Rent guarantee insurance is a specialised policy designed to protect your rental income when a tenant stops paying. Think of it as an income protection plan for your property business. It ensures your cash flow stays healthy, even if you're suddenly faced with a tenant who can't or won't pay the rent. For UK landlords and homeowners, it’s a vital financial safety net against the very real risk of rent arrears.

So, What Is Rent Guarantee Insurance Really?

Imagine your rental income is a river. This river powers your financial life—it covers the mortgage, pays for repairs, and hopefully provides a profit. When a tenant defaults on their rent, it’s like a dam suddenly blocking that river. Your cash flow stops dead.

Rent guarantee insurance acts like a bypass channel. It reroutes the flow of income, this time from the insurer directly to you, while you work on clearing the blockage—which usually means starting the lengthy eviction process.

This insurance kicks in when a tenant fails to pay their rent, covering the missed payments for a set period, often up to 12 months. It’s built specifically to handle the financial damage of rent arrears, one of the biggest headaches a landlord can face. In an unpredictable market, that kind of stability brings incredible peace of mind.

How It Differs from Other Landlord Insurance

It's easy to get rent guarantee insurance mixed up with other types of landlord cover, but they all do very different jobs. Getting the distinction right is key to making sure you’re properly protected.

- Standard Landlord Insurance: This is your foundation. It protects the physical building against disasters like fire, floods, and subsidence. It also usually includes property owners' liability in case a tenant or visitor gets injured at your property. Crucially, it will not cover lost rent if a tenant stops paying.

- Loss of Rent Cover: This is an add-on to standard landlord insurance, but it only activates if the property becomes unliveable because of an insured event, like a serious fire. It covers the lost income while you’re making repairs, not when a tenant simply defaults on their payments.

Key Takeaway: Rent guarantee insurance fills a specific, critical gap. While standard insurance protects your building and loss of rent covers you during major repairs, only rent guarantee insurance protects your income from the direct financial hit of tenant non-payment.

Why It Matters in the UK Market

For UK landlords, whether you're managing a portfolio of HMOs or just letting a room in your own home, a reliable income stream is non-negotiable. With rising mortgage rates and maintenance costs, a single tenant defaulting can quickly turn a profitable venture into a financial nightmare.

The legal landscape is also getting more complicated. The eviction process can be a long and expensive journey. During that time, you could be facing months without any rental income while still being on the hook for the mortgage, council tax, and all the other bills.

That’s where this insurance really proves its worth. Not only does it replace your lost income, but many policies also include legal expenses cover. This helps fund the costly legal process of regaining possession of your property. It’s a strategic tool for managing risk in a modern rental business.

How The Rent Guarantee Process Actually Works

It’s one thing to understand the idea of rent guarantee insurance, but seeing how it plays out in the real world is where you really appreciate its value. The process isn't just about getting a payout; it's a structured system designed to protect your income and take the stress out of a nightmare scenario. It all begins long before a tenant even thinks about missing a payment.

The journey starts with good old-fashioned due diligence. Before an insurer will cover you, they need to know you’ve done your bit to minimise risk from the get-go. This means having a solid tenancy agreement in place and, crucially, carrying out comprehensive tenant referencing. This isn’t just a box-ticking exercise; it’s a non-negotiable part of the deal.

The Tenant Referencing Foundation

Think of tenant referencing as the insurer's eyes and ears on the ground. They are backing your judgement, so they need to see you’ve done everything possible to find a reliable person for your property. If you skip this part, your policy is probably worthless from day one.

Proper, comprehensive referencing must include:

- Credit Checks: To get a clear picture of the tenant's financial history and reliability.

- Income Verification: To confirm they earn enough to comfortably afford the rent, which is usually at least 2.5 times the monthly payment.

- Previous Landlord References: To check they have a track record of paying on time and looking after a property.

Without this paper trail, an insurer has no way of knowing the tenant was a reasonable bet when you took out the policy. This makes referencing the absolute cornerstone of any valid rent guarantee insurance.

From Missed Payment To Making A Claim

Let's walk through a typical situation. Your tenant, who sailed through their referencing checks, misses their rent payment on the 1st of the month. You’ve sent polite reminders, but all you've got is silence. This is the moment your policy transforms from a safety net into an active tool.

Here’s how it generally unfolds:

- Notify Your Insurer: Most policies insist you tell them about the arrears within a set timeframe, often between 30 to 60 days after the payment was first missed. Don't put this off—missing the deadline can completely invalidate your claim.

- Serve The Correct Legal Notices: You have to follow the proper legal steps for your part of the UK to inform the tenant of their arrears and your intent to regain possession. Your insurer will need proof you’ve done this by the book.

- Submit Your Claim: Next, you’ll need to provide all the required documents. This will include the tenancy agreement, the full tenant referencing reports, proof of the rent arrears, and copies of the legal notices you’ve served.

Your insurer effectively becomes your partner in this difficult process. They don’t just cut a cheque; they often take over the complicated and draining legal work of eviction, saving you a huge amount of time, money, and stress.

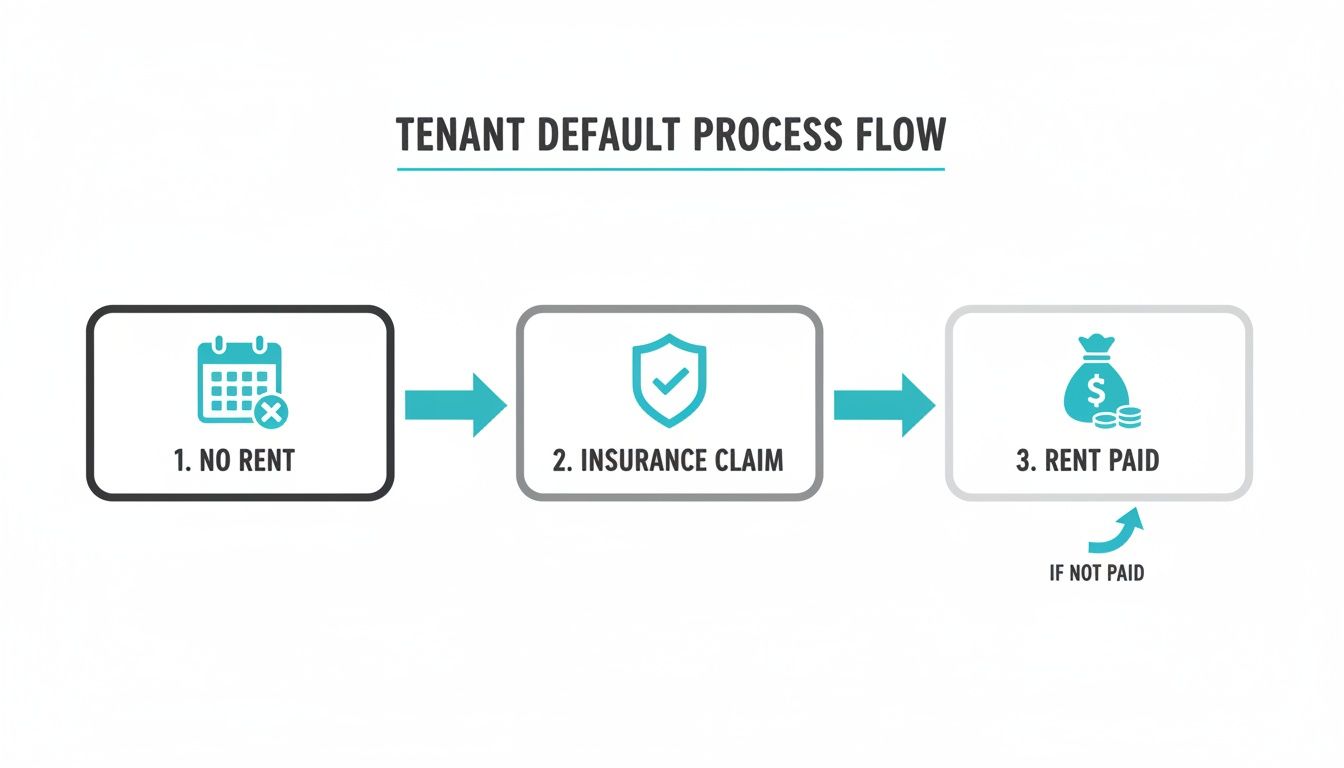

This visual breaks down the simple flow from a tenant defaulting on rent to the insurance kicking in to protect your income.

As you can see, the insurance acts as a financial bridge, turning a stressful non-payment event into a successful income recovery.

Receiving Your Payout And Regaining Possession

Once your claim gets the green light, the policy springs into action. Most policies have an excess period, which is often the equivalent of one month's rent (usually covered by the tenant's deposit). After that, the insurer starts making rent payments directly to your account.

These payments will continue until the tenant is evicted and you get your property back, up to the limit of your policy—which is typically 6 or 12 months.

At the same time, the legal expenses cover kicks in. The insurer's legal team will manage the court applications, handle the paperwork, and provide representation to secure an eviction order. Having experts handle this ensures everything is done correctly, helping you avoid costly legal mistakes and getting you back on track with a new, paying tenant as quickly as possible.

What Your Policy Covers And What It Excludes

Not all rent guarantee insurance policies are created equal. While they all share the core purpose of protecting your rental income, the fine print is where you'll find the crucial differences that determine how well you're actually covered. Getting to grips with what's included—and more importantly, what's left out—is essential to avoid nasty surprises just when you need that safety net.

Think of it like this: your policy document is a contract for a financial bodyguard. It lists exactly when your guard will step in and when they'll have to stand back. Let's break down what you can typically expect.

Core Coverage: What Your Policy Delivers

The main job of rent guarantee insurance is, of course, to replace your lost income. But a good policy offers much more than just cash; it provides a comprehensive support system during what can be a stressful and costly time.

Here’s what’s usually included:

- Unpaid Rent Payments: This is the headline benefit. If your tenant defaults, the policy pays out the monthly rent. This cover typically lasts for a fixed period, often up to 6 or 12 months, or until you get vacant possession of your property back.

- Legal Expenses Cover: Honestly, this part is incredibly valuable. Evicting a tenant can be a legal minefield, with court fees and solicitor costs stacking up fast. Legal expenses cover helps fund this process, and often the insurer’s own legal team will take the lead for you.

- Maximum Payout Limits: Policies will specify a maximum monthly rent they’ll cover (e.g., up to £2,500 per month) and a total claim limit (e.g., up to £100,000 in legal costs). It’s vital to check these limits are suitable for your property and its location.

These core elements work together to build a robust financial shield, protecting both your income stream and your savings from the punishing costs of a tenant dispute.

Common Exclusions: The Devil In The Detail

Exclusions are simply the conditions under which your insurer won't pay a claim. Ignoring this section is one of the biggest mistakes a landlord can make, as your claim will almost certainly be denied if it falls under one of these clauses.

Critical Insight: An insurance policy is a two-way agreement. The insurer agrees to cover your risk, but only if you meet your obligations as a diligent landlord. Failing to uphold your end of the bargain, like skipping proper checks, is the fastest way to invalidate your cover.

Be sure to watch out for these typical policy exclusions:

- Inadequate Tenant Referencing: If you can't prove you carried out thorough, professional-grade referencing before the tenancy started, your claim will be rejected. This means having proof of credit checks, employer references, and previous landlord checks.

- Invalid Tenancy Agreement: A poorly drafted or legally non-compliant tenancy agreement can void your policy entirely. Make sure your agreement is up-to-date and legally sound for your part of the UK.

- Pre-existing Arrears: You can't take out a policy to cover a tenant who is already behind on rent. The insurance is designed for future, unforeseen defaults, not problems that already exist.

- Claims During the Initial Waiting Period: Most policies have an initial exclusion period, often the first 90 days, during which you cannot make a claim. This prevents landlords from taking out cover only when they suspect a problem is just around the corner.

- Failure to Notify the Insurer in Time: You must tell your insurer about rent arrears within a specific window, usually 30 to 60 days after the first missed payment. Delaying this notification is a common reason for a claim being denied.

Understanding these exclusions is just as important as knowing what’s covered. It empowers you to read any policy document with confidence and make sure you're ticking all the boxes to keep your protection solid.

The Financial Case For Protecting Your Rental Income

Is rent guarantee insurance just another line item on your balance sheet, or is it one of the smartest investments you can make for your property business? For landlords who have been in the game a while, the answer is crystal clear. It's a strategic move that turns a potentially volatile income stream into a predictable, reliable asset.

Thinking of the premium as a simple cost misses the bigger picture entirely. It's much better to see it as a financial safety net. This is the tool that stops a single tenant default from spiralling into a full-blown crisis, protecting your ability to pay the mortgage, cover repairs, and meet your own financial obligations. It’s what lets your rental property operate like a proper business, not a gamble.

Cost vs Potential Loss: A Landlord's Financial Snapshot

To really get to grips with the value, you just need to do some simple landlord maths. The annual premium for a solid rent guarantee policy is often a surprisingly small figure, especially when you weigh it against the catastrophic cost of a tenant failing to pay for several months on end.

And the damage isn't just the lost rent. The eviction process in the UK can be painfully slow and expensive, with legal fees quickly piling up into the thousands. All the while, your property is sitting there generating zero income but still racking up costs.

Let's break down how quickly the numbers can stack up against you.

| Expense / Loss Scenario | Typical Annual Cost | Potential Financial Impact |

|---|---|---|

| Rent Guarantee Insurance Premium | £150 – £300 | £0 (Covered by policy) |

| Lost Rent (4 months at £900/month) | Not Applicable | £3,600 |

| Legal & Court Fees for Eviction | Not Applicable | £1,500+ |

| Total Potential Loss | ~£225 (Your only cost) | £5,100+ |

As the table shows, the fallout from just one tenant default can easily cost you more than 20 times the price of an annual insurance premium. This stark comparison completely reframes the conversation—the real financial gamble isn't paying for the insurance; it's trying to operate without it.

A Tax-Deductible Business Expense

Here’s another crucial financial upside: the premium for your rent guarantee insurance is an allowable business expense. This means you can deduct the full cost from your rental income when calculating your tax bill, which makes the net cost of the policy even lower.

This tax-deductible status cements its role as a legitimate and essential business tool. It’s not just about personal peace of mind; it’s a financially savvy way to de-risk the core of your business—your rental income.

The growing recognition of this value is reflected across the market. The UK landlord insurance market itself is projected to expand substantially, growing from £20.7 billion in 2023 to £40.9 billion by 2032. This isn’t just about more landlords buying policies; it's also a reflection of rising property values and the increasing need for robust protection.

Beyond direct insurance, it's vital for landlords to understand the wider financial landscape and to continuously explore various solutions for property investors to safeguard their portfolios. Securing your income is the bedrock of a successful, sustainable rental business. Without that guarantee, you're building on shaky ground. By investing in rent guarantee insurance, you’re not just buying a policy; you're buying financial certainty.

Why New Rental Laws Make This Insurance a Must-Have

The UK's rental market is undergoing a massive shake-up, and the rulebook for landlords is being rewritten. Keeping up with these legal changes isn’t just good housekeeping; it’s a crucial part of protecting your investment. New laws are reshaping the landlord-tenant relationship, directly cranking up your financial risk and making rent guarantee insurance more important than ever.

For years, the eviction process gave landlords a fairly clear, if not always easy, path when a tenancy went sour. But the legal landscape is shifting under our feet. This means the old safety nets you might have relied on just aren't strong enough anymore, forcing a serious rethink about how you safeguard your rental income.

The End of Section 21 and What It Really Means

The biggest tremor rocking the rental world is the coming abolition of Section 21 'no-fault' evictions. This has been a cornerstone of tenancy management for decades. It allowed landlords to regain their property at the end of a fixed term without having to prove a specific reason, offering a predictable way to end a tenancy.

With Section 21 on its way out, removing a tenant—even one who has stopped paying rent—is set to become far more complicated. You'll have to rely on proving specific grounds for possession, which can be a much higher bar to clear. This change fundamentally tips the scales of risk. The upcoming changes, detailed in this Renters Reform Bill 2025 Guide, make it crystal clear why proactive protection like insurance is no longer optional.

Let’s be blunt: the eviction process is becoming slower and more expensive. Without Section 21, landlords are staring down the barrel of longer court delays and steeper legal bills when rent arrears build up. This is precisely where rent guarantee insurance steps in. It’s designed to cover your unpaid rent for up to 12 months after a tenant defaults, giving you a financial lifeline until you can get your property back.

Navigating Your Increased Financial Exposure

This new legal reality puts your finances directly in the firing line. When a tenant stops paying, you could face a long, frustrating battle to regain possession, all while the rent money has dried up. Every month that process drags on, your losses multiply.

Picture these two scenarios:

- Without Insurance: You’re hit with months of lost rent, easily running into thousands of pounds. On top of that, you have to find the cash for legal fees, which can quickly spiral past £1,500.

- With Insurance: Your policy pays out the lost rent, keeping your cash flow steady. It also covers the legal costs, and the insurer's experts often take on the headache of managing the eviction for you.

The Modern Landlord's Reality: In this changing legal climate, rent guarantee insurance isn't a 'nice-to-have' extra. It's a core tool for managing risk, turning a potential financial disaster into a manageable business expense.

It's clearer than ever that just holding a security deposit is a high-stakes gamble. A deposit might cover a month's rent, but it offers virtually no protection against the prolonged income loss and legal fights that are becoming the new norm. For more tips on managing your properties effectively, check out our other guides on the Rooms For Let blog.

At the end of the day, insuring your income is the smartest way to navigate the UK's evolving rental laws with confidence.

How To Choose The Right Rent Guarantee Policy

Picking the right rent guarantee insurance can feel like navigating a minefield, but if you know what to look for, it's actually pretty straightforward. The real goal is to find a policy that genuinely fits your situation, whether you're letting out a single room or running a full-scale HMO. It's crucial to look beyond the headline price to make sure the cover you're paying for is the protection you'll actually get when you need it most.

A good starting point is to gather a few quotes from specialist landlord insurance providers. But don't just glance at the annual premium. You need to dig into the policy details to understand the true value on offer. A slightly cheaper policy might look tempting, but if it comes with hefty exclusions or a massive excess, it could end up costing you a whole lot more down the line.

Scrutinise The Policy Details

The devil is always in the detail, and the policy wording is where you'll spot the real differences. A truly robust policy does more than just cover missed rent; it provides a complete support system when things go wrong.

Here are the critical details to check when comparing your options:

- The Policy Excess: This is the amount you have to pay before the insurer steps in. It's often set at the equivalent of one month's rent, which your tenant's deposit can usually cover. Be wary of any policy that asks for a higher excess than this.

- The Waiting Period: This is the time you'll have to wait between making a claim and getting your first payment. A short delay is standard, but you'll want a policy with the shortest possible waiting period to protect your cash flow.

- Level of Legal Cover: Check the maximum amount the policy will pay out for legal fees to handle an eviction. This figure can vary wildly, from £25,000 to £100,000. In this case, more is definitely better.

- Specific Exclusions: Keep an eye out for clauses related to your specific property type. For instance, some standard policies won't cover HMOs or student lets, so you must ensure your tenancy type is explicitly included.

Ask The Right Questions

Once you've shortlisted a couple of providers, it's time to ask some direct questions to get absolute clarity on what you're buying. Any reputable insurer will be more than happy to give you clear, straight answers.

A great policy should align perfectly with your reality as a landlord. If the terms don't match the types of tenancies you manage or the value of your rental income, it's not the right fit, no matter the price.

Crucially, remember that the premiums for rent guarantee insurance are a tax-deductible expense against your rental income, which makes it an incredibly efficient way to safeguard your investment. The best policies go beyond just the basics, covering your lost income for up to 12 months or until you regain vacant possession of the property, which is a lifesaver for keeping up with mortgage payments during a void period. You can discover more about how this coverage works on money.co.uk.

Making an informed choice here will give you genuine peace of mind. For landlords on our platform, getting this protection sorted is a key step before you list your room and find your next tenant with Rooms For Let.

Common Questions About Rent Guarantee Insurance

Even when you understand the benefits, it's natural to have a few practical questions about how rent guarantee insurance works day-to-day. Let's tackle some of the most common queries to give you complete confidence.

Can I Get a Policy for an Existing Tenant?

Yes, in most cases you can. Insurers will want to see that the tenant has a solid payment history with no previous arrears.

You'll also need to dig out the original referencing checks you did before they moved in. If you can't find them, the insurer will likely ask you to run new checks before they'll approve the policy.

Do I Still Need to Reference Tenants If I Have This Cover?

Absolutely. In fact, it's non-negotiable. Comprehensive tenant referencing is the foundation of any valid rent guarantee insurance policy.

Insurers see it as your first line of defence against bad tenants. If you fail to carry out and document thorough credit, income, and previous landlord checks before the tenancy starts, any future claim you make will almost certainly be rejected.

A policy doesn't replace your due diligence; it actually rewards it. Think of it as a partnership where the insurer agrees to back your good judgement, which you first have to demonstrate through professional referencing.

What Is the Difference Between Rent Guarantee and Loss of Rent?

This is a critical distinction that often trips landlords up, but it's quite simple when you break it down.

- Rent Guarantee Insurance is your safety net when a tenant simply stops paying their rent. It’s all about protecting your income from tenant default.

- Loss of Rent Insurance is usually an add-on to your main landlord insurance policy. It only pays out if your property becomes uninhabitable because of something like a fire or major flood, covering the rent you lose while repairs are made.

So, one covers tenant-related financial problems, while the other covers property-related structural disasters. They are not interchangeable. For more help with your landlord responsibilities, you can always get in touch with our team for guidance.