It's a moment that makes every landlord's stomach drop: the rent due date has passed, and the payment hasn't appeared. When your tenant hasn’t paid rent for their room, the first reaction might be panic or frustration, but the most effective approach is to stay calm and methodical.

Your initial actions in the first 48 hours can set the tone for the entire resolution process, often preventing a simple hiccup from spiralling into a serious problem.

What To Do First When a Tenant Hasn't Paid Rent

Discovering a missed rent payment is unsettling, but your first move shouldn't be a confrontational letter. Before you even think about picking up the phone, take a breath and check your own records.

Pull out the tenancy agreement. Double-check the exact rent due date, the agreed payment method, and any clauses you have about grace periods or late fees. This quick bit of due diligence ensures you're acting on accurate information and prevents any awkward "it's not actually late yet" conversations.

Open a Dialogue Promptly and Professionally

Once you've confirmed the payment is officially late, it’s time to reach out. While automated reminders have their place, nothing beats a personal touch in this situation.

A simple phone call is often the best starting point. It feels less formal than an official letter and allows you to have a real conversation to understand what’s going on. The goal here isn't to demand, but to diagnose.

Try starting the conversation with a helpful, yet firm, tone. Something like, "Hi [Tenant's Name], I'm just calling to check in as I haven't seen the rent come through for this month. Is everything okay on your end?" This opens the door for them to explain the situation.

There could be any number of reasons for the delay:

- A simple banking error or a transfer that's taking longer than usual.

- They might have just forgotten, especially if they're usually a reliable tenant.

- It could be something more serious, like a sudden job loss or a family emergency.

How they respond will tell you everything you need to know about what to do next. An honest mistake can usually be sorted within a day, but a significant financial issue will require a more structured plan.

For a quick reference, here's a simple plan to follow as soon as you notice the rent is late.

Immediate Action Plan for Unpaid Rent

| Timeframe | Action | Purpose |

|---|---|---|

| 24-48 Hours | Review tenancy agreement & your bank statements. | Confirm the due date, amount, and that the payment has definitely been missed. |

| 48 Hours | Make a friendly phone call to the tenant. | Open a non-confrontational dialogue to understand the reason for the delay. |

| Immediately After Call | Send a brief follow-up email or text. | Create a written record of the conversation and any agreed-upon actions. |

| If No Contact | Send a more formal, but still polite, letter. | Formally notify the tenant of the arrears and request immediate contact. |

This structured approach keeps things professional and ensures you have a clear record from the very beginning.

Document Every Single Interaction

No matter the reason for the late payment, it's absolutely crucial to follow up on any phone call in writing. A quick email or even a text message creates a time-stamped record of your communication. Keep it brief and factual.

Key Takeaway: Always create a paper trail. A simple follow-up email confirming your phone call, the amount due, and the new date they promised to pay by is invaluable. This documentation becomes essential proof that you acted reasonably if the situation escalates.

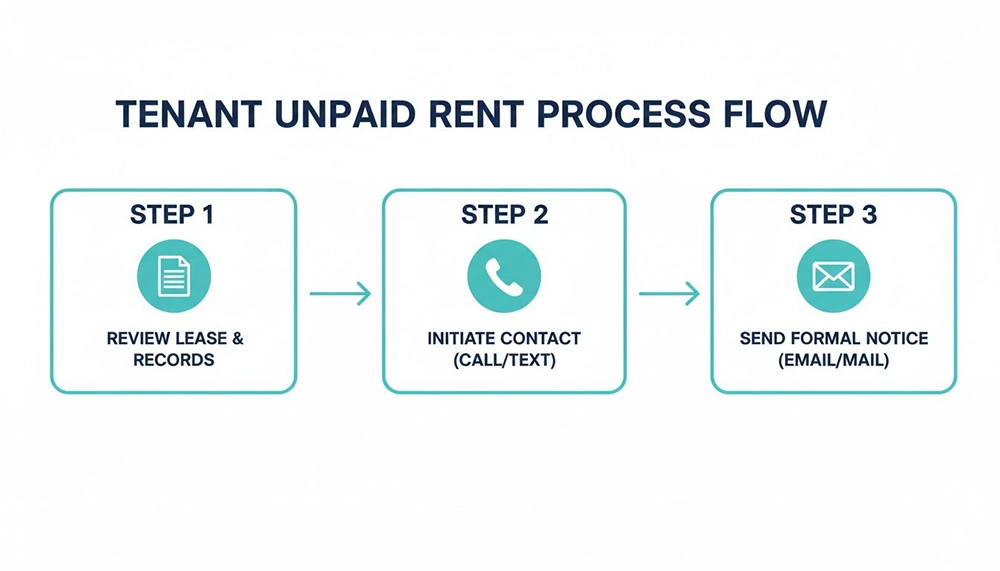

The flowchart below breaks down this simple, three-step initial process.

This visual guide reinforces the importance of a structured approach: review your documents, make personal contact, and then formalise that contact in writing.

With rent arrears becoming a bigger issue across the UK, this disciplined approach is more important than ever. In the first quarter of the year, the average amount owed by tenants in arrears rocketed to a record £2,237—a sharp 23% annual increase.

If you find yourself dealing with a complex situation or need guidance on your legal obligations, our team is here to help. Don't hesitate to get in touch with us.

Time to Formalise: Letters, Plans, and Getting Back on Track

When a friendly phone call doesn’t get the rent paid, it's time to change gears. This doesn't mean you need to get aggressive, but it does mean you need to get more formal. Shifting to written communication is about protecting yourself and the tenant by creating a clear, factual paper trail of the situation. It’s an essential step if you ever need to prove that you’ve acted reasonably down the line.

Your first move here is to send a rent arrears letter. Think of this not as just another reminder, but as a professional document that lays out the facts of the missed payment. It’s an official notification that the account is in arrears and requires their immediate attention.

Keep the tone firm but fair, and steer clear of emotional language. Stick to the facts as they’re laid out in your tenancy agreement and payment records. The goal is to prompt action while keeping the landlord-tenant relationship as professional as possible.

What Goes into a Rent Arrears Letter?

To be effective—and legally sound—your letter needs to be specific. Ambiguity is your worst enemy at this stage. Missing key details can seriously weaken your position and just create more confusion for the tenant.

Make sure your letter clearly includes:

- The total amount of rent outstanding. Be precise, right down to the penny.

- A clear breakdown of the arrears. List which rental periods (e.g., May rent, June rent) have been missed or only partially paid.

- Any applicable late fees. You can only include these if they are explicitly written into your signed tenancy agreement.

- A deadline for payment. Give them a reasonable timeframe, like seven days from the date of the letter, to pay the full amount.

- Instructions on how to pay. Remind them of the accepted payment methods.

This formal letter is a critical piece of evidence. It shows you've officially informed the tenant of the debt and given them a clear chance to fix things before you escalate the matter.

Opening the Door to a Repayment Plan

Sometimes, a tenant falls behind because of a genuine, temporary financial hiccup. They might want to pay but simply can’t find the full amount in one go. In your letter, or perhaps in a follow-up conversation, it’s often a smart move to open the door to discussing a repayment plan.

Suggesting a structured plan shows you’re a reasonable landlord who is willing to find a solution. Let's be honest, it’s often a much better path than the costly and drawn-out eviction process. Any agreement, however, must be realistic and—most importantly—put down in writing.

A proper repayment plan agreement should detail:

- The total debt to be repaid.

- The amount of each extra instalment they'll pay towards the arrears.

- The dates these extra payments are due, alongside their normal rent.

- A clause stating that if they fail to stick to the plan, you'll have to take further action.

Key Insight: A repayment plan isn't a casual chat. It needs to be a formal, signed addendum to the original tenancy agreement. This makes sure both you and the tenant know exactly what's expected and gives you a legal document to fall back on if they default on the new terms.

This kind of proactive negotiation can often sort the problem out without ever needing to serve legal notices. It gives the tenant a clear path to get back on their feet while ensuring you eventually get the rent you're owed. For more practical tips on managing your tenancies, check out our landlord advice blog.

While we saw rent arrears hitting record highs at the start of the year, there have been some positive signs recently. By the second quarter, tenant rent arrears in the UK had seen a welcome 12% year-on-year drop, with the average falling to £1,861. This was a huge 20% decrease from the first quarter's peak, which suggests some of the financial pressure on renters might be easing. You can find more insights on this recent trend in tenant arrears on Landlords Guild.

Serving the Correct Legal Notices for Rent Arrears

When the phone calls have gone unanswered and repayment plans have failed, you’ve reached a critical point. If your tenant still hasn't paid their rent despite your best efforts, it's time to begin the formal legal process. This isn’t optional—serving a valid legal notice is a non-negotiable first step before you can even think about applying to the courts for possession of your property.

This stage isn't about being heavy-handed; it's about following a precise legal path. I’ve seen countless cases where a simple mistake—a misspelled name, an incorrect date, or a miscalculation of the notice period—has rendered a notice completely invalid. That one small error can force you to start the whole process from scratch, leading to months of delays and even more lost rent.

In England, landlords have two primary tools for this job when a tenant is in arrears: the Section 8 notice and the Section 21 notice. Knowing which one to use, and exactly how to use it, is absolutely crucial.

Getting to Grips with the Section 8 Notice

A Section 8 notice is your go-to when a tenant has breached their tenancy agreement. While it covers various breaches, rent arrears is by far the most common reason for using one. For most landlords dealing with unpaid rent, this is the most direct route.

The notice works by citing specific legal "grounds" for possession. When it comes to rent arrears, three grounds are your key players:

Ground 8 (The Mandatory Ground): This one is the heavy hitter. If you can prove it, the court must grant you a possession order. To use Ground 8, the tenant has to be in at least two months' rent arrears if they pay monthly (or eight weeks' arrears if they pay weekly). This isn't a one-time check; the debt must meet this threshold both when you serve the notice and on the day of the court hearing.

Ground 10 (A Discretionary Ground): This ground is more flexible and can be used for any amount of rent arrears, no matter how small. The catch? It's discretionary, which means a judge has the final say on whether it’s reasonable to grant possession based on the circumstances.

Ground 11 (Another Discretionary Ground): This ground targets a pattern of behaviour. It applies if the tenant is persistently late with their rent, even if they aren't deep in arrears right now. It focuses on the history of late payments rather than the total amount owed.

From my experience, it’s always best practice to cite all three grounds (8, 10, and 11) on your Section 8 notice. This creates a vital safety net. If the tenant makes a partial payment right before the court date and the debt drops below the two-month threshold for Ground 8, you can still argue your case for possession based on the other two discretionary grounds.

The Role of the Section 21 Notice

The Section 21 notice is a different beast altogether. Often called a 'no-fault' eviction, it lets you regain possession of your property without giving a reason, typically at the end of a fixed term or during a rolling periodic tenancy. It can be a simpler path if you want to avoid a court hearing focused on proving the arrears.

But here’s the crucial part: a Section 21 notice is only valid if you've been a perfect landlord from day one. You must have everything in order. The notice will be thrown out unless you can prove you’ve:

- Correctly protected the tenant's deposit in a government-approved scheme and given them all the required information.

- Provided the tenant with a copy of the property's Energy Performance Certificate (EPC) and a current Gas Safety Certificate.

- Given the tenant the government's official "How to Rent" guide right at the start of their tenancy.

Legislation around Section 21 notices is constantly evolving, so you absolutely must check the latest government guidance before you even think about serving one. For a straightforward case of rent arrears, the Section 8 notice is often the more robust and direct approach.

Expert Tip: Don't just post the notice and hope for the best. Cover all your bases by serving it in multiple ways—by hand (with an independent witness), by first-class post, and by email if your tenancy agreement permits it. The moment you've done this, fill out a Certificate of Service (Form N215). This form is your proof and will be invaluable if the tenant later claims they never received the notice.

To help you decide which path is right for your situation, here's a quick comparison of the two notices.

Comparing Section 8 and Section 21 Notices for Rent Arrears

Choosing the right notice is a strategic decision. The table below breaks down the key differences to help you decide on the best approach.

| Feature | Section 8 Notice (Grounds 8, 10, 11) | Section 21 Notice |

|---|---|---|

| Reason for Notice | Based on a breach of tenancy (e.g., rent arrears). | No reason ('no-fault') is required to be given. |

| Timing | Can be served anytime during the tenancy once grounds are met. | Can only be used to end a tenancy after a fixed term or during a periodic tenancy. |

| Notice Period | Typically 2 weeks' notice for rent arrears grounds. | A minimum of 2 months' notice is required. |

| Court Process | Often requires a court hearing where you must prove the grounds. | Can often use an 'accelerated' paper-based court process if undisputed. |

| Money Judgment | You can ask the court to issue a County Court Judgment (CCJ) for the rent arrears at the same time as the possession order. | A possession order only; you must make a separate court claim for any unpaid rent. |

| Key Requirement | The tenant must be in arrears by a specific amount (for Ground 8) on the day of service and the day of the hearing. | Strict procedural requirements (deposit protection, EPC, etc.) must have been met perfectly. |

In the end, it comes down to your specific circumstances. If your tenancy admin is flawless and you want to avoid a potentially contentious court hearing, a Section 21 might be the cleaner option. However, if your main goal is to tackle the unpaid rent head-on and get a money judgment at the same time as the possession order, the Section 8 notice is purpose-built for the job.

Navigating the Court Process for Possession

So, the notice period has come and gone, the tenant is still in the property, and the rent arrears remain unpaid. What now? At this point, your only legal route to reclaim your property is to apply to the court for a possession order.

This can feel like a huge, intimidating step, but it’s actually a very structured legal process. It’s all about following the correct procedure to get a resolution. The path you take hinges entirely on the type of notice you originally served.

If you used a Section 8 notice (due to rent arrears), you’ll be heading down the standard possession procedure route. If, however, you served a valid Section 21 notice, you can use the much simpler accelerated possession procedure.

Choosing Your Possession Procedure

The standard possession route, which you must use for Section 8 claims, always involves a court hearing. This is your day in court to present the evidence to a judge and prove the grounds for eviction – namely, the significant rent arrears. The judge can ask questions, and both you and the tenant will have a chance to speak.

In contrast, the accelerated procedure for Section 21 cases is usually just a paper-based exercise. A judge simply reviews the paperwork and, if everything is in order and the tenant hasn’t raised a valid defence, grants possession without a hearing. It’s faster and more direct, but there’s a catch: you can't claim for the rent arrears in the same application. It’s purely for getting the property back.

Key Takeaway: If your goal is to both evict the tenant and get a court judgment for the unpaid rent in one go, the standard possession procedure following a Section 8 notice is the way to do it. It wraps both claims up into a single, efficient legal process.

Getting Your Paperwork and Evidence in Order

Starting a standard possession claim is all about meticulous paperwork. You'll need to complete two main forms: Form N5 (Claim for possession of property) and Form N119 (Particulars of claim for possession). Think of these as your formal request to the court – they need to be filled out with total accuracy.

Alongside the forms, you need to build a rock-solid evidence pack. This is your opportunity to build an undeniable case that leaves no room for interpretation.

Your evidence bundle absolutely must include:

- A complete, signed copy of the original tenancy agreement.

- An up-to-date rent statement that clearly shows every payment, every missed payment, and the running total of arrears.

- A copy of the Section 8 notice you served.

- Proof of service for that notice. This could be a completed Certificate of Service (Form N215) or a signed statement from a witness who saw you post it.

- Copies of any letters you sent about the rent arrears and any other relevant communication.

Precision is everything here. A simple mistake, a missing document, or an inconsistency can cause massive delays or, worse, get your case thrown out, forcing you to start from scratch. That's the last thing you want when you're already months out of pocket.

What to Expect at the Court Hearing

Walking into a possession hearing can be daunting, but it’s usually over before you know it. Most hearings are surprisingly brief, often lasting no more than 10-15 minutes. You’ll present your case to a District Judge, either in a formal courtroom or, more commonly, in their office (known as 'chambers').

Be ready to give a quick summary of the facts, confirm the amount of rent owed, and answer any questions the judge might have. The tenant will also get their chance to speak. The most important thing is to remain calm, be professional, and stick to the facts.

After hearing both sides, the judge will make their decision. There are a few possible outcomes:

- Outright Possession Order: This is the best-case scenario. The judge grants an order requiring the tenant to leave, usually within 14 days. In cases of extreme hardship for the tenant, this can be extended to a maximum of 42 days.

- Suspended Possession Order: The judge grants the order but puts it on hold based on certain conditions. Typically, the tenant must pay their normal rent plus an extra amount towards the arrears each month. If they break this agreement (even by a day), you can apply to have the order enforced without another hearing.

- Adjournment: The judge might postpone the hearing if they need more information or if a complex legal point has been raised.

- Dismissal: If your paperwork is faulty or you haven't followed the correct procedures, the judge can dismiss your case entirely.

At the same time as requesting possession, you should also ask the judge to issue a County Court Judgment (CCJ) for the money owed. This formalises the debt, making it much easier to enforce repayment later on and turning your court application into a powerful tool for recovering your losses.

Enforcing an Eviction and Managing the Aftermath

Getting that possession order from the court can feel like the finish line. But as many landlords have discovered, it doesn't always mean your tenant will pack their bags and hand over the keys.

If the date on the order comes and goes, and the property is still occupied, you have to fight the urge to take matters into your own hands. It’s tempting, I know. But changing the locks or trying to physically remove the tenant yourself is an illegal eviction. That’s a serious criminal offence, and it could land you in far more trouble than the rent arrears.

The only lawful path forward is to apply to the court for a warrant for possession. This is the official document that authorises County Court bailiffs to show up and carry out the eviction for you. At this point, the responsibility shifts from you to the court's enforcement officers.

Applying for a Warrant and What to Expect

To get the ball rolling, you'll need to fill out and submit Form N325 to the court. There's a fee for this, which is currently £143 in England and Wales. It’s another frustrating cost in a long line of expenses, but it’s a non-negotiable step in the legal process.

Once the warrant is issued, the eviction gets scheduled. Now for the hard part: the wait. Bailiff services are often stretched thin, so the timeline can vary wildly depending on how busy your local court is. You could be waiting a few weeks or, in some cases, several months.

You will be given a date and time for the eviction. My advice? Be there on the day, and have a locksmith ready to go. The moment the bailiffs give you the nod, you can secure the property immediately.

Crucial Reminder: You are legally responsible for any of the tenant's belongings left behind. You can't just throw them in a skip. You have to make a reasonable effort to contact the tenant to arrange for them to collect their things and store them safely for a reasonable amount of time.

Document everything. A good way to protect yourself is by sending a formal letter (known as a Torts notice) that details where their possessions are, how they can be collected, and a clear deadline for them to do so.

The Immediate Post-Eviction Checklist

The second the bailiffs confirm the tenant has gone and you’re legally back in possession, the work isn't over. Your focus now pivots to damage control, securing the property, and starting down the road of financial recovery.

Here are your immediate priorities:

- Change the locks immediately. This is non-negotiable. It’s the single most important step to prevent any unauthorised re-entry.

- Conduct a thorough inspection. Grab your check-out inventory and walk through every inch of the property. Document every bit of damage with time-stamped photos and detailed notes.

- Take meter readings. Get on the phone with the utility companies right away. Give them the final readings to close the tenant's accounts and open new ones in your name. This stops you from being billed for their usage.

- Secure the property. Double-check that all windows and doors are locked and that the property is safe, especially if it’s going to be empty for a while.

Recovering Your Financial Losses

Getting your property back is a huge relief, but recovering the unpaid rent and the cost of repairs is a whole other battle. Your first port of call is the tenancy deposit. You’ll need to make a formal request to the tenancy deposit scheme to claim for the arrears and any damages you’ve meticulously documented.

If the deposit doesn’t cover the full debt—and let's be honest, it often won’t—the County Court Judgement (CCJ) you got with the possession order is your next tool. A CCJ officially records the debt and trashes the former tenant's credit rating, but it doesn’t magically force them to pay up.

To actually see the money, you may need to take further enforcement action, such as:

- An attachment of earnings order: If you know where they work, you can apply to have the debt deducted directly from their salary.

- Third-party debt order: This can freeze their bank account and instruct the bank to pay you directly from any funds they have.

Going through an eviction is draining, both financially and emotionally. If you're looking to find reliable, pre-vetted tenants next time around and reduce the risk of this happening again, you can learn how to list your room and connect with tenants on Rooms For Let.

Your Rent Arrears Questions Answered

When a tenant stops paying rent, it throws up a minefield of legal questions and practical worries. As a landlord, you need clear, direct answers to handle the situation correctly and confidently. Let's tackle some of the most common questions we hear.

Can I Change the Locks if My Tenant Hasn’t Paid Rent?

Let’s be crystal clear on this: absolutely not.

Changing the locks, turning off the water, or clearing out a tenant's belongings is classified as an illegal eviction. This is a serious criminal offence in the UK, and it can land you in a whole lot of trouble, including hefty fines and even a prison sentence.

There are no shortcuts here. You must follow the proper legal channels to get your property back. That means serving the right notices, getting a possession order from the court, and if it comes to it, using court-appointed bailiffs.

How Much Rent Arrears Before I Can Start Eviction?

To use the most powerful tool in your arsenal – a Section 8 notice citing the mandatory Ground 8 – the arrears have to be significant.

The specific legal threshold is:

- At least two months' arrears if the rent is paid monthly.

- At least eight weeks' arrears if the rent is paid weekly.

Crucially, this amount must be outstanding on both the day you serve the notice and the day of the court hearing. While you can use other grounds like Ground 10 and 11 for smaller amounts, they are discretionary, which means a judge gets to decide if eviction is reasonable. Ground 8 removes that uncertainty and gives you the clearest path to a possession order.

Does Accepting Partial Rent Payments Affect the Eviction Process?

This is a common worry, but accepting a partial payment doesn't automatically derail a Section 8 eviction process. As long as the total debt remains above that two-month (or eight-week) threshold for Ground 8, your legal standing is secure.

The key is meticulous record-keeping. Always provide the tenant with a receipt for any partial payment and send a follow-up email confirming that while you've accepted the funds, the payment does not resolve the full debt and the possession proceedings will continue.

This clear paper trail prevents any claims that you've implicitly agreed to a new payment plan or forgiven the debt.

Can I Use the Tenancy Deposit for Rent Arrears?

Yes, but only once the tenancy is over. You can’t dip into the deposit to cover a missed payment while the tenant is still living in the property.

At the end of the tenancy, you must make a formal request through the government-approved deposit protection scheme where the money is held. If the tenant disagrees with your claim, the scheme's dispute resolution service will step in. You’ll need to provide solid evidence, like a detailed rent statement and copies of all correspondence, to back up your claim. This is yet another reason why keeping detailed records is so important.

The scale of this issue is huge. In the social housing sector alone, a staggering 40% of units managed by UK councils are in arrears, with average debts per household hitting £669. You can discover more insights about the rising rental arrears on Access Paysuite.

Of course, the best way to deal with rent arrears is to avoid them in the first place by finding reliable tenants. Rooms For Let connects you with thousands of prospective tenants across the UK, helping you fill your rooms quickly and with confidence. Advertise your room for free today and find your next great tenant.