simple decision tree helps to visualise the process.

As you can see, earning more than the allowance just means it’s time to engage with the tax system, but the steps are perfectly logical.

A Step-by-Step Guide to Your Tax Return

Filing a tax return is how you officially inform HMRC which method you’ve chosen: taking the tax-free allowance or deducting your actual expenses. Here’s a quick rundown of what you need to do.

- Register for Self Assessment: If you’re not already registered, you must do it by the 5th of October that follows the end of the tax year you earned the income in. Don’t miss this deadline!

- Gather Your Information: Pull together your records. You'll need the total gross rental income for the tax year (that’s 6th April to 5th April). If you plan to deduct your expenses instead, you’ll also need a detailed breakdown of all those allowable costs.

- Complete the Property Pages (SA105): When you fill out your tax return, either online or on paper, you’ll navigate to the specific section for UK property income.

- Declare Your Choice: On the form, you’ll enter your total gross rental income. The system will then give you a clear choice: either claim the Rent a Room allowance or enter your total allowable expenses. The online software does the heavy lifting and calculates your taxable profit based on what you select.

- Submit and Pay: Once you're done, you submit the return before the deadline (usually 31st January for online filing) and pay any tax that’s due.

Making this declaration on your tax return is your formal claim. It’s how you ensure HMRC knows exactly how you've worked out your profit and that you're using the Rent a Room Scheme correctly.

Getting to Grips with Complex Scenarios and Edge Cases

Real life rarely fits into neat boxes, and renting is no exception. Thankfully, the Rent a Room Scheme is pretty flexible and can handle some of the more unusual situations you might come across. Knowing how the rules apply in these less common cases is key to staying on the right side of HMRC and getting the most out of the rent a room tax allowance.

A big question we often hear is whether the scheme can be used for short-term lets on platforms like Airbnb. The answer is a definite yes, but with one crucial condition: the room you’re letting out must be part of your main home. If you’re renting out a separate flat, annexe, or holiday home, that falls under different tax rules altogether.

This adaptability has seen the scheme’s popularity soar. Housing market analysis shows a huge rise in its use, with the number of homeowners taking in lodgers tripling in just ten years. The total tax relief claimed shot up from around £48.8 million in 2008/09 to a whopping £140.5 million by 2018/19 — that’s a 187% increase. You can dig deeper into these trends in the Rent a Room Scheme on LandlordStudio.com.

What About Houses in Multiple Occupation (HMOs)?

This is a common setup for resident landlords with larger properties: what if you live in a property that you also run as a House in Multiple Occupation (HMO)?

Good news. You can absolutely use the Rent a Room Scheme in this scenario.

So long as the property is your main residence, the income you get from renting rooms to your tenants qualifies. The thresholds are exactly the same: you can earn up to £7,500 tax-free. And if you own the property jointly with a partner and you both live there, you each get your own £3,750 allowance.

Thinking About the Broader Financial Picture

Taking in a lodger does more than just affect your tax return. It’s vital to think about the ripple effects across your other finances to avoid any nasty surprises down the line.

Here are the three main areas you need to get straight:

- Means-Tested Benefits: If you’re receiving benefits like Universal Credit, you must declare your rental income. Even if it's completely tax-free under the scheme, it will almost certainly be counted as income and could change the amount of benefit you get.

- Your Mortgage Lender: Buried in the small print of most mortgage agreements is a clause requiring you to tell your lender if you plan to take in a lodger. Forgetting to do so could technically put you in breach of your contract. Lenders are usually fine with it, but it’s an essential box to tick.

- Your Insurance Policy: Your standard home insurance probably won’t cover you for having a paying lodger. You’ll likely need to update your policy or get a specific landlord insurance product to make sure you’re properly protected.

Taking in a lodger basically turns part of your home into an income-generating asset. This change means you need to get your financial partners—your mortgage provider, insurer, and the benefits office—on the same page.

A Quick Word on Capital Gains Tax

Finally, let’s look at the long-term view. When you eventually sell your home, you're usually shielded from Capital Gains Tax (CGT) by something called Private Residence Relief (PRR). This handy relief means you don't pay tax on the profit you make when you sell your main home.

However, if a part of your home has been used exclusively for "business purposes," that section might not qualify for PRR. The good news is that letting a room to a lodger rarely causes a problem here. As long as your lodger lives as part of the family, sharing spaces like the kitchen and living room, it's highly unlikely to affect your PRR. The relief is only really at risk if a part of your home is used exclusively by the lodger for their own business, or if you make major structural changes just to accommodate them.

Essential Record Keeping for Peace of Mind

Whether your rental income falls comfortably under the rent a room tax allowance or you’ve opted out to claim expenses, organised records are your best defence against tax-time stress. Don't think of it as a chore. Think of it as a blueprint for financial clarity and genuine peace of mind.

Even if your income is well below the £7,500 threshold and you don't need to file a tax return, keeping your documents in order is still a very smart habit. It helps you see at a glance whether your venture is profitable and makes sure you're prepared if your circumstances change or if HMRC ever has a query.

Good records are also what allow you to make an informed decision each year about whether to stick with the allowance or switch to deducting your actual expenses. You can't accurately compare your options without proof of what you've spent.

Your Record Keeping Checklist

You don't need a complex system. A simple setup is all it takes. Just organise your documents into three main categories to keep everything straightforward and easy to find when you need it.

1. Income Records

This is simply the proof of all money you’ve received from your lodger. It's the foundation of any tax calculation.

- Rental statements or a rent book: A clear, running log of payments received.

- Bank statements: These should clearly show the corresponding deposits from your lodger.

- Invoices for services: Keep copies of any bills for extras you provide, like meals or laundry.

2. Expense Records

If you're ever going to consider opting out of the scheme, these documents are completely non-negotiable.

- Receipts and invoices: For absolutely everything, from minor repairs and cleaning supplies to new furniture for the room.

- Utility and Council Tax bills: You'll need these to work out the proportional share of costs your lodger is responsible for.

- Insurance policies: Any documents relating to your landlord or specific home insurance policies.

3. Tenancy Documents

These records are just as crucial for managing the practical side of your arrangement with your lodger.

- Lodger agreements: The signed contract that outlines all the terms of the let.

- Correspondence: Any important emails or letters that pass between you and your lodger.

HMRC guidelines state you should keep your tax records for at least 22 months after the end of the tax year they relate to. If you're filing a Self Assessment tax return, this extends to at least 5 years. Having this paper trail provides undeniable proof of your income and expenses, should you ever need it.

Frequently Asked Questions

Even the clearest guides can leave you with a few lingering questions about your specific situation. Let’s tackle some of the most common queries that pop up about the rent a room tax allowance.

Can I Rent a Room to My Son or Daughter?

This is a really common question, and the answer is a straightforward no. You can't use the Rent a Room Scheme if the room is let to your own child. The scheme is designed for genuine, arm's-length arrangements, and it specifically excludes immediate family like sons and daughters.

Interestingly, though, the rules are different for other relatives. Letting a room to a niece, nephew, or cousin is perfectly fine and qualifies for the tax relief without any issues.

What Expenses Can I Claim If I Opt Out?

Sometimes, your actual costs of letting the room will be higher than the £7,500 allowance. If that's the case, opting out of the scheme is the smart financial move. When you do this, you can deduct any expenses that were incurred "wholly and exclusively" for your rental activities.

Think of it this way, you're essentially running a mini-business from your home. Common expenses you can claim include:

- A slice of your household bills: This means a fair percentage of your gas, electricity, water, and Council Tax.

- Insurance: Any specific landlord insurance you've taken out, or the extra cost added to your standard home insurance policy.

- Maintenance and repairs: The cost of redecorating the lodger's room, fixing their window, or even a portion of a boiler service.

- Advertising costs: Any fees you paid to websites or platforms to find your lodger.

- Professional fees: If you paid an accountant or solicitor for advice related to the letting, that's claimable too.

Just remember, HMRC will want to see proof. Keep meticulous records and receipts for every single penny you plan to claim.

Does a Lodger Affect My Council Tax Discount?

Yes, and this is a big one to watch out for. If you're currently benefiting from the 25% Single Person Discount on your Council Tax, taking in a lodger will almost certainly mean you lose it. The discount is strictly for adults who live alone.

As soon as a lodger moves in, they count as a second adult in the property, so you have to let your local council know. The good news is that the resulting increase in your Council Tax bill is an allowable expense, which you can claim against your rental income if you decide to opt out of the Rent a Room Scheme. For more practical advice on managing your rental, our UK landlord blog is packed with useful information.

At Rooms For Let, we're dedicated to making the process of finding the right lodger simple and efficient. Advertise your spare room for free and connect with thousands of potential tenants across the UK. Visit https://www.roomsforlet.co.uk to get started today.